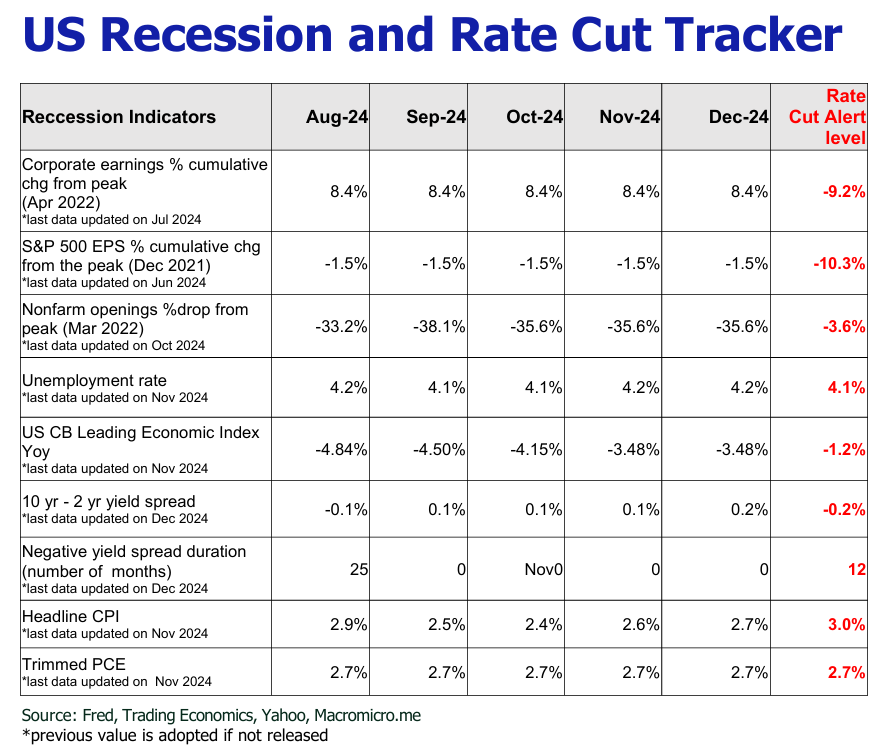

Rate cut may switch to a lower gear in 2025

Austin Or, CFA

Highlights

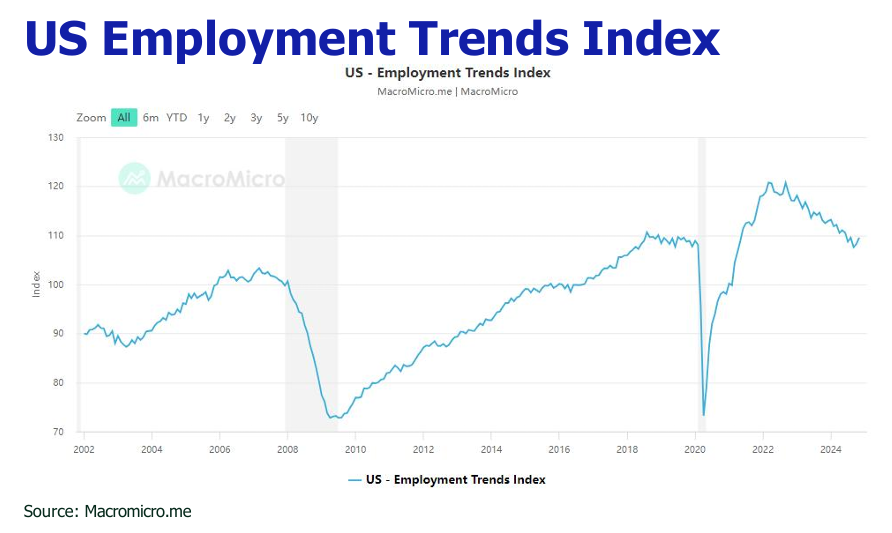

![]() Thelabor market showed mixed signals, with November’s NFP rising to 227,000, while theunemployment rate increased to 4.2% and the overall employment figures declined.

Thelabor market showed mixed signals, with November’s NFP rising to 227,000, while theunemployment rate increased to 4.2% and the overall employment figures declined.

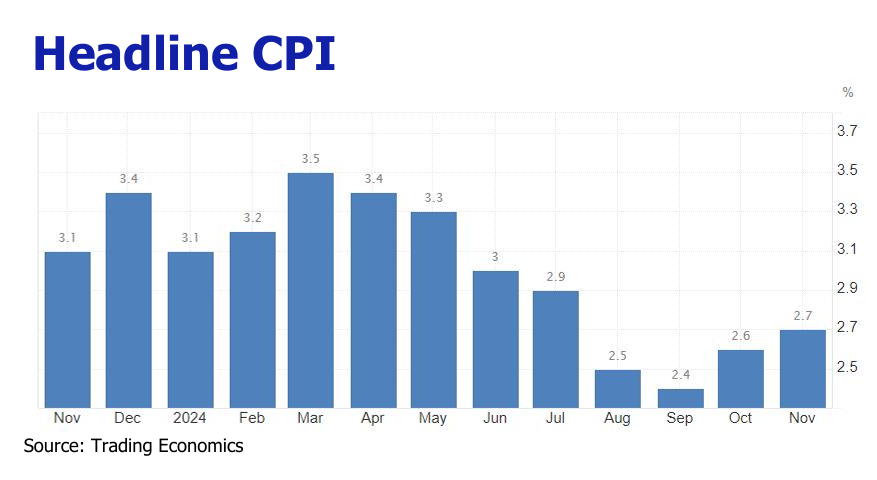

![]() Headline inflation edged up and core inflation leveled off year over year, hindering progress in disinflation.

