Trump 2.0 presents a new challenge to the world economy

Austin Or, CFA

Highlights

![]() US headline inflation perked up to 2.6%YoY due to food, used cars and shelter costs hike.

US headline inflation perked up to 2.6%YoY due to food, used cars and shelter costs hike.

![]() October NFP buckled to 12000 due to the recent hurricanes and the dockworkers’ strike.

October NFP buckled to 12000 due to the recent hurricanes and the dockworkers’ strike.

![]() Retail sales nudged 0.4%MoM growth in October, driven by softer inflation and higher income.

Retail sales nudged 0.4%MoM growth in October, driven by softer inflation and higher income.

![]() Markit service industry PMI in November was 57, the highest since March 2022.

Markit service industry PMI in November was 57, the highest since March 2022.

![]() Markit manufacturing PMI in November ameilorated to 48.8, as factories step up purchases of imported inputs before tariffs.

Markit manufacturing PMI in November ameilorated to 48.8, as factories step up purchases of imported inputs before tariffs.

![]() Trump2.0 economic policies are poised to boost US GDP growth at the expense of reflation and higher fiscal deficit.

Trump2.0 economic policies are poised to boost US GDP growth at the expense of reflation and higher fiscal deficit.

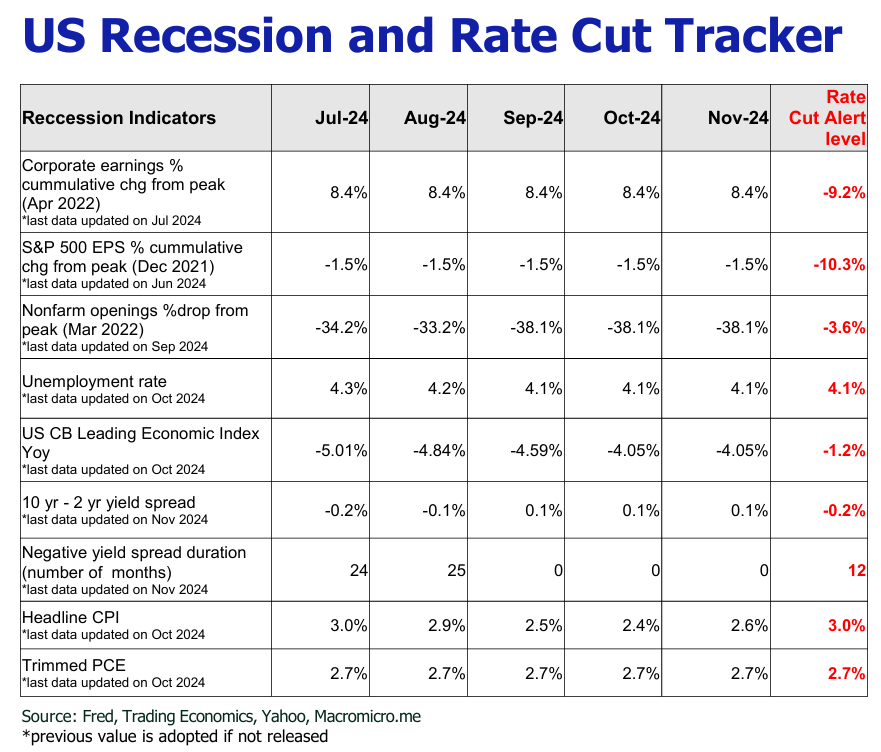

![]() Fedis expected to make another 25bp rate cut in December but slowed the pace in 2025 against the backdrop of manufacturing reboot tactics, substantial amount of maturing treasuries requiring refinancing, and the higher reflation risk engendered by Trump 2.0.

Fedis expected to make another 25bp rate cut in December but slowed the pace in 2025 against the backdrop of manufacturing reboot tactics, substantial amount of maturing treasuries requiring refinancing, and the higher reflation risk engendered by Trump 2.0.

![]() US equities, gold and crypto will be the winners while US dolllar and US treasuries will be the losers.

US equities, gold and crypto will be the winners while US dolllar and US treasuries will be the losers.

