Rate cut is on the cards

Austin Or, CFA

Highlights

the dual mandates of wrangling inflation and defending employment.

repurchase increase (+13%YoY), humming of AI and upcoming rate cut.

HK$71 billion-HK$135 billion.

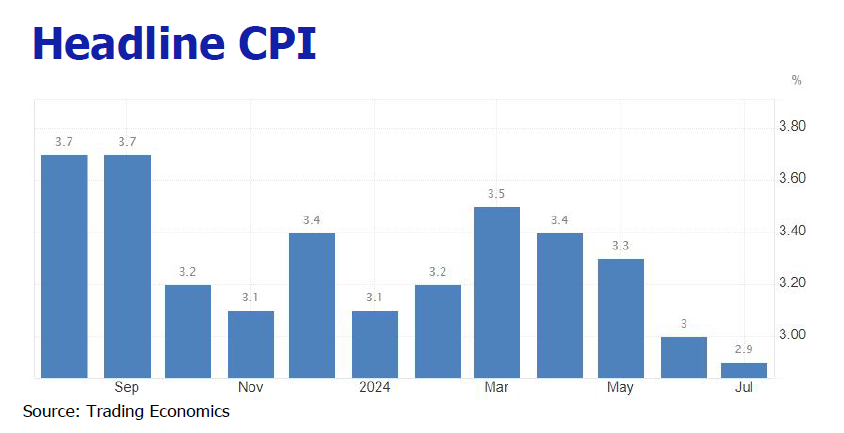

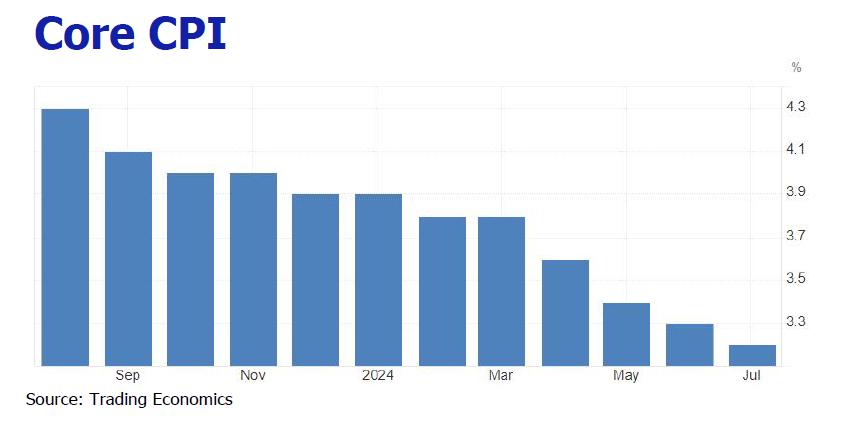

Inflation mellowed to 2.9%YoY in July

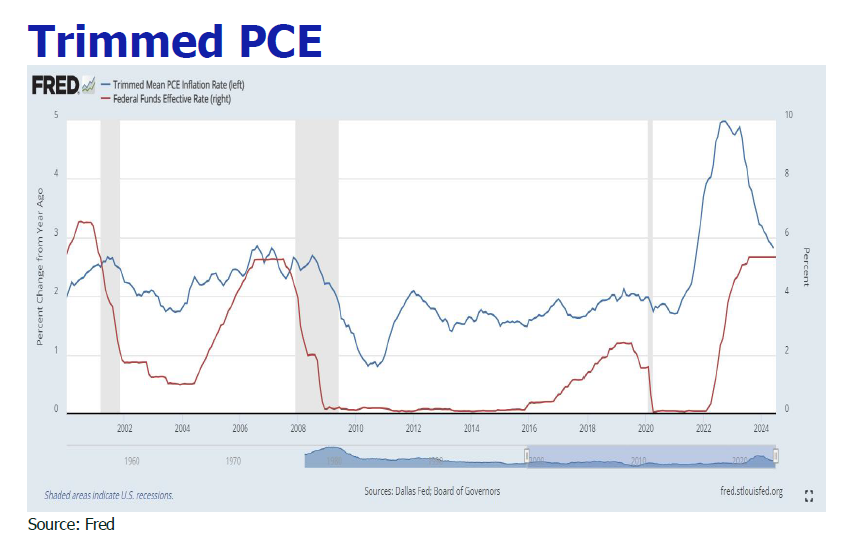

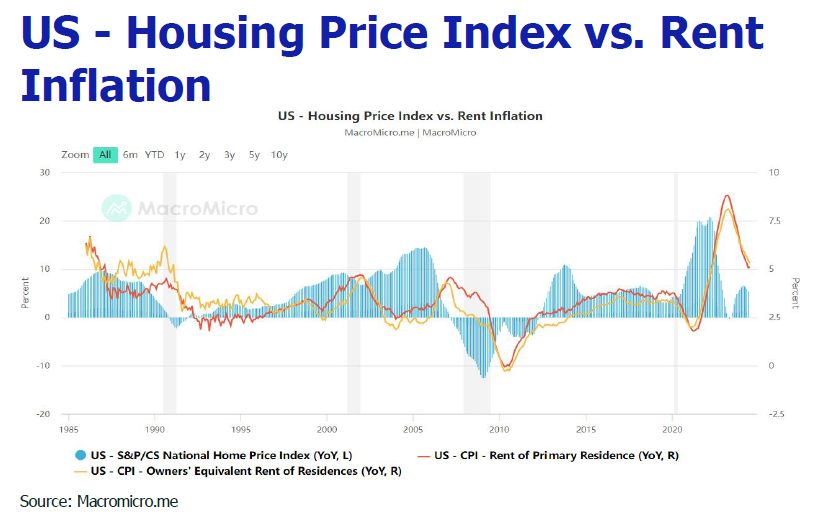

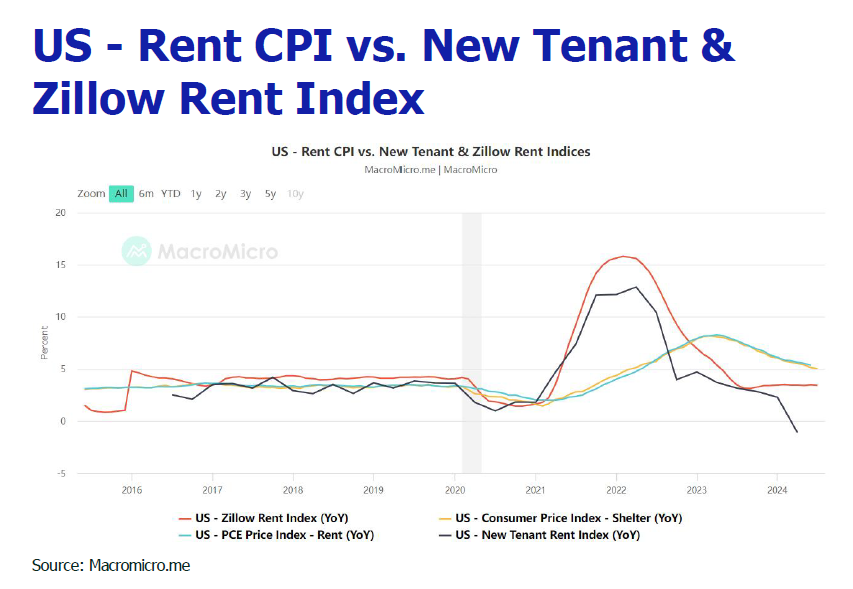

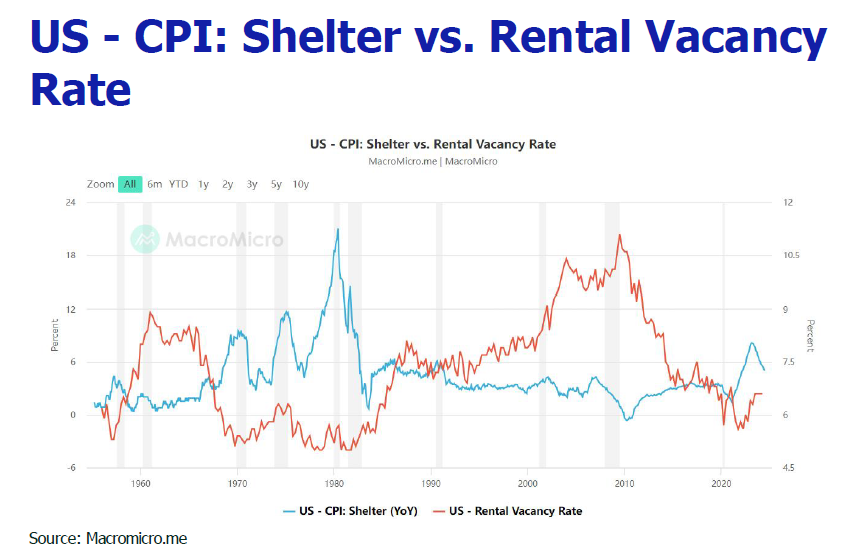

The U.S. CPI narrowed to 2.9%YoY and rose 0.2% MoM in July, core CPI was up 3.2%YoY and 0.2% MoM, both headline and core reading retarded for the fourth consecutive month. Super inflation indicators (excluding housing) relented to 4.73%YoY and inched up with a 0.2% MoM surge. Still, adamant shelter cost which was up 5.03%YoY and 0.4% MoM kept infaltion deviating from 2% goal. With 5.09%YoY and 0.4%MoM and rises in shelter costs, the core services shot up 4.9%YoY and 0.3% MoM. Goods inflation, however, was down 1.9%YoY and slowed the roll of headline inflation.