Headline inflation edged up and core inflation leveled off year over year, hindering progress in disinflation.

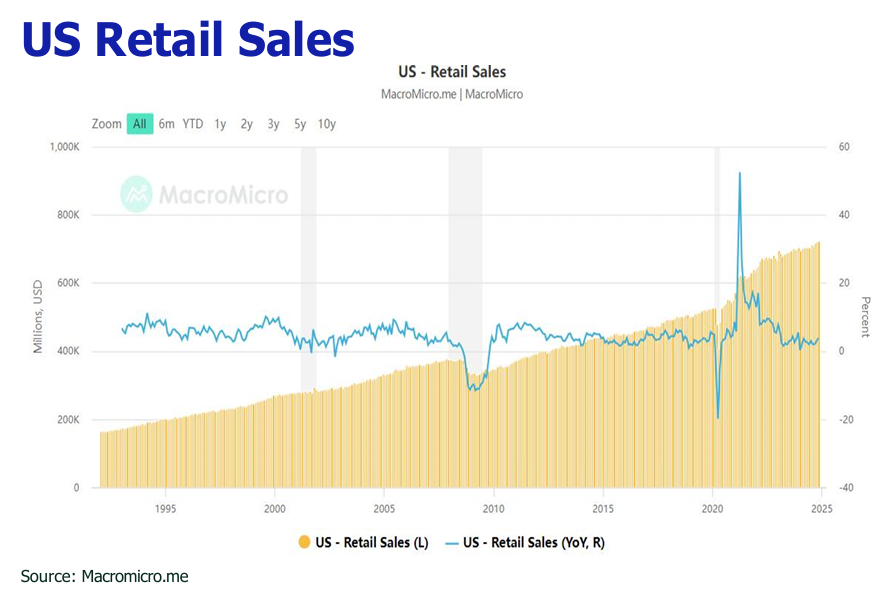

![]() Retail sales vaulted 3.8% YoY and 0.7% MoM in November, underscoring resilience in the US economy.

Retail sales vaulted 3.8% YoY and 0.7% MoM in November, underscoring resilience in the US economy.

![]() US Services PMI hit a 38-month high of 58.5 up from 56.1 last month, outweighing the pullback of Manufacturing PMI from 49.7 to 48.3.

US Services PMI hit a 38-month high of 58.5 up from 56.1 last month, outweighing the pullback of Manufacturing PMI from 49.7 to 48.3.

![]() Fedis expected to hold back rate cut in January 2025 and may tail off the pace to two times or fewer in 2025 due to anticipated higher inflation from Trump’s tariff and tax cut policies.

Fedis expected to hold back rate cut in January 2025 and may tail off the pace to two times or fewer in 2025 due to anticipated higher inflation from Trump’s tariff and tax cut policies.