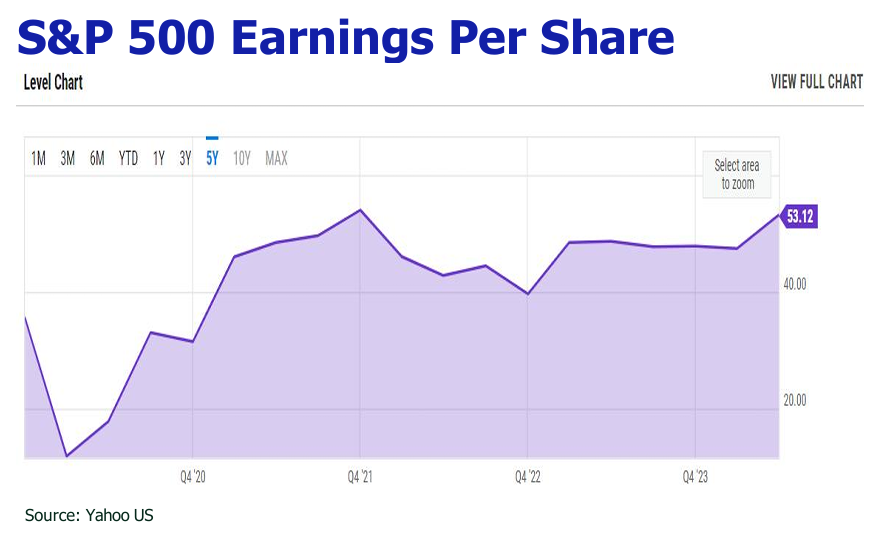

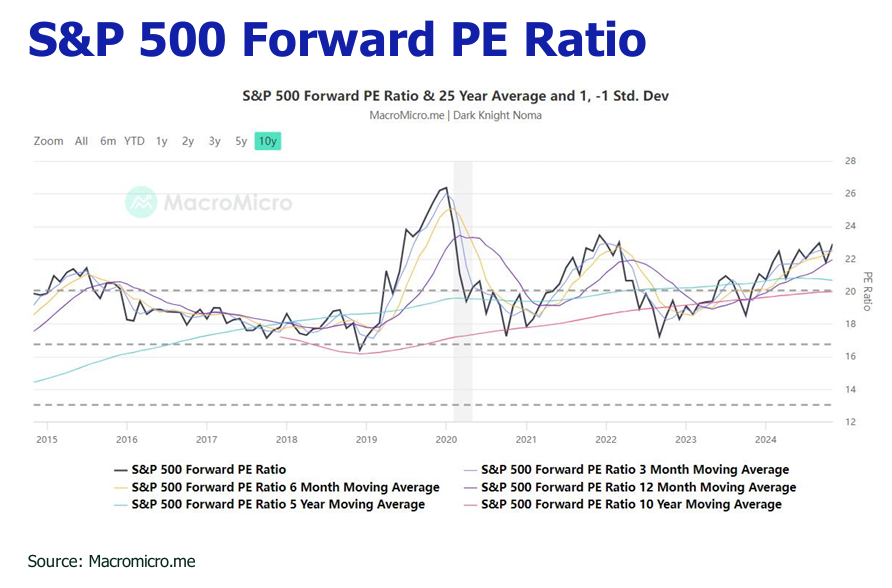

![]() Wemaintained our S&P 500 forecast at 5800-6000 ending 2024 and extend our short term bullish view on S&P500 in 2025 with a target of 6600, seeing higher corporate EPS due to tax and rate cuts.

Wemaintained our S&P 500 forecast at 5800-6000 ending 2024 and extend our short term bullish view on S&P500 in 2025 with a target of 6600, seeing higher corporate EPS due to tax and rate cuts.

![]() InNovember, Hong Kong Hang Seng Index (HSI) sagged to around 19400 with trading volume plunging to HK$ 100 billion- HK$ 200 billion due to lack of confidence of China’s new RMB 10 trillion provincial debt replacement meassures to simtulate domestic economy, and shadow of Trump’s pledge of 60% tariff hike to China goods.

InNovember, Hong Kong Hang Seng Index (HSI) sagged to around 19400 with trading volume plunging to HK$ 100 billion- HK$ 200 billion due to lack of confidence of China’s new RMB 10 trillion provincial debt replacement meassures to simtulate domestic economy, and shadow of Trump’s pledge of 60% tariff hike to China goods.