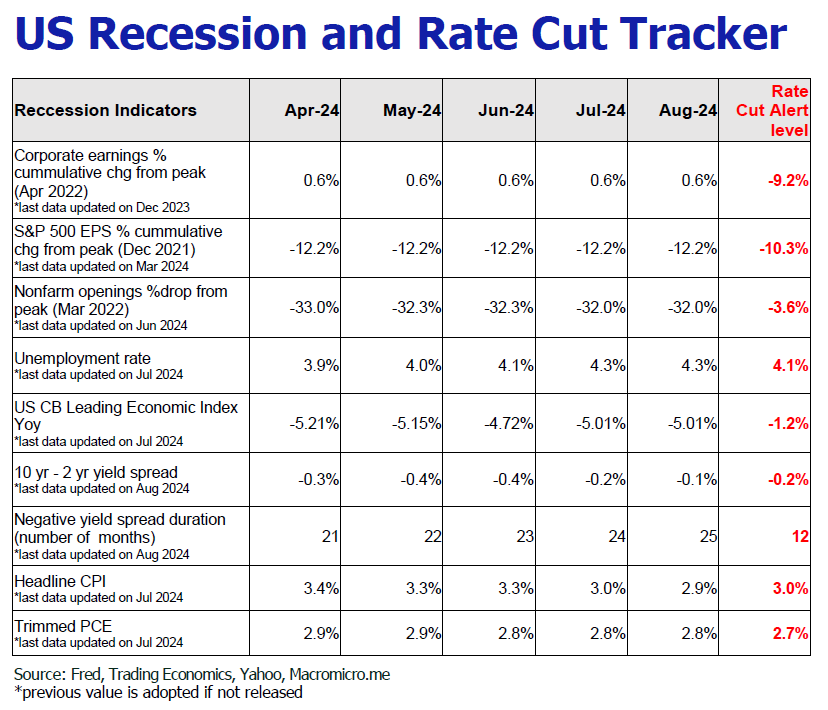

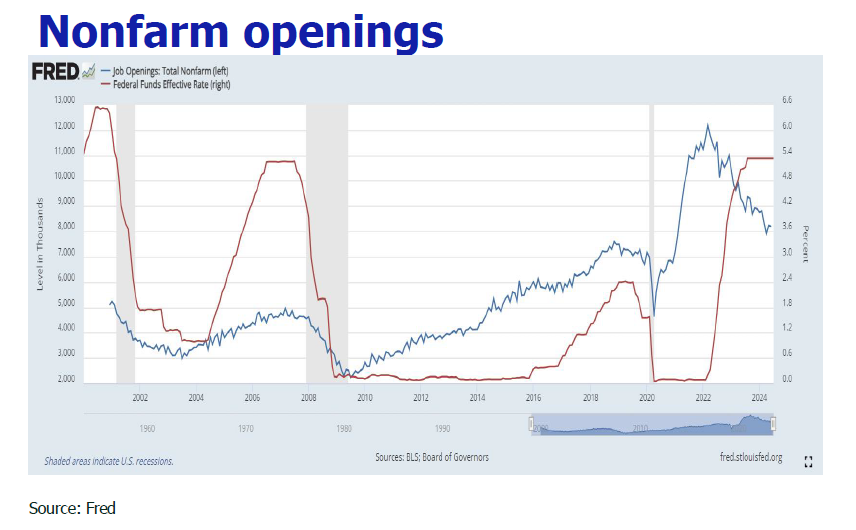

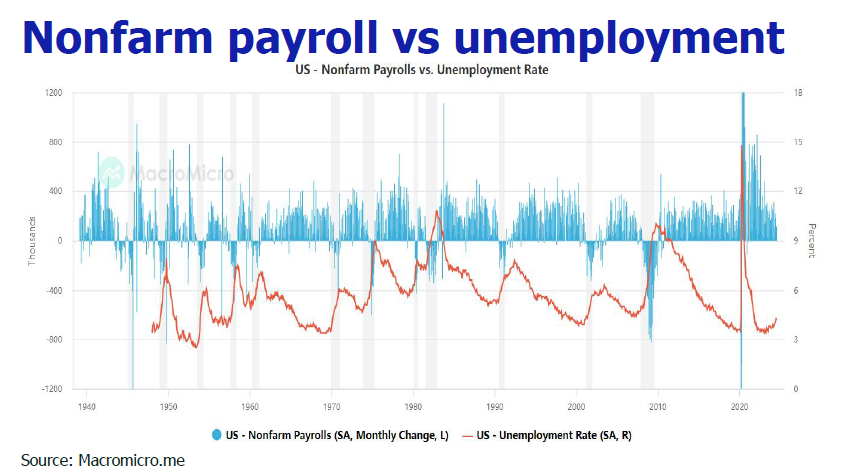

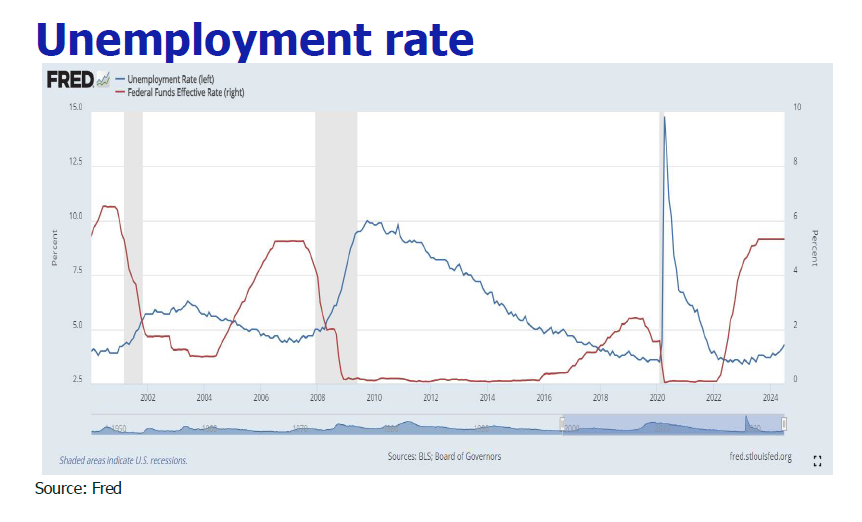

Meltdown of NFP and aggravation of unemployment rang the recession alarm

July U.S. non-farm employment jolted the market with an anemic add of 114,000MoM, the lowest record since December 2020, a herculean miss from the expected 175,000, and a sharp decline from the previous revised value of 179,000. To make matters worse, the annual total number of U.S. non-farm payroll as of March 2024 was shed by 818,000, a downward revision of 0.5%, the largest drop since 2009. Accompanying the crummy NFP was the ramp-up of unemployment, which added 0.35 million to 7.2 million in July, with a 0.2 ppt hike in unemployment rate to 4.3% from the previous month, exceeding expectation of 4.1%, and triggering the Sahm rule with 100% hisotrical accuracy rate to recession prediction. That said, Powell downplayed the 4.3% unemployment rate, regarding it as a result of rising labor supply and slowed hiring, not outright job losses.