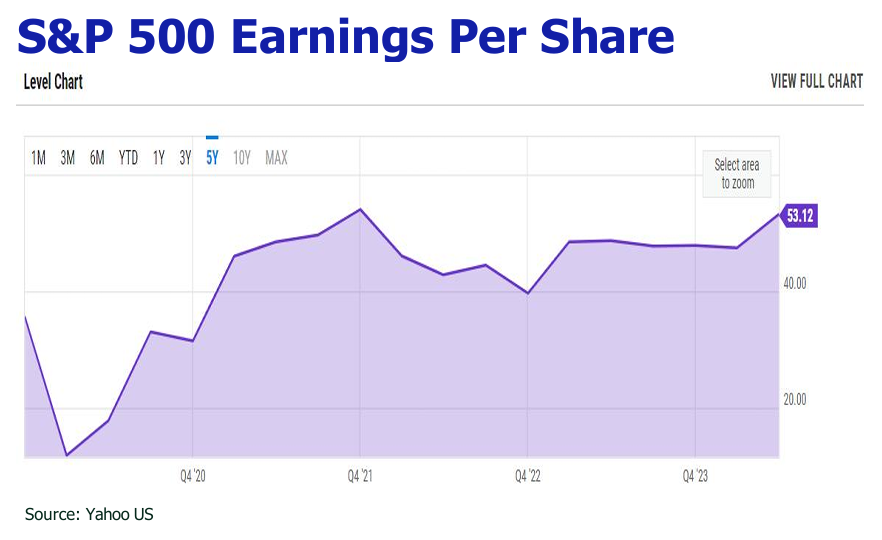

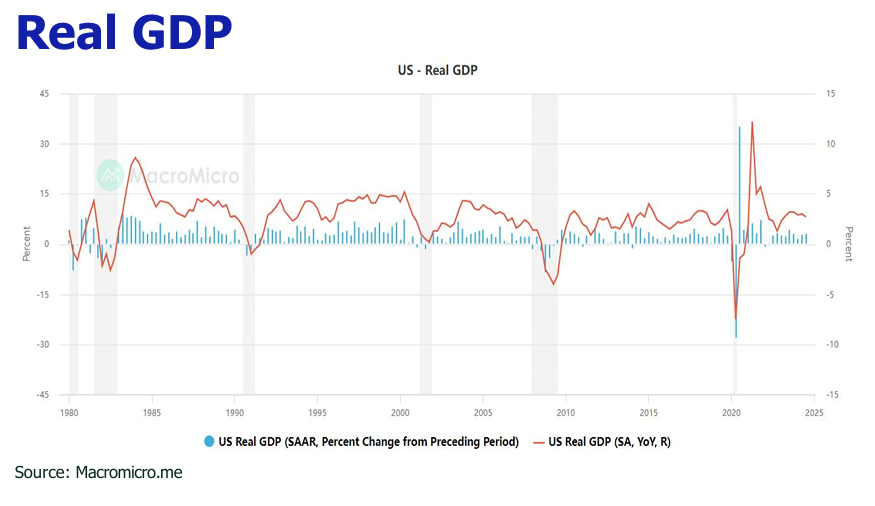

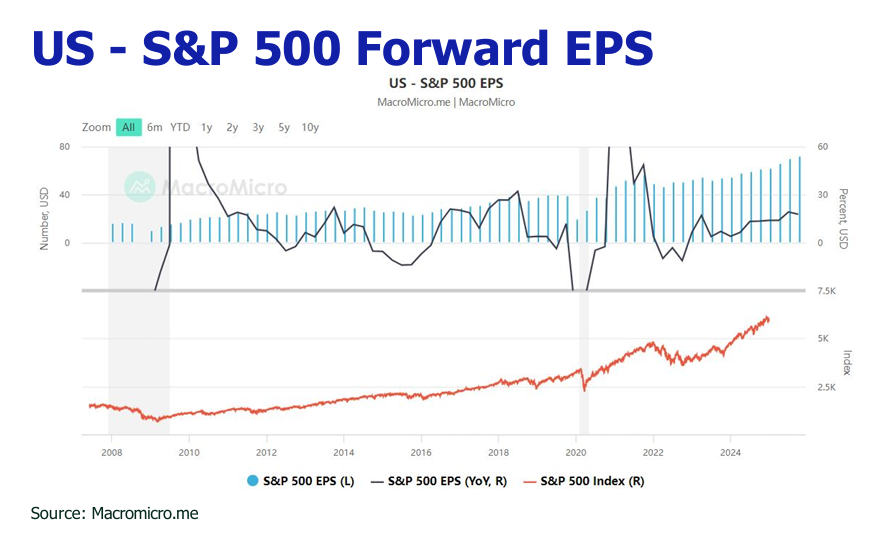

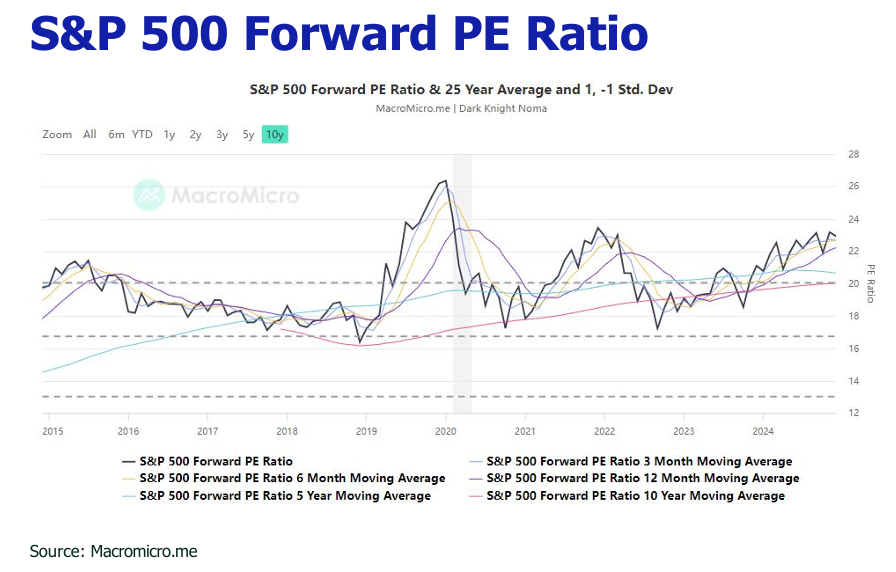

![]() We maintained our 2025 S&P 500 target at 6600, mapping to a resilient US economy (2.1% GDP growth in 2025), fanatic investment sentiment in AI and quantum computing, ongoing rate cuts by the Fed, and favorable Trump 2.0 policies.

We maintained our 2025 S&P 500 target at 6600, mapping to a resilient US economy (2.1% GDP growth in 2025), fanatic investment sentiment in AI and quantum computing, ongoing rate cuts by the Fed, and favorable Trump 2.0 policies.

![]() In December, Hong Kong Hang Seng Index (HSI) rallied to above 20000 with trading volume ticking up to HK$ 130 billion- HK$ 200 billion, driven by China’s proposed new stimulus measures for 2025 aimed at boosting consumption, stabilizing the property market, and further loosening monetary and fiscal policies.

In December, Hong Kong Hang Seng Index (HSI) rallied to above 20000 with trading volume ticking up to HK$ 130 billion- HK$ 200 billion, driven by China’s proposed new stimulus measures for 2025 aimed at boosting consumption, stabilizing the property market, and further loosening monetary and fiscal policies.