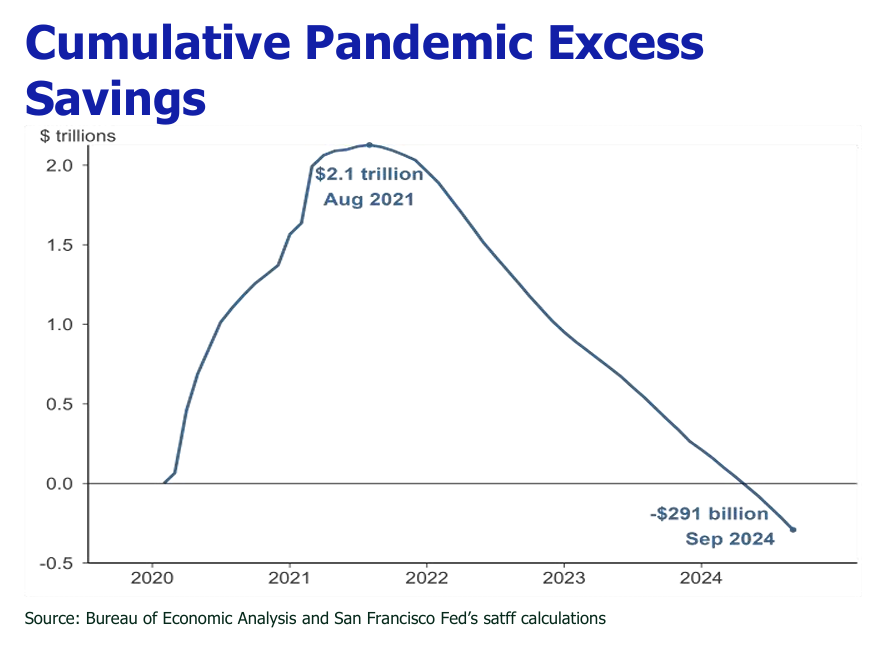

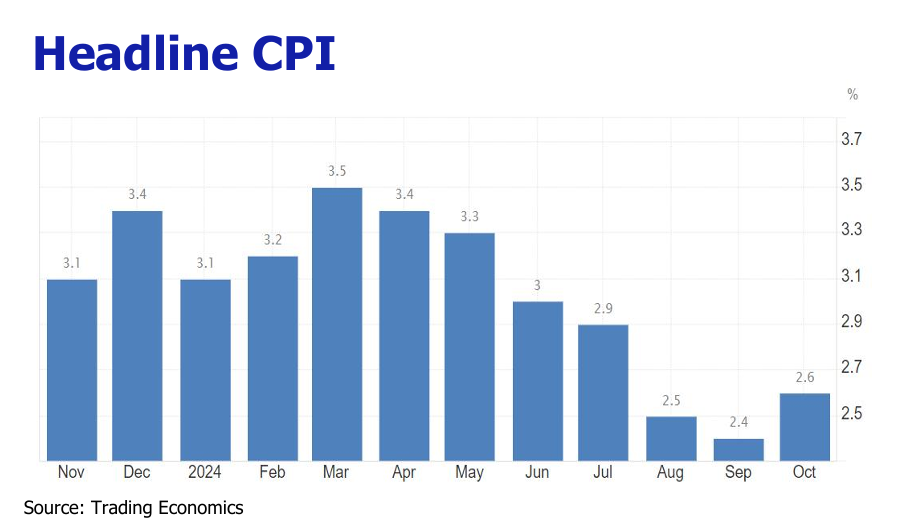

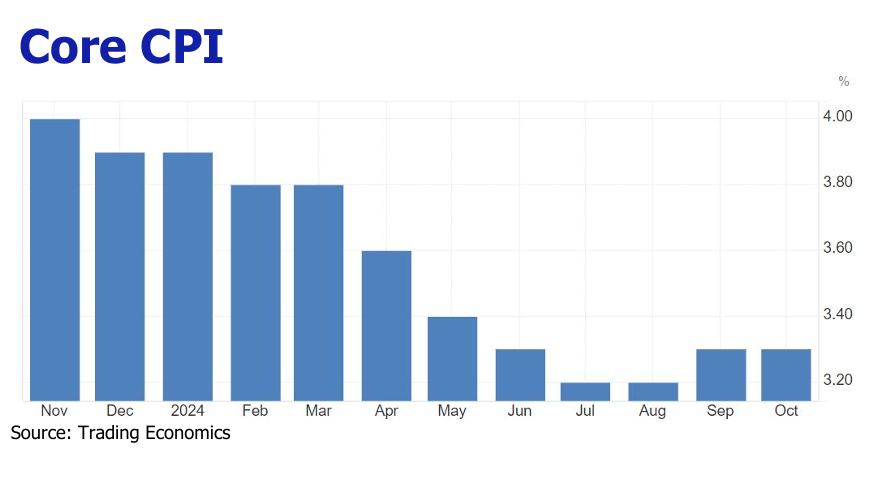

Inflation rallied in Ocotber

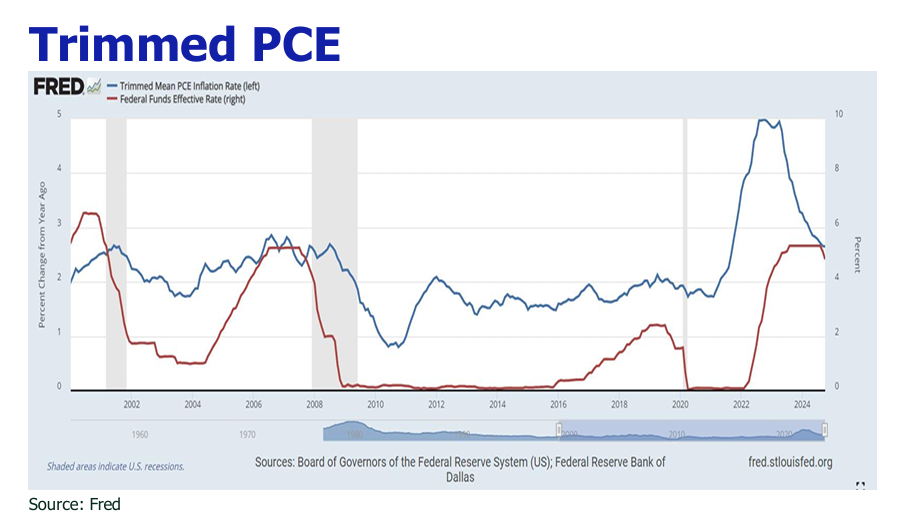

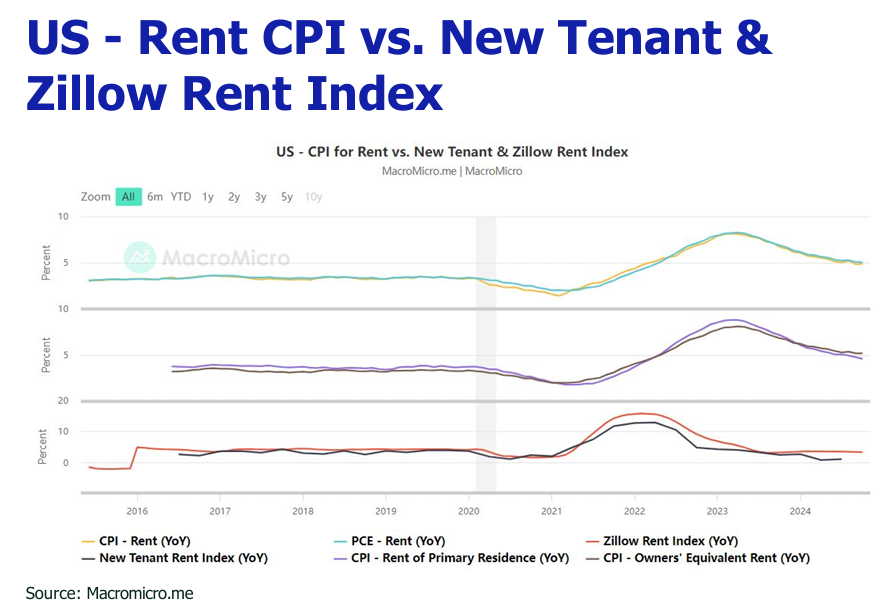

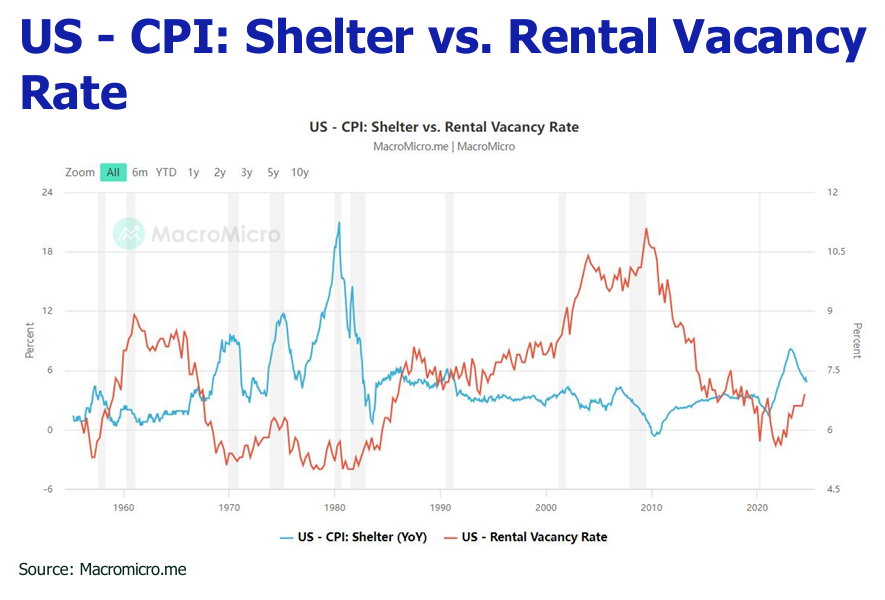

Headline inflation perked up in October by 0.2% MoM and 2.6% YoY and so did core inflation with small spike to 0.3% MoM and 3.3% YoY. Food, used cars and shelter are to blame for the disruption to the disinflation progress in October. Food index increased 0.2% MoM and 2.1% YoY, and used vehicle prices rose by a sharper 2.7%, following a 0.3% rise the month prior. Still, shelter cost was the greatest pain in the neck. It climbed 0.4% MoM and 4.9%YoY in October. The reflation spectre is also captured by PCE, which mounted slightly to 2.3%YoY from the previous value of 2.1% YoY, and remained unchanged at 0.2% MoM.

U.S. core PCE in October edged higher to 2.8% from the previous value of 2.7%, with a stalling 0.3% MoM change. However, broad signs of inflation moderating are noted elsewhere. The energy index remained unchanged MoM and was off by 4.9% YoY. The “super core” service index, which excludes the cost of buying a home, rose the smallest in three months in October with a 0.31% MoM increase; core goods prices excluding second-hand cars fell 0.2% MoM, the largest decline this year. If Trump policies enact, this will potentially lead to higher inflation due to higher import prices.

