Market focused on inflation data and Fed rate cut bet

Austin Or, CFA

Highlights

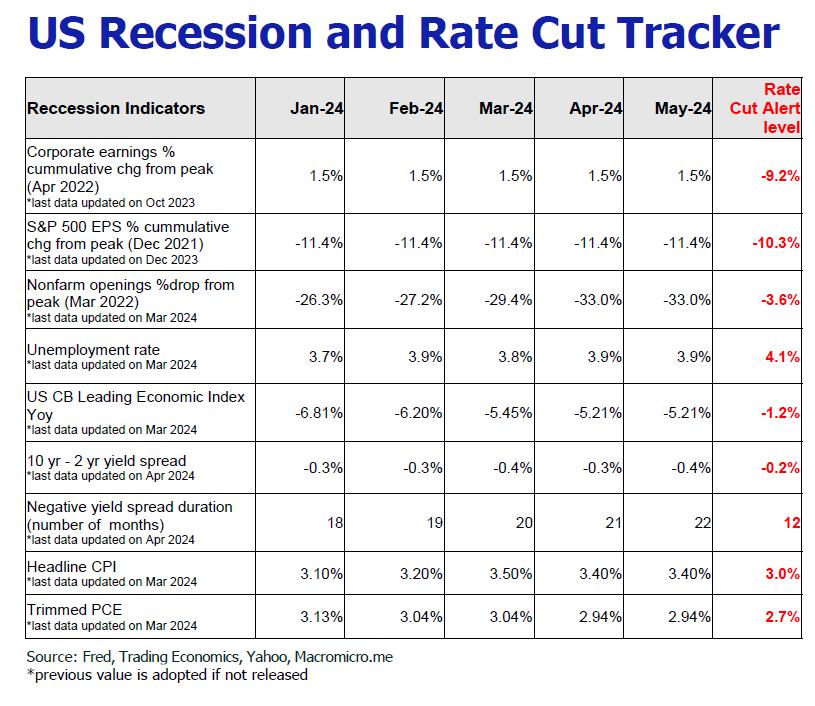

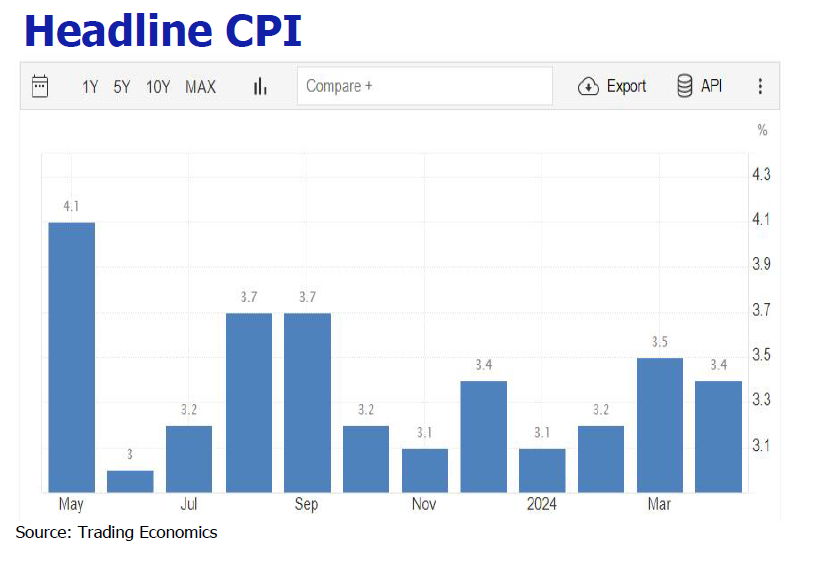

Monthly CPI, core CPI and core PCE reprieved

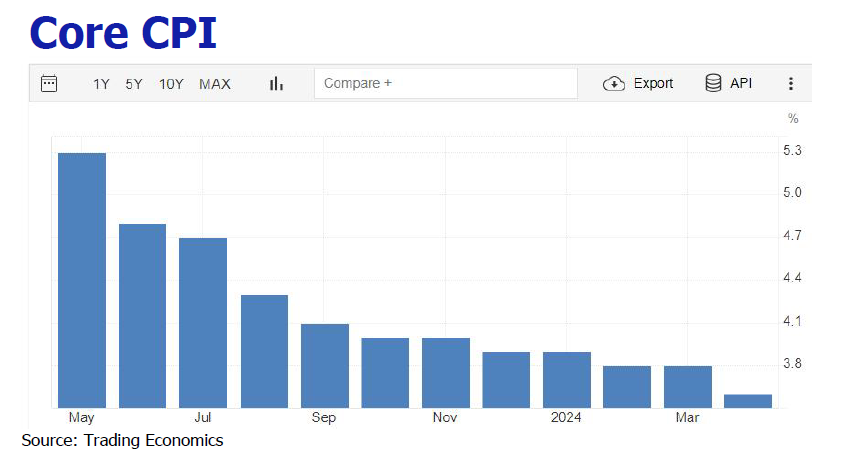

The US CPI in April rose 3.4%YoY, in line with expectations, slightly ebbed from the prior 3.5%. The monthly CPI increase in April was 0.3%, lower than the expected and prior 0.4%. Taming inflation remains a daunting task as energy price and shelter cost stay elevated. Gasoline prices increased 2.8% after rising by 1.7% in March. There was a slight moderation in housing costs, 0.2% versus 0.4% in the prior month. Shelter costs rose 0.4%, the same as in recent months, with no sign of relief. Food prices stalled over the past three months. Excluding food and energy costs, the April core CPI growth sagged