Lousy manufacturing PMI, brawny service PMI

The preliminary value of the US Markit manufacturing PMI in August was 48, an eight-month low, as production, orders and factory employment have grown more knackered. Increased rates of decline for new orders and inventories were accompanied by the first fall in factory production for seven months. Employment growth meanwhile slowed to near-stagnation. Inventories of finished goods rose markedly for the third time in the past four months. Conversely, the initial value of the U.S. Services Business Activity Index notched 55.2, a 2-month high, as inflows of new business in the service sector showed the second largest rise recorded over the past 14 months. Battered down by manufacturing PMI, the PMI Composite Output Index edged down from 54.3 in July to a four-month low of 54.1 in August.

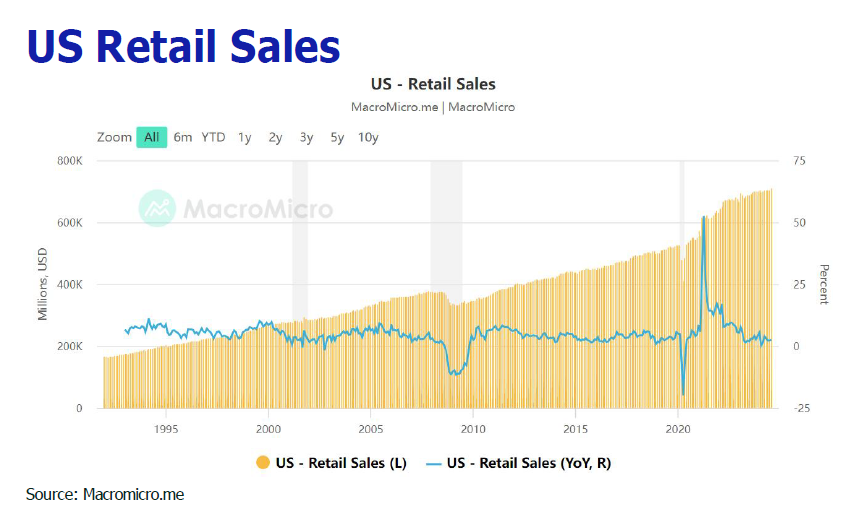

Retail sales sizzled in July

Irrespective of the headwind of crummy nonfarm payorll growth and proliferating unemployment rate, retail sales were up 1.1%MoM, and up 2.7%YoY, reversing the 0.2%MoM drop in June. Excluding gas station sales, which do not reflect Americans’s appetite to spend, retail purchases also rose 1%. Given that activity and hiring in services industries remains solid, and average wages have also been rising (July hourly wages up 0.2% MoM), many households are furbished with ample capacity to keep spending. Consumers are maintaining spending by bargain hunting and trading down to lower-priced substitutes. Upper-income households have also seen their wealth increase, with stock prices and home values having jumped in the past three years.

Wholesome US new home sales provide boost to US economy

As the average mortgage rate ticked down in anticipating of rate cut, the pace of new-home sales in July rose 5.6%YoY, and new-home sales from January through July rose 2.6%YoY. Given that the real estate market contributed 18% to the GDP in 2023, the robust property sales could help hedge the downfall of manufacturing sector and bolster US economy.

The time has come for policy to adjust

Powell made his keynote in Jackson Hole that Fed was more asssured now in the careening of inflation to its 2% target and was discreet about the surge of unmployment to 4.3% lately. He purported that the rate cut is around the corner for upholding the dual mandates of quelling inflation and staving off labor market debacle. Many U.S. Federal Reserve officials have also voiced support for a rate cut in September, pinpointing that U.S. inflation has fallen sharply from highs and the labor market has started to tarnish.