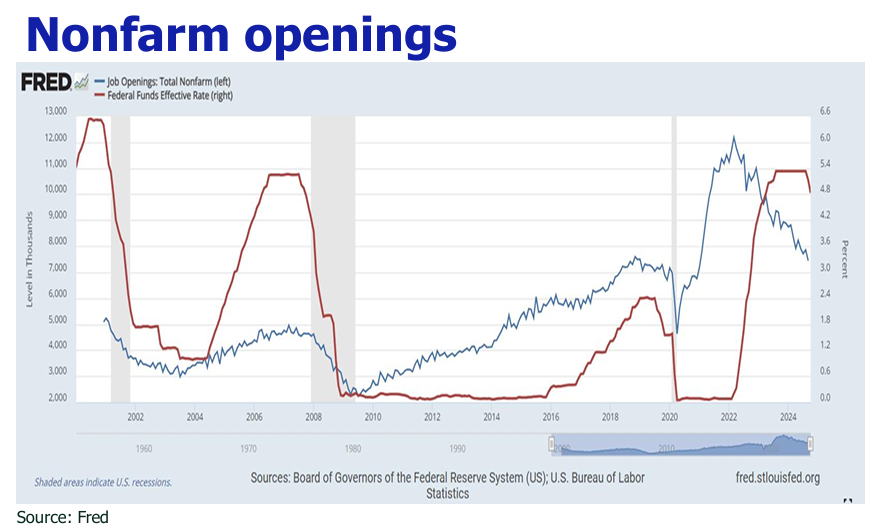

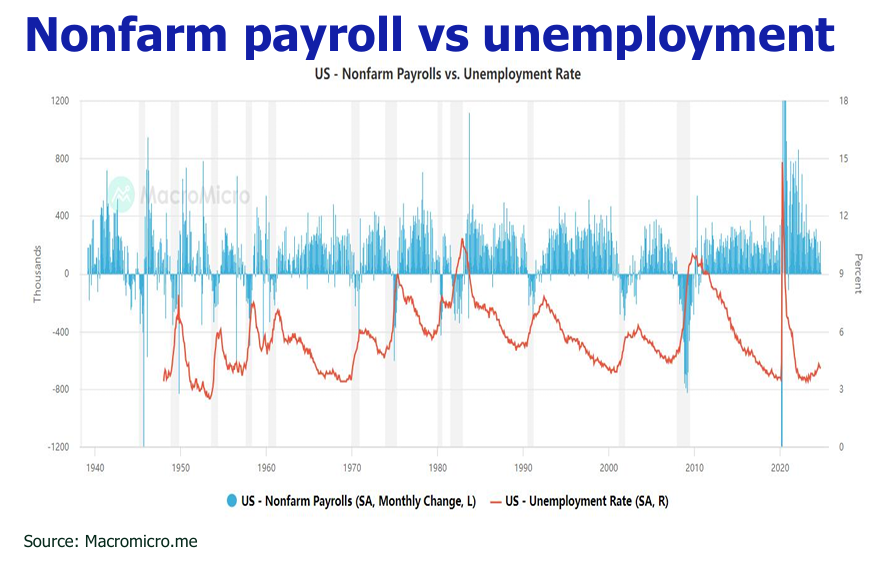

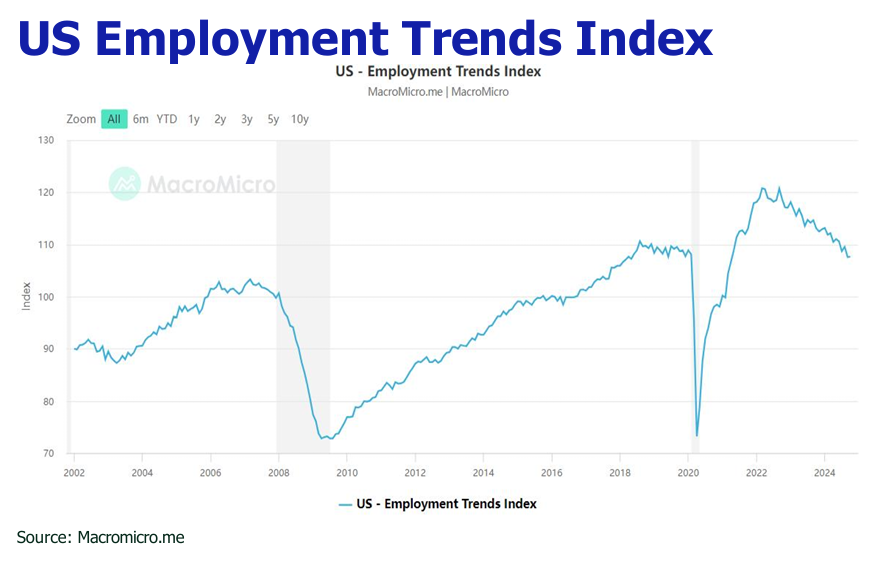

NFP buckled while unemployment stayed steady

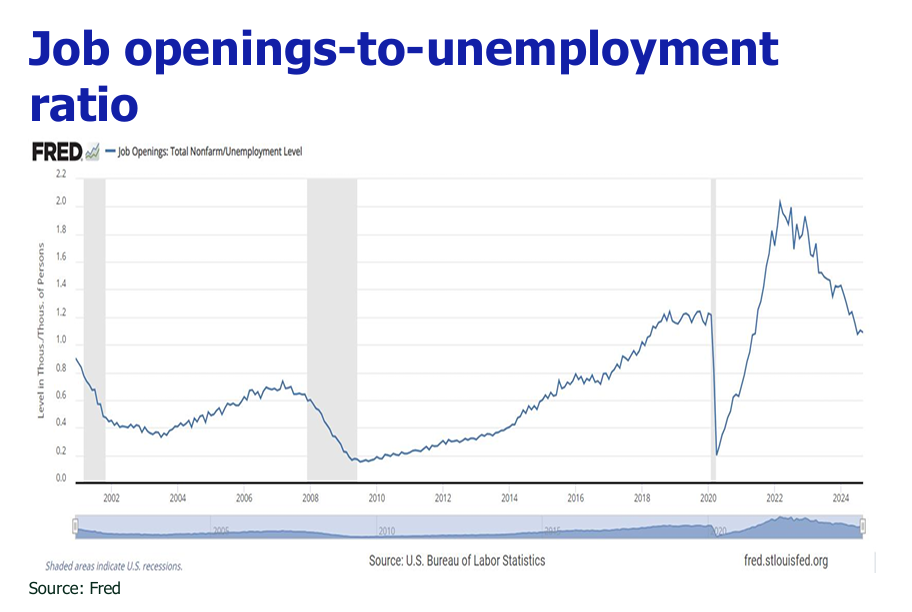

Due to recent hurricanes and the dockworkers’ strike, the nonfarm payrolls posted an off the charts add of only 12,000 jobs, a landfall from 223,000 jobs added in September. The August and September jobs reports were revised lower, down by 81,000 to 61000 and by 31,000 to 223,000, respectively. The job market felt the heat as the growth was concentrated in the health care (+52,000) and government (+40,000) sectors. The unemployment rate depicts a soothing condition with a steady print of 4.1% and the number of unemployed individuals changed slightly at 7 million.