to 0.3%MoM from 0.4% in March, the first decline in 6 months. The US April core PCE price index rose 2.8% YoY unchanged from the prior month; the monthly growth showed a stride to 0.2%, the lowest since December 2023, lower than the expected 0.3%.

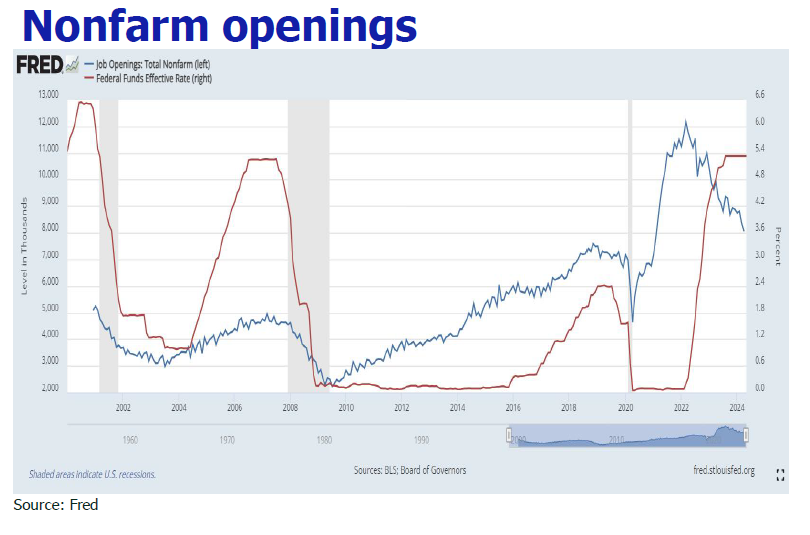

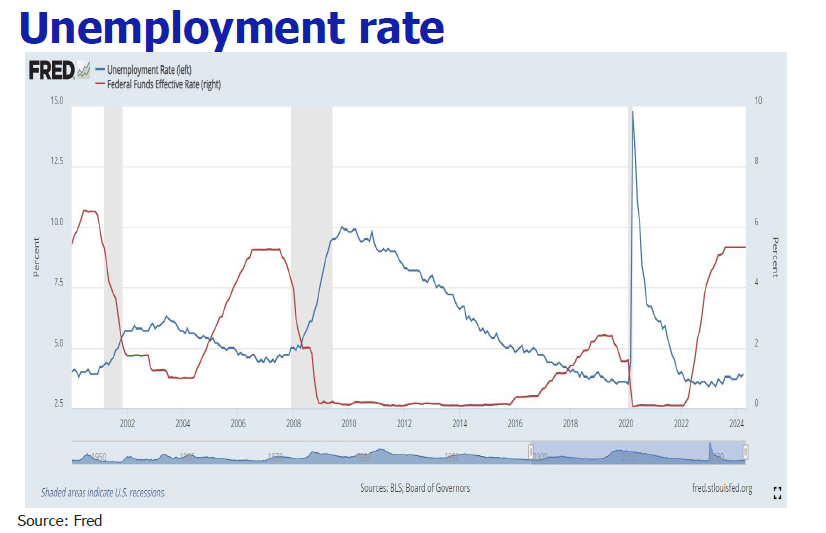

Job market is flipping down

The seasonally adjusted non-farm payrolls in the United States increase routed to 175,000 in April, the lowest growth rate since October 2023, which was way below the expected 243,000 and the previous print of 303,000. The U.S. unemployment rate unexpectedly rose to 3.9% in April, while market expectations remained unchanged at 3.8%. The average hourly wage rate in in April was 0.2%, lower than the previous value of 0.3%. There were 8.059 million JOLTS job openings in April, the lowest level since February 2021, and missed the expectations of 8.35 million. The ratio of job vacancies to