Prediction

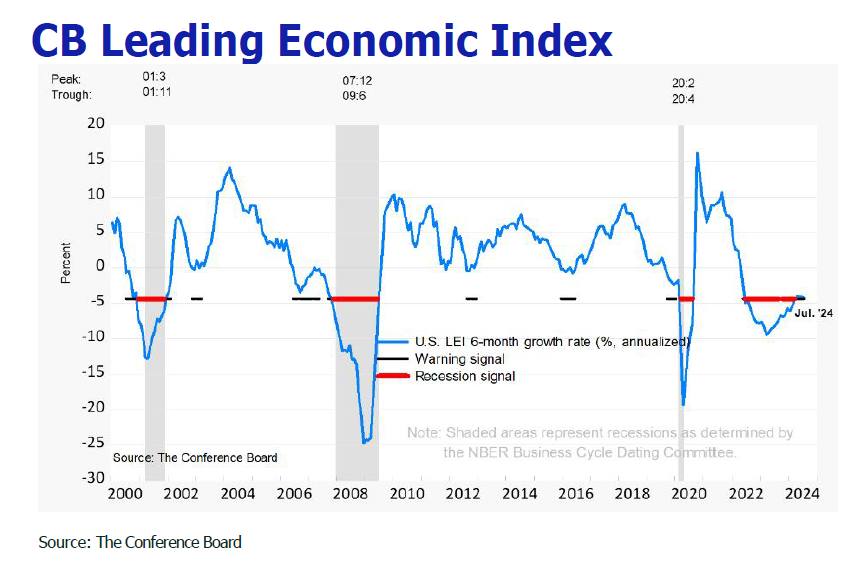

1. Upbeat service consumption distances US economy from recession in the near timeframe.

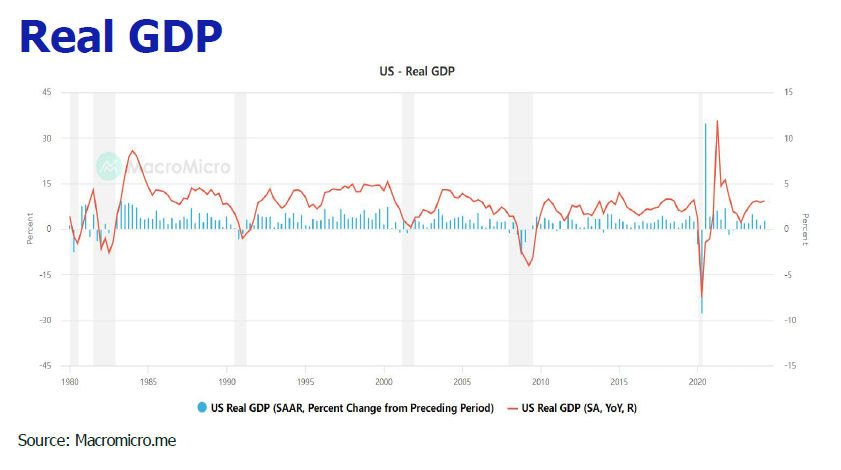

With Americans’ sturdy spending, economists at Morgan Stanley have boosted their forecast for growth in the July-September quarter to a 2.3% annual rate, whereas the economy expanded at a healthy 2.8% rate in the April-June quarter. The take was echoed by S&P Global, contending that the solid growth of service sector in August points to robust GDP growth in excess of 2% annualized in the third quarter.