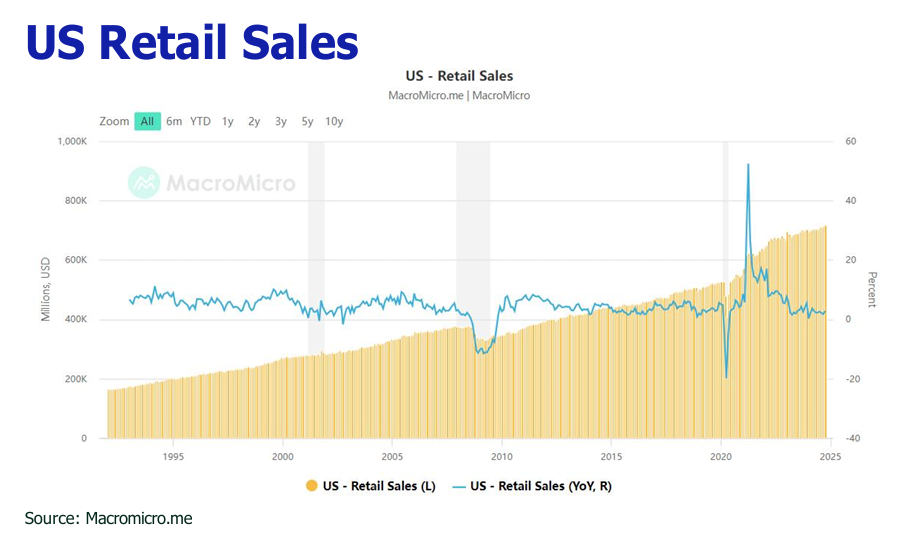

Indomitable retails sales mainly backed by robust income growth

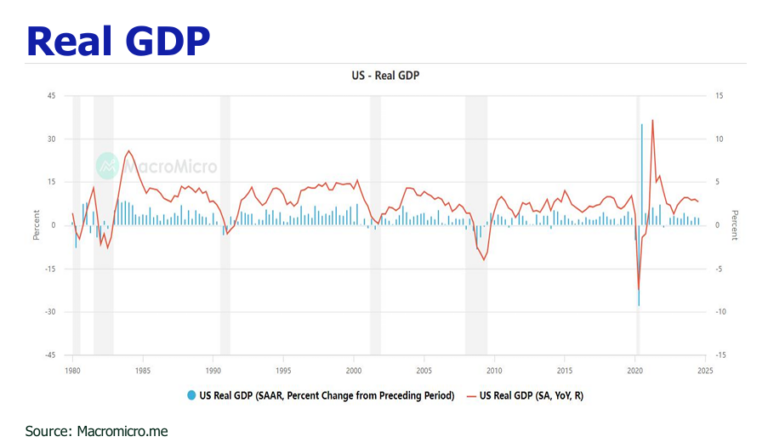

Retail sales increase 0.4%MoM in October, and September sales gain was raised to 0.8%MoM from 0.4%MoM. The big chunk of growth came from auto sales which accelerated by 1.6%, and electronics and appliance good which rebounded 2.3%. Moderated inflation, bullish stock market, falling energy prices, strident wage growth (0.4%MoM, 4%YoY) and disposable personal income (0.7%MoM) are contributors to the awesome retail sales. Pivoted on sturdy retail consumption of 3.5%YoY in Q3, US GDP growth nudged 2.8%YoY and is projected to hit 2.3%YoY and 2.8%YoY in Q4.

Service PMI was in tip-top shape, manufacturing PMI bucked the downtrend

The initial value of the Markit comprehensive PMI in the United States in November was 55.3, the highest since April 2022, and the previous value was 54.1 in September. Whereas, the initial value of the Markit service industry PMI in November was 57, the highest since March 2022, and the previous value was 55; the preliminary value of the Markit manufacturing PMI in November was 48.8, the highest reading since July 2024, and the previous value was 48.5. Manufacturing is back on its feet as factories step up purchases of imported inputs and seek to preempt tariffs.