unemployed people fell to 1.24, the lowest level since June 2021 and showed a sharp decline from 1.30 in March. The actual current labor market condition may even be more ugly as the average monthly growth of 130k reported in QCEW (Quarterly Census of Employment and Wages ) was 100k below the average NFP monthly growth in 2023.

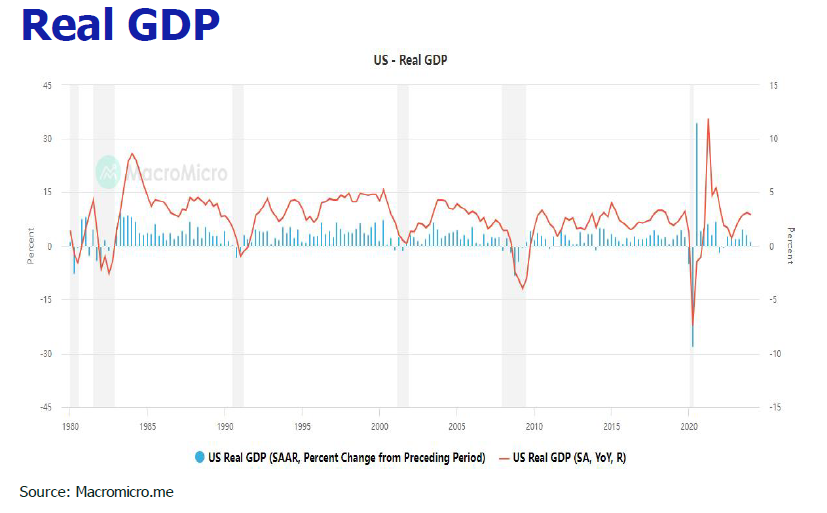

GDP flywheel starts sputtering

Due to reductions in consumer spending expectations, net exports and government spending, the U.S. real GDP in the first quarter of 2024 increased at 1.6%YoY, which is lower than market expectations of 2.4% and lower than the 3.4% in the fourth quarter of last year. Consumer spending increased 2.5% in the period, down from a 3.3% gain in the fourth quarter and below the 2.5% economist consensus. Fixed investment and government spending at the state and local level helped keep GDP positive on the quarter, while a decline in private inventory investment and an increase in imports. Net exports subtracted 0.86 percentage points from the growth rate while consumer spending contributed 1.68 percentage points.

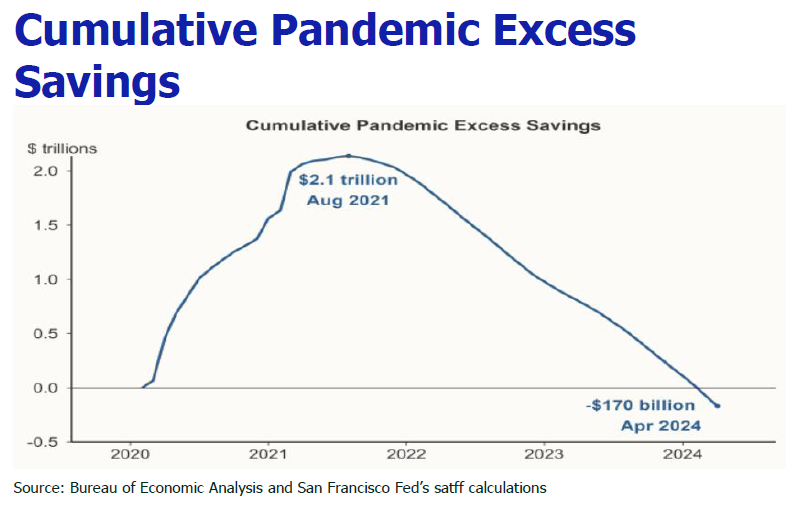

Personal wage and spending lost momentum on the heels of depletion of excessive savings