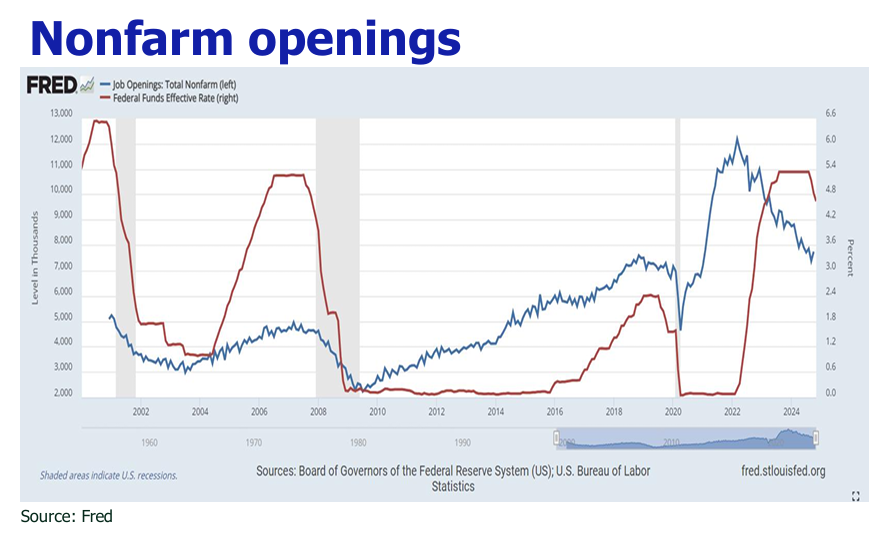

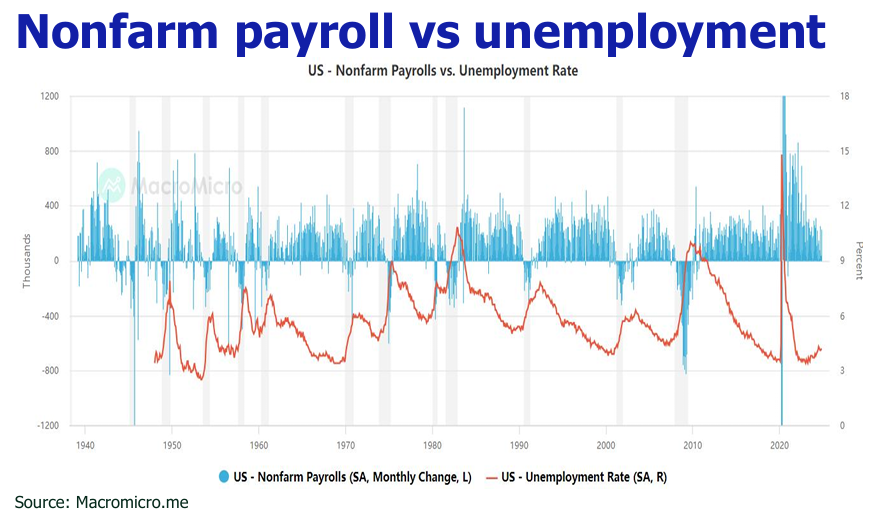

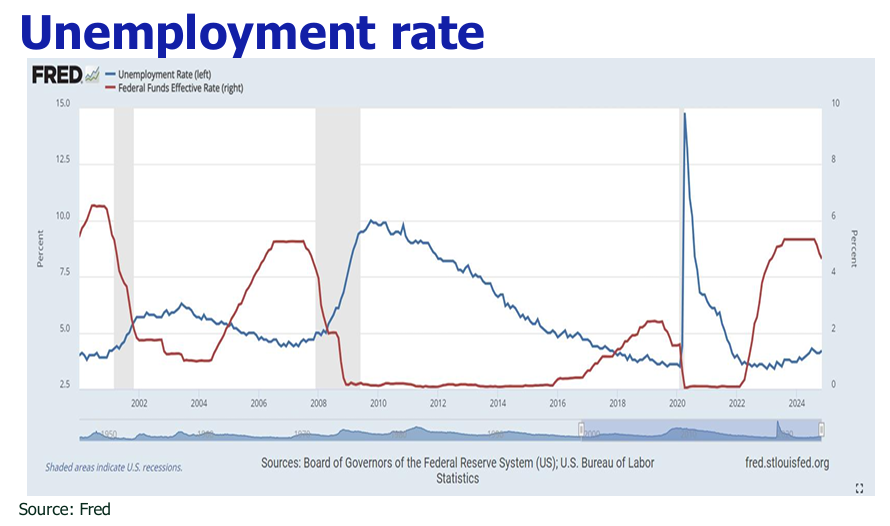

Upswing of NFP to 227k with the unemployment rate ticking up to 4.2%

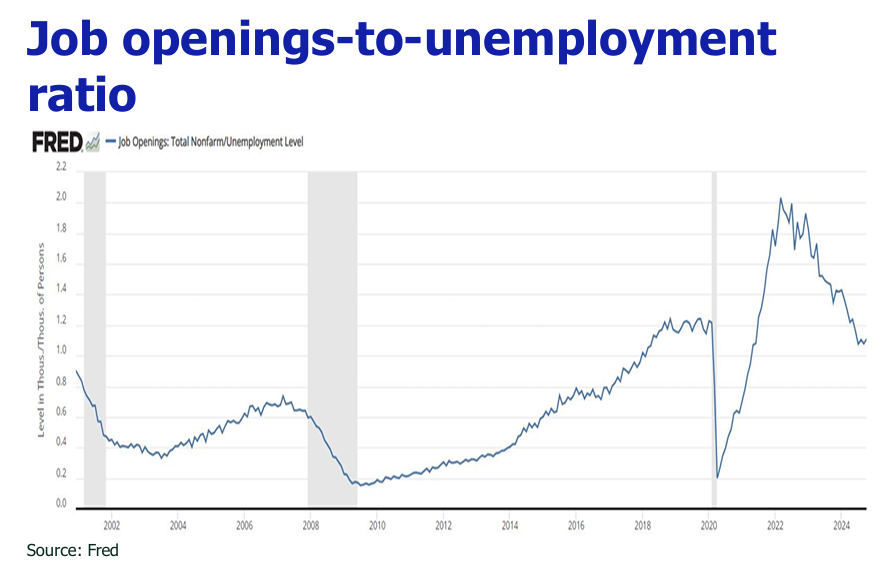

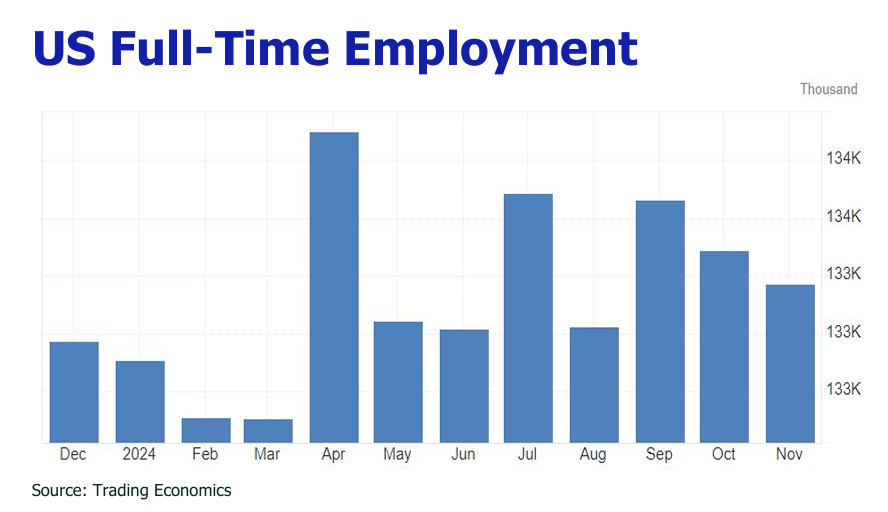

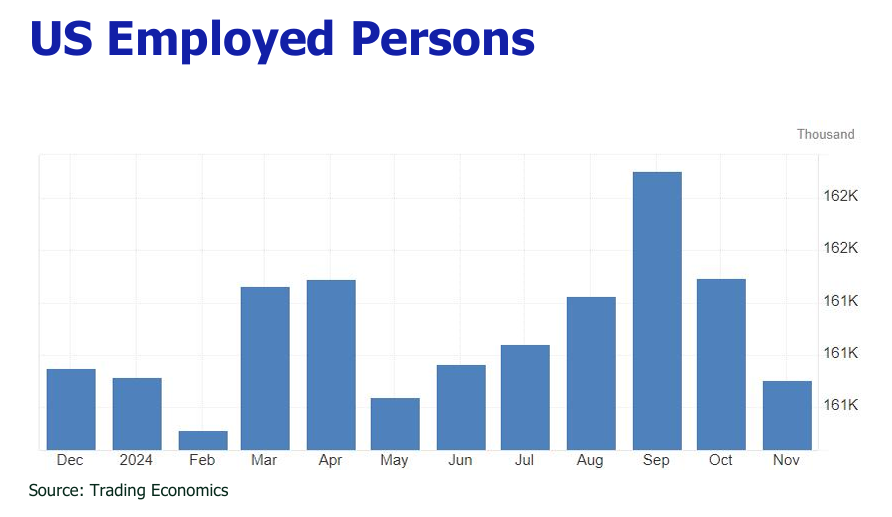

After withering of the hiccup of hurricanes and worker strikes, November NFP bounced back powerfully to 227,000 from the revised gutted print of 36,000 in October. Yet, the unemployed population surged from 6984 thousand in October and 7145 thousand in November, pulling the unemployment rate up from 4.1% to 4.2% during the month. A look at the total employment indicates a disparate labor market condition from what the NFP portrayed. The number of employed persons decreased to 161,141 Thousand in November of 2024 from 161,496 Thousand in October of 2024, and full-time employment dropped to 133,385 Thousand from 133,496 Thousand.