Prediction

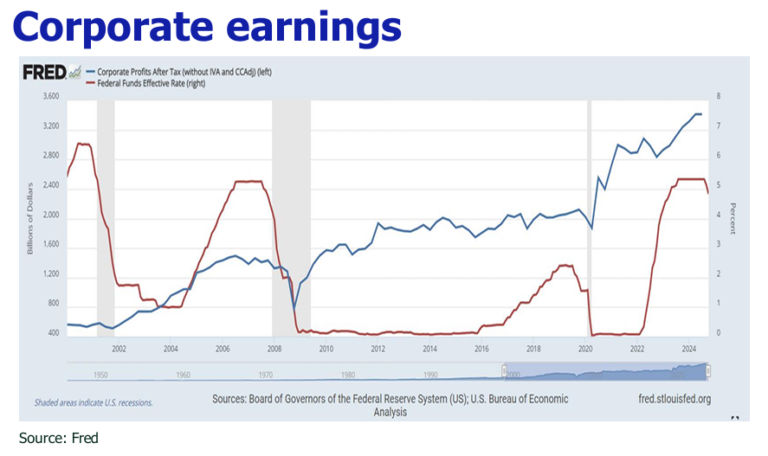

1. Stronger economic growth, higher inflation risk and worsening fiscal deficit during Trump’s second presidency.

In the new tenure of Trump’s presidency, he will implement a basket of economic policies including tax cut, tariff, illegal immigrants deportation, relief of supervision of finance industry, advocation of US oil, auto, AI and crypto industries, and fiscal expenditure reduction, creating mixed aftermaths to US economy and inflation.

Trump claimed that he will lower US corporate tax rate from 21% to 15%, and trim the highest personal tax rate from 39.6% to 37% in the next four years. We reckon that the tax cuts will translate into higher US economic growth by boosting corporate recruitment, personal consumption

and return of overseas US manfacturing capital. According to Goldman Sacchs, the tax cuts will boost S&P500 EPS by 20% in the next two years and ratchet up US GDP growth from the current market consensus of 1.9% to 2.5% in 2025.

Trump’s plan to levy a 10% tariff on all imports and 60% or more on Chinese goods represents boon and bane to US economy. On Nov 26, he kept his word by announcing to levy 25% for all Canada and Mexico goods and 10% import tariff on China goods. US Tax Foundation estimates a 10 percent universal tariff would raise $2 trillion revenue from 2025 through 2034. On the flip side, the imposition of tariff will engender backfire of higher import prices and a passthrough to inflation. Deutsche Bank and Goldman Sacchs forecast that US core PCE will be lifted by 1.4 ppt or 0.9 ppt. The mass deportation plan will rattle the balance of US labor market, refueling labor wages and inflation pressure.

Apart from potential upturn of inflation, tariff will pummel US GDP growth due to retaliation of tariff on US export goods and curtailed domestic consumption. A study by the National Retail Federation (NFR) pointed out that if Trump’s proposed new tariff plan is implemented, American consumers may spend $78 billion less annually. S&P Global forecasts that the full tariff plan will shrink US GDP by 1 ppt. However, we submit that the adverse impact of tariff to US economy will be mitigated by tax cut stimulus to domestic consumption and pro-growth policies on finance, oil, auto, AI and crypto industries.

Alongside tariff, Trump pledged to reduce fiscal expenditure in order to improve US government balance sheet. However, Committee for Responsible Federal Budget finds that Trump tax cut plan would aggravate US fiscal deficit and sink the nation $7.5 trillion (neutral scenario) further into debt over the next decade.

Trump has also vowed to conduct the largest deportation effort targeting at an estimated 13.3 million undocumented immigrants in the U.S, with a possible initial scale of 1 million. The American Immigration Counci estimates that the cost associated with arrest, detain and legal process would

cost some $88 billion annually for 1 million deportation per year, and the price tag for removing 13.3 million people would require $967.9 billion over the course of more than 10 years. Additionally, the mass deportation will remove the low end workers in construction, child care and elder care. This will create a negative impact on native workers’ employment because of the loss of complementary labor inputs. The sudden loss of millions of people could also jeopardize US economies because there would be fewer people who are eating at local restaurants and paying for goods and services provided by local businesses. Mass deportation would also result in high default rates for the mortgages held by households with undocumented immigrants and would undercut the US housing market. The mass deportation program simply does more harm than good, as it will dampen employment opportunities for U.S. workers and US economic growth, coupled with a surge in inflation and bigger budget deficits.