The US average hourly wage rose 0.2%MoM in April, lower than the prior 0.3% increase, and posted 3.9%YoY gain, both marking the smallest gain in five months. Personal spending increased 0.2% in April, also below the expected 0.3% rise. The seasonally adjusted QoQ increase in personal consumption expenditures for the first quarter was revised down to 2.0%, slower than the initial estimate of 2.5%, signaling a cooling in economic growth. The dismal consumption outlook is reasonated by the gone of excessive savings reported by Federal Reserve Bank of San Francisco. Its latest estimates show that the overall pandemic excess savings remaining in the US economy have turned negative as of March 2024 to US$-170 billion, suggesting that American households have maxed out their pandemic-era savings.

US manufacturing sector continued regression in May

After breaking a 16-month streak of contraction by expanding in March, the manufacturing sector has contracted the last two months, and at a faster rate in May diving from 49.2 to 48.7. ISM New Orders Index contracted in May for the second month, registering 45.4 percent, a decrease of 3.7 percentage points compared to April’s figure of 49.1 percent. The figures indicate U.S. manufacturing is struggling to gain momentum due to high borrowing costs, restrained business investment in equipment and softer consumer spending.

Prediction

1. US GDP growth is switching to a lower gear.

The second estimate of first quarter GDP growth

was revised down from a preliminary 1.6% to 1.3% last week. By virtue of weakening consumer spending, Goldman Sachs took down its projection for second quarter GDP growth from 3.2% to 2.8%, and the Atlanta Fed lowered its Q2 GDP forecast from 2.7% to 1.8% late last week as well. For 2024,

US GDP growth by economist consensus will slow down to 2.1% vs 2.5% in 2023.