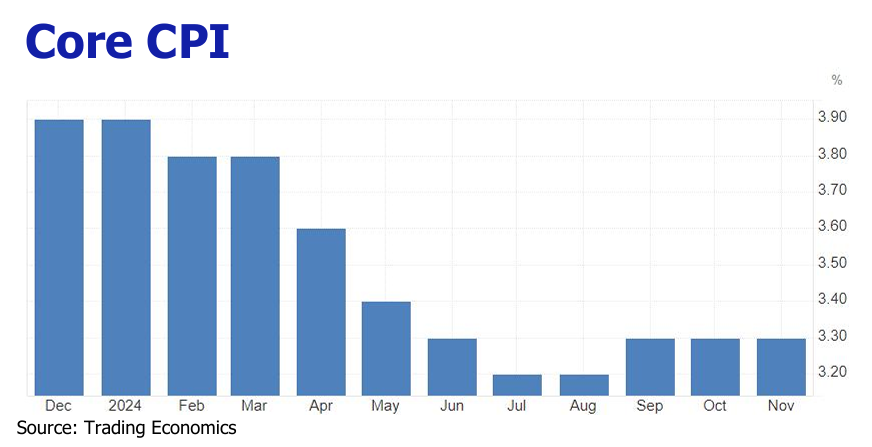

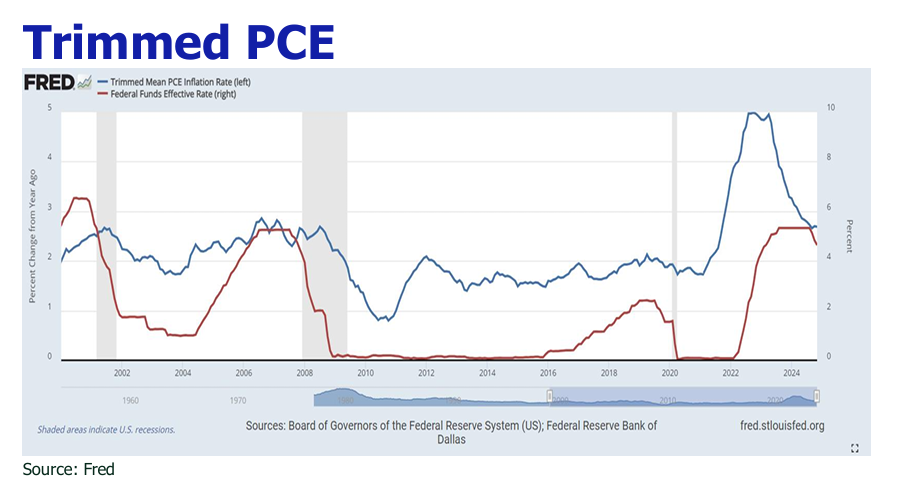

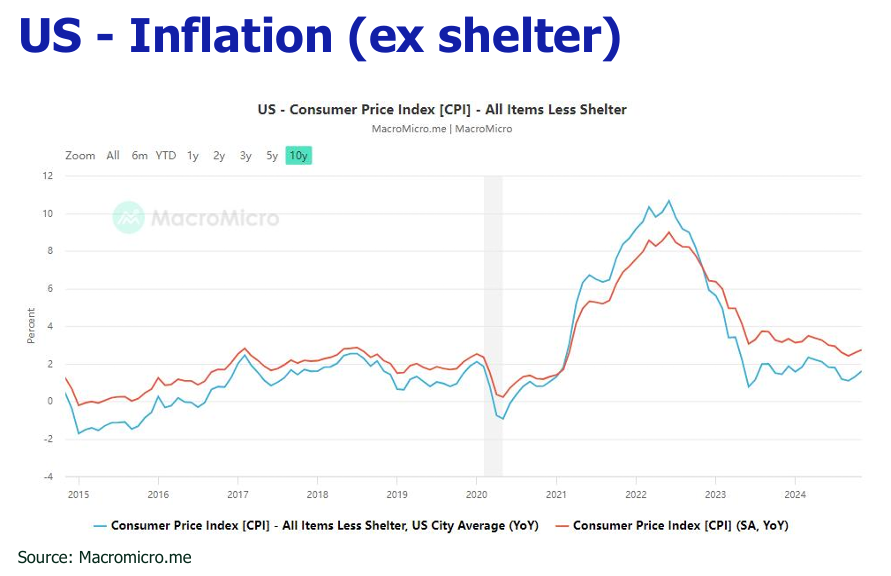

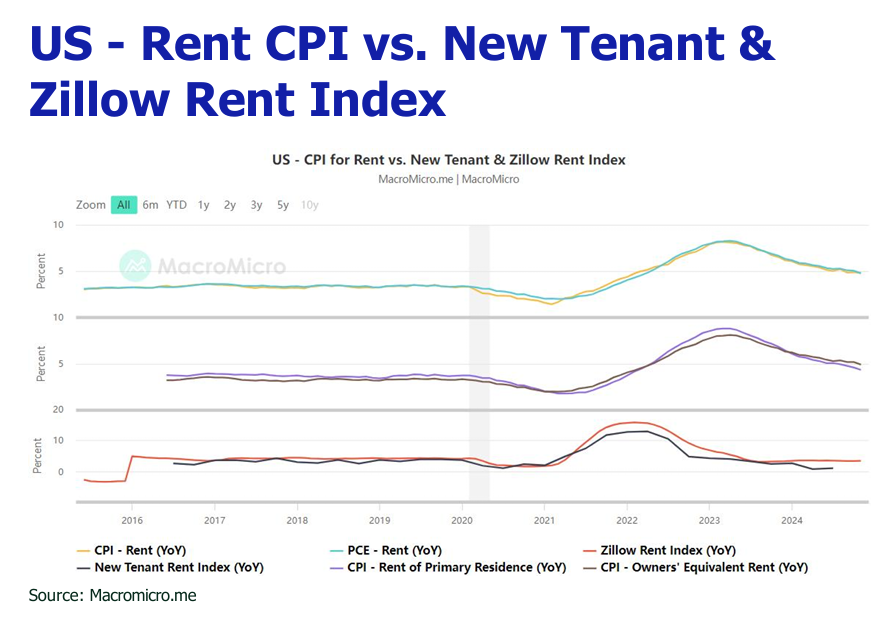

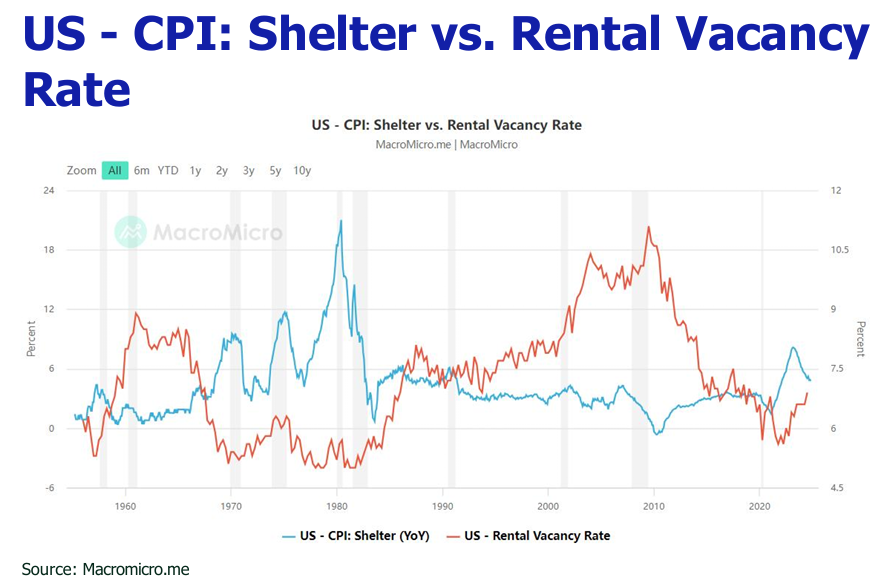

Disinflation ensnared in stagnation

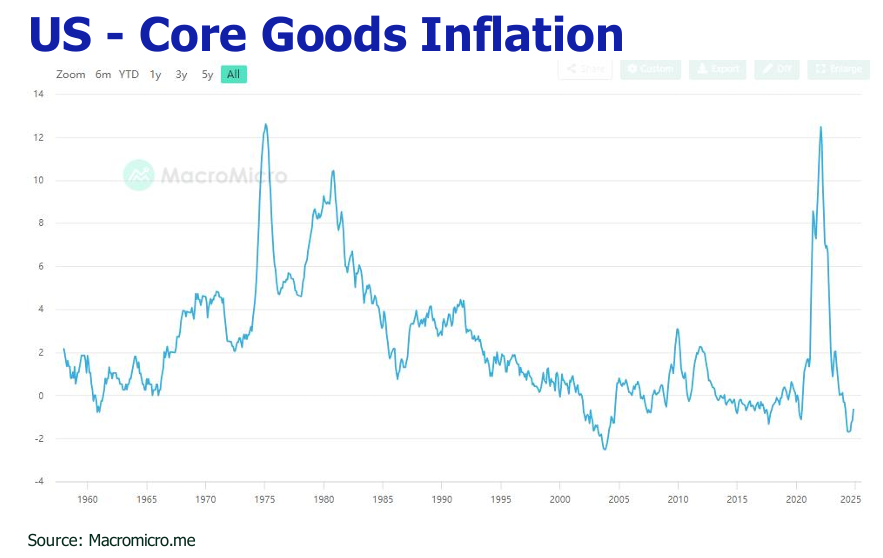

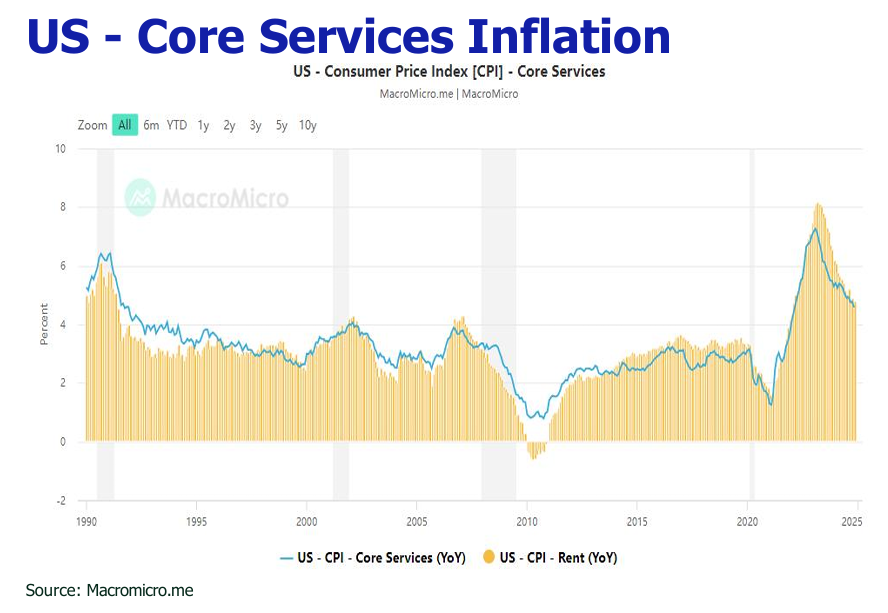

Inflation in November irked the market with headline CPI edging up 2.7% YoY from 2.6% YoY and PCE romping to 2.4% YoY from 2.3% YoY driven by the surge of food, new vehicles, apparel and household furnitures and supplies, while the core CPI and core PCE leveled off at 3.3% YoY and 2.8% YoY with the last month. Lensing the monthly movement, inflation maintained at a steady and genial pace with headline and core CPI sticking with 0.3% MoM, and PCE and core PCE slowing to 0.1% MoM. Food prices are generally volatile, so one month of elevated grocery inflation data should not set off alarm bells. The spikes in new vehicles, apparel and household furnitures and supplies are also largely the seaonsal bouts. On the surface, the progress of disinflation has wandered in recent months, but the moderating shelter costs and service costs attached hope to the taming of inflation over the horizon. Shelter costs posted 4.7% YoY and 0.3% MoM gains in November, unwinding from 4.9% YoY and 0.4% MoM in October, while supercore service costs (ex shelter) relented to 4.3% YoY from 4.4% YoY and 0.19% MoM from 0.3% MoM respectively.

Retail sales and service PMI keep high spirits in US economy growth

Retail sales vaulted 3.8% YoY and 0.7% MoM in November, shored up by resilient consumption spending (5.5% YoY, 0.4% Mom) and higher wage growth (4% YoY and 0.7% MoM) relative to inflation. The USservice sector continues to be supportive of the US economy in December. With output rising at the steepest rate for 33 months, the US Services PMI hit a 38-month high of 58.5 up from 56.1 last month, outweighing the pullback of Manufacturing PMI from 49.7 to 48.3.

Prediction

1.Trump2.0 muddles the inflation water.