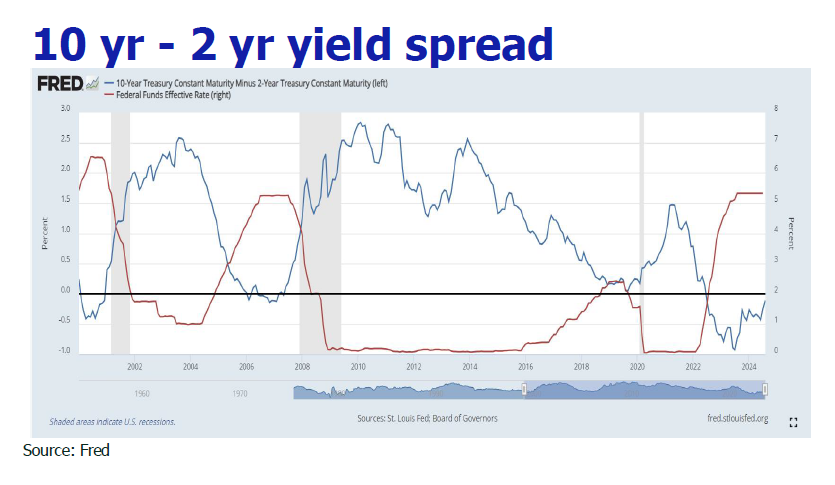

2. Sustained cooling of inflation and labor market greatly aggrandize 25 bp rate cut odd in September.

Fed signaled that, with an appropriate dialing back of policy restraint, there is good reason to think that the economy will get back to 2 percent inflation while maintaining a strong labor market, opening the door to imminent rate cut in September. The CME FedWatch tool flags a 67.5% chance for a 25 bp rate cut and a 32.5% chance for 50 bp rate cut in September. We are on the same page that Fed is girding for a pre-emptive rate cut of 25 bp rather than 50 bp in September with very high conviction.

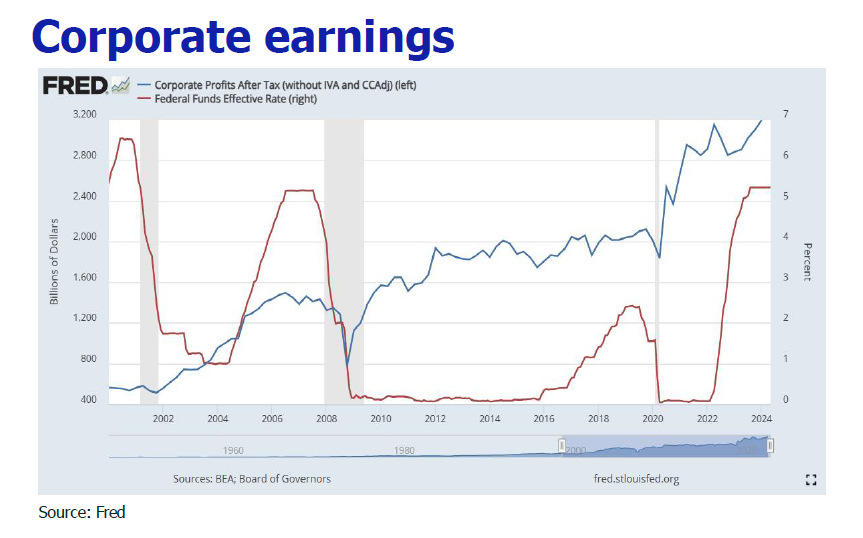

First and foremost, the NFP is slumping and the unmployment rate is ticking up at the pace out of left field. The employment is literally window-dressed as one man working for several part time jobs are multi-counted as two or more workforces. As US corporate bankrupcty is on the tear

(+40.4%YoY ending 2024Q1) due to elevated interest rate and the manufacturing sector forwardlooking orders-to-inventory ratio has fallen to one of the lowest levels since the global financial crisis, the NFP and the unemployment rate are circling the drain.

Second, shelter inflation which made up of one-third of CPI is seen moderating and closing the wedge with Zillow rent index incessantly, signifying more room for CPI to descend going forward.