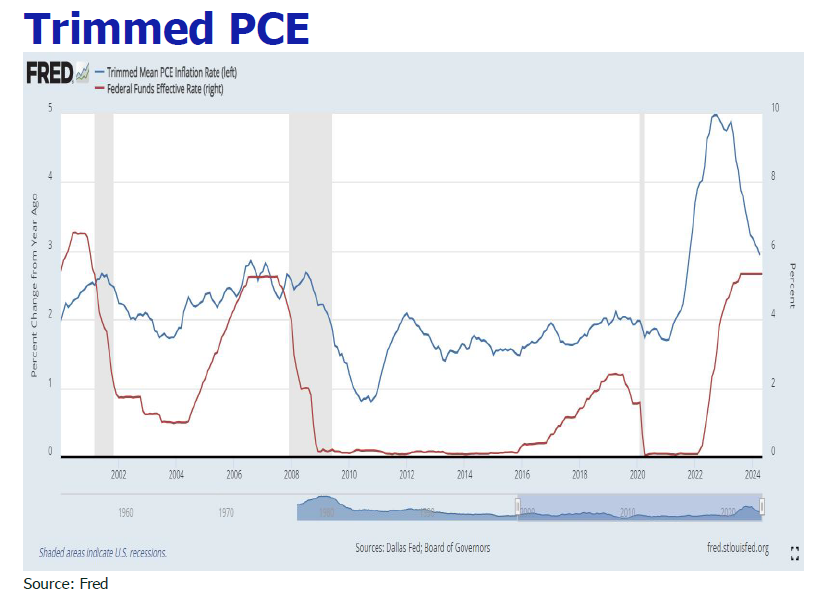

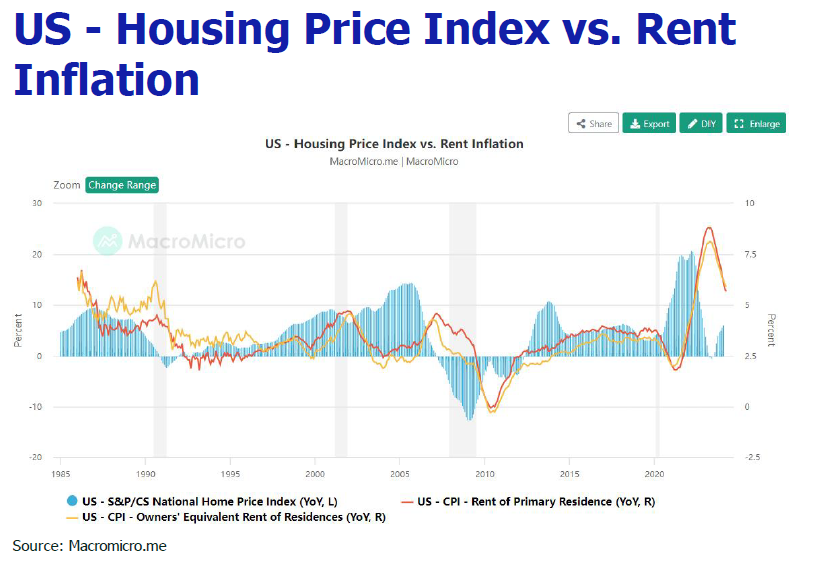

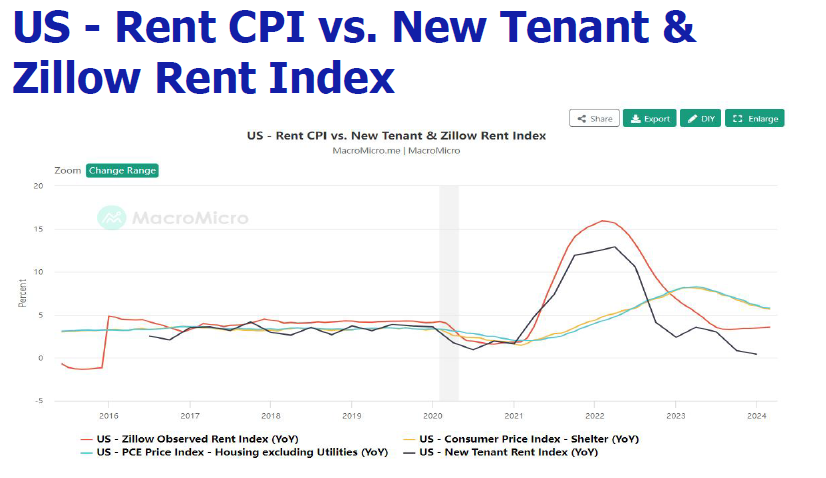

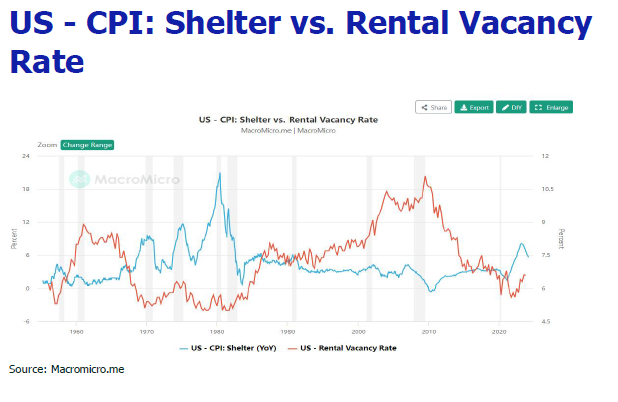

2. Rent prices will finally cool down but inflation will fail to hit 2% goal until 2026.

As per U.S. census data, more than half of U.S. renters pay over 30% of their income in rent, crossing the line where rental units stop being considered affordable. The situation is prompting renters to remain in their rental units for extended periods, aiming to minimize rent increases. According to data from the St. Louis Fed, vacancies across the country during the first quarter of 2024 came in at a rate of 6.6%, the same as the two previous quarters and higher than any other period since mid-2021. So, the high rent prices could start to cool down again if vacancies continue to grow or remain higher than in previous years. However, eocnomists forecast that inflation will not return to 2% territory until 2026, in view of the robust US economy and the tepid unemployment rate.

3.The global easing trend will put pressure on the Fed to cut rates.

The Bank of Canada has announced its June rate decision, stating that it will lower its benchmark rate by 25 basis points to 4.75%, leading the charge in G7 country to cut rates in this global easing cycle. According to market expectations, the European Central Bank will initiate a rate cut cycle very soon, followed by the Bank of England in two weeks.

Disclaimer

All information used in the publication of this newsletter has been compiled from publicly available sources that are believed to be reliable, however we do not guarantee the accuracy or completeness of this report and have not sought for this information to be independently verified. Forward-looking information or statements in this report contain information that is based on assumptions, forecasts of future results, estimates of amountsnot yet determinable,

and therefore involve known and unknown risks, uncertainties and other factors which may cause the actual results to be materially different from current expectations.

We shall not be liable for any direct, indirect or consequential losses, loss of profits, damages, costs or expenses incurred or suffered by you arising out or in connection with theaccess to, use of or reliance on any information contained on this note.