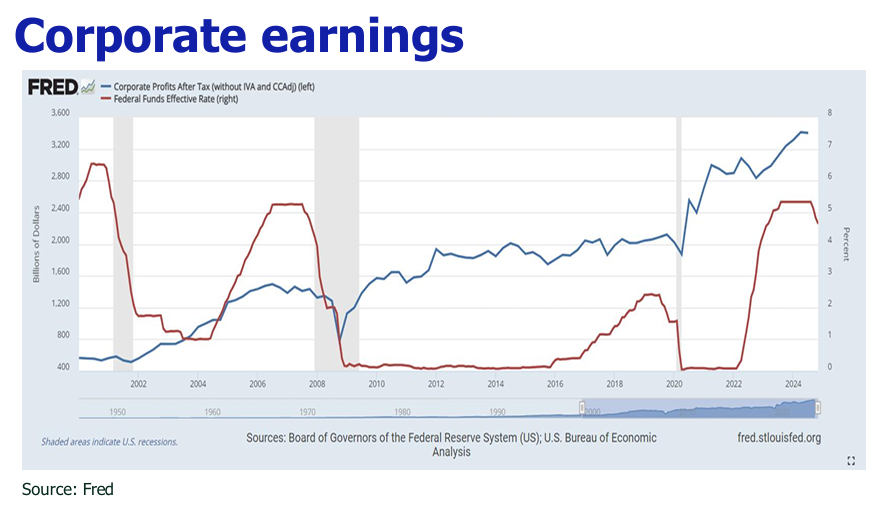

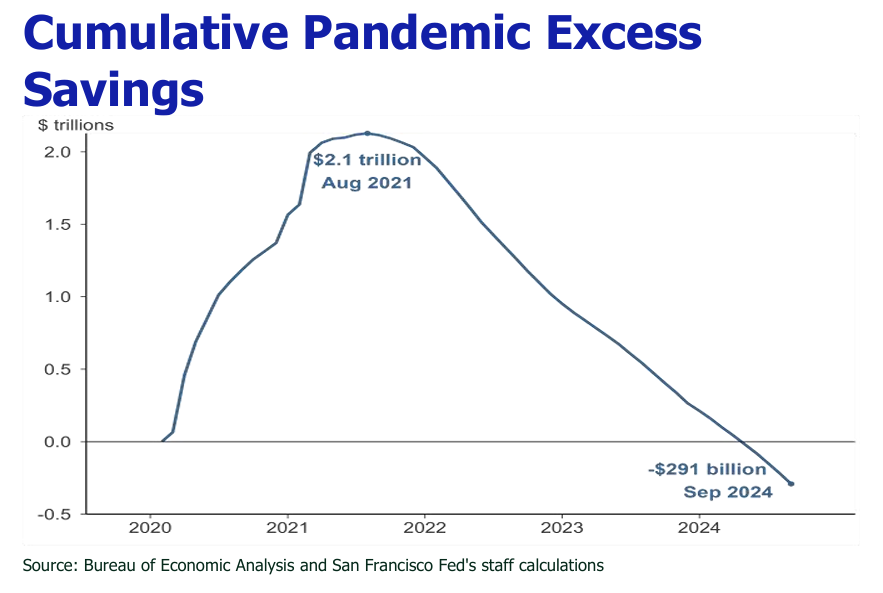

Trump’s vow to increase tariffs, lower tax rates, and deport illegal immigrants is set to reignite inflation. During Trump’s first presidency spanning from January 20, 2017, to January 20, 2021, when tariff and tax cuts were imposed, the annual CPI fluctuated between 1.5% to 2.5%, which on average, was 0.5% higher than Obama’s presidency. Trump’s hardline to exercise up to a maximum of 60% tariff on all imports from China and 10% – 20% tariffs on those from the rest of the world, is expected to exert higher inflation pressure than Trump 1.0, during which 10%-25% tariffs were imposed on China, and 10%-25% on other countries’ products. That said, we assert that retaliation tariff from China and other trade partners of US would possibly force Trump to rein in the size of tariff, and the counter depreciation of RMB against USD by China and re-export of China goods to the US through other countries would mitigate the impact. As for tax cut, the boost to corporate earnings will be milder compared to Trump 1.0 as the tax reduction from 21% to 15% (7.6% PAT increase) is smaller than that from 35% to 21% (21.5% PAT increase), thus leading to a weaker push to inflation compared to Trump 1.0. Since shelter costs (32%/30% weighting in CPI/PCE) are cooling and WTI oil price (7%-8%/5%-6% weighting in CPI/PCE) is projected to slip from the current $71 to $60-$72 in 2025, the rally of inflation sparked by tariffs would be partly offset.

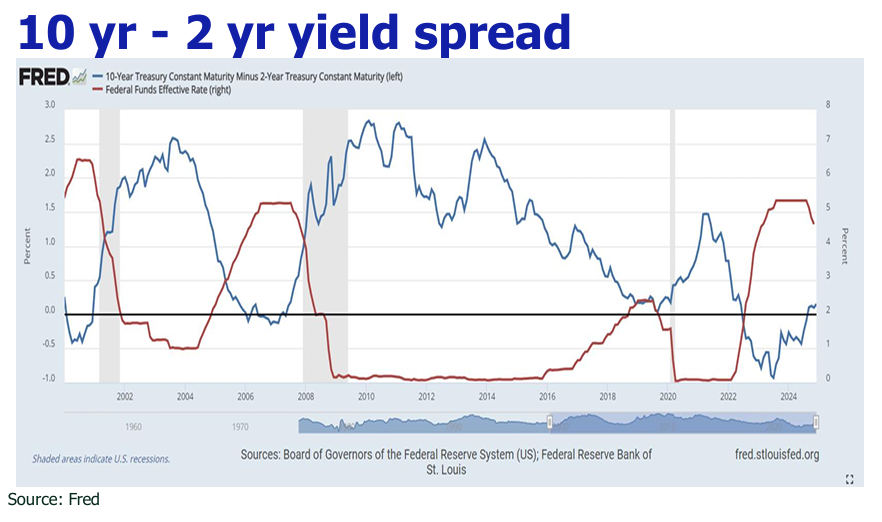