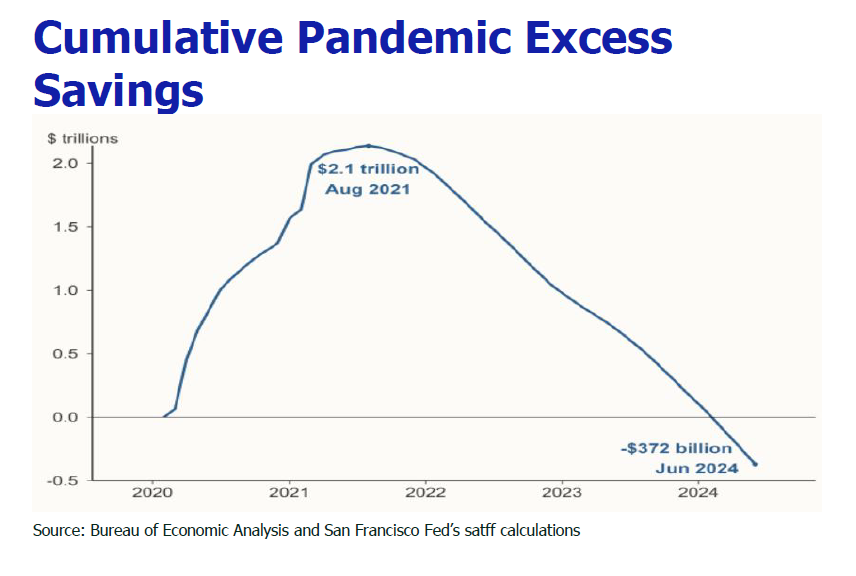

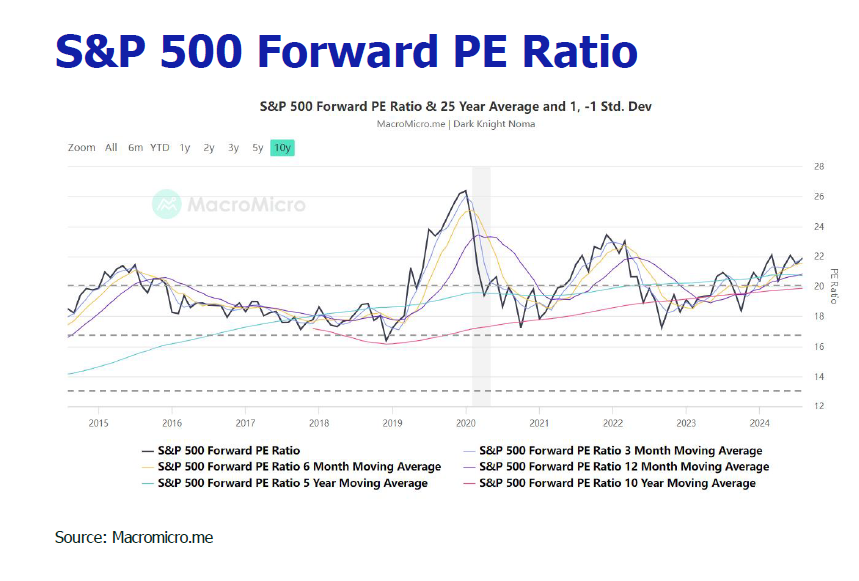

Next, US consumption power which has long been buoyed on wage growth, pandemic excess saving, credit borrowing and financial asset appreication is denting as mirrored by downgrade of consumption. Average hourly wage growth has been slowing from 4.83% in January to 3.63% in July, and pandemix excess saving was fully depeleted in March/April. So, the finale would be an advent of a consumption cliff when the labor market goes wrong, the credit limit is maxed out and the US stock market hits the roof as the valuation is stretched.

Additionally, the US treasury debt interest payment is set to increase by almost $234 billion to $892 billion by the end of 2024 at the current interest rate level. According to the CBO, the United States will suffer a fiscal deficit of $1.9 trillion in 2024, prompting Fed to lower rate to offload interest burden.

Furthermore, the wave of interest rate cuts announced by global central banks poses a challenge to U.S. exports. The European Central Bank may announce an interest rate cut in September. The Swiss and Canadian central banks have already cut interest rates twice this year and may continue to cut interest rates in the future. The Bank of England cut interest rates for the first time in four years in August, and Australia and Norway may start cutting interest rates at the end of the year. As exports of goods and services commands around 11% of US GDP, Fed is tempted to cut rate to the end of maintaining export.

Last, a 50 bp cut would signal that US economy outlook is gloomier than expected which is not the case in light of the strong Q3 GDP growth ahead and no recession signal is captured by US LEI for the fourth consecutive month.

Disclaimer

All information used in the publication of this newsletter has been compiled from publicly available sources that are believed to be reliable, however we do not guarantee the accuracy or completeness of this report and have not sought for this information to be independently verified. Forward-looking information or statements in this report contain information that is based on assumptions, forecasts of future results, estimates of amountsnot yet determinable,

and therefore involve known and unknown risks, uncertainties and other factors which may cause the actual results to be materially different from current expectations.

We shall not be liable for any direct, indirect or consequential losses, loss of profits, damages, costs or expenses incurred or suffered by you arising out or in connection with theaccess to, use of or reliance on any information contained on this note.