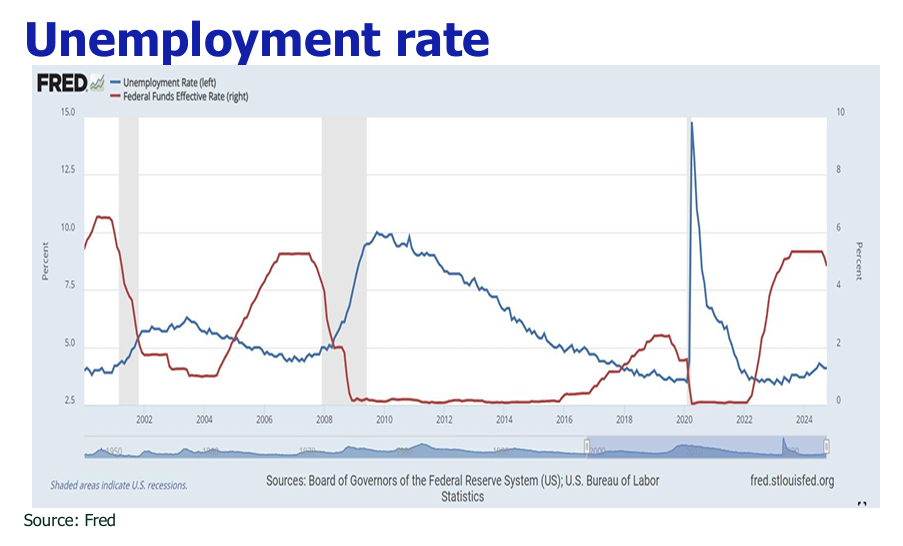

2. Another 25bp rate cut in December after 75 bp rate cuts in November and September.

The latest brisk retail sales and uptick of inflation have dialed back rate cut odds in December. CME FedWatch tool only priced in a nearly 55% chance for a 25 bp rate cut at the next FOMC meeting on Dec 18. Dissecting the genuine inflation and job market conditions, we believe Fed will not pull the plug of rate cut in Decemeber. As the recent two hurricanes engendered temporary relocation of households from home to hotel (lodging away from home is counted in shelter CPI) and interference to car components supply chain, the surge in October inflation should be fleeting.Taking note of the core shelter components, the rent of primary residence and owners’ equivalent rent (OER), they are still progressing on the cooling path. The rent of primary residence and owners’ equivalent rent (OER) revealed 4.6% YoY and 5.19% YoY growth respectively in October, both were better off than the September readings of 4.78%YoY and 5.2%YoY. Although the one-off impacts by hurricanes and strikes to the dreaded NFP plunge in October are distortions to be reckoned with, the meltdown was way beyond the market’s expected reduction of 40,000 due to hurricanes and strikes. Despite the noise in the October NFP, some Fed officials voiced supports for continuing 25bp rate cut in December FOMC to bring down the Fed rate closer to the neutral rate target of 2.9%-3.25% as long as the inflation is migrating to 2% goal.

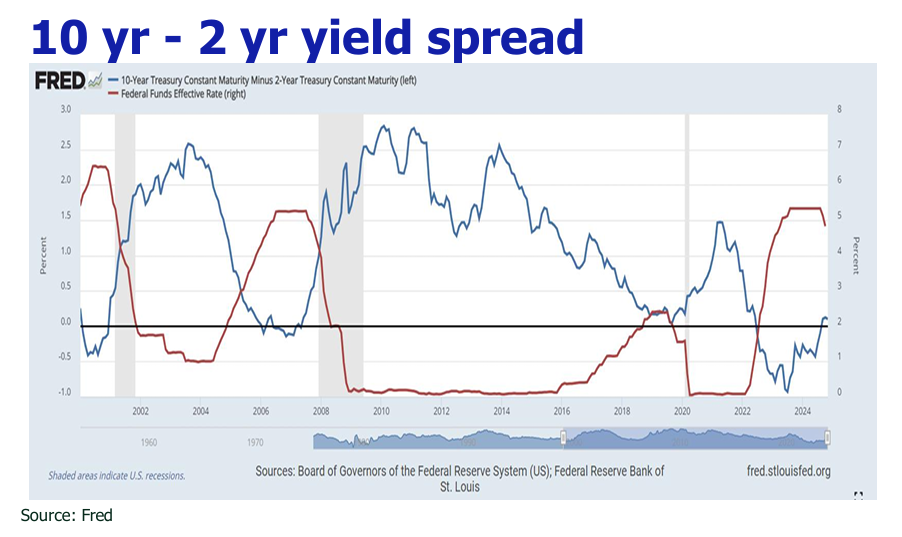

3. Recalibration of rate cut in 2025 due to Trumpflation.

Despite the reflation threat posed by Trump 2.0 policies, we still posit that Fed will continue rate cut in 2025 for two-fold reasons. First, Trump repeatedly expressed that he wanted to bring back manufacturing companies to US by lowering interest costs and exercised stronger influence on Fed to push rate lower. Second, Bloomberg pointed out that US$ 6.74 trillion treausry debt (19% of US$ 36 trillion total debt) will become due in 2025, pressing Fed to lower rate in December to unload the sheer interest burden which become increasingly dire with aggravating fiscal deficit. As Trump 2.0 policy risks ramping up inflation, the market lowered rate cut odds in 2025 from 3-4 times to 1-3 times by 50bp-75bp, echoeing Fed latest speech of tweaking future rate cut to a slower pace. The market now widely renews 2025 year end Fed rate target to 3.75%-4.00% or 3.5%-3.75%, equating to a 75bp or 100 bp rate cut from the current 4.5%-4.75% Fed rate.

4. Positve for US equities, gold and crypto, negative for US dolllar and US treasuries.

In light of stronger corporate earnings, pro-growth Trump 2.0 policies and continuing rate cut odds, wallstreet investment banks raised 2025 S&P 500 target to 6500-7000. Gold will cascade higher due to insitution accumulation for hedging inflation and dollar devaluation, while crypto will advance to a loftier level on the back of relaxation of insitutional investment and possible inclusion of bitcoin into US national reserve. As US fiscal deficit is expected to aggravate, US dollar will be under headwinds. Although US treasuries will benefit from further rate cut, Fed’s ongoing QT and overseas holdings reduction, along with issuance increase for funding expanding fiscal deficit will weigh on US treasuries.

Disclaimer

All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however we do not guarantee the accuracy or completeness of this report and have not sought for this information to be independently verified. Forward-looking information or statements in this report contain information that is based on assumptions, forecasts of future results, estimates of amounts not yet determinable, and therefore involve known and unknown risks, uncertainties and other factors which may cause the actual results to be materially different from current expectations.

We shall not be liable for any direct, indirect or consequential losses, loss of profits, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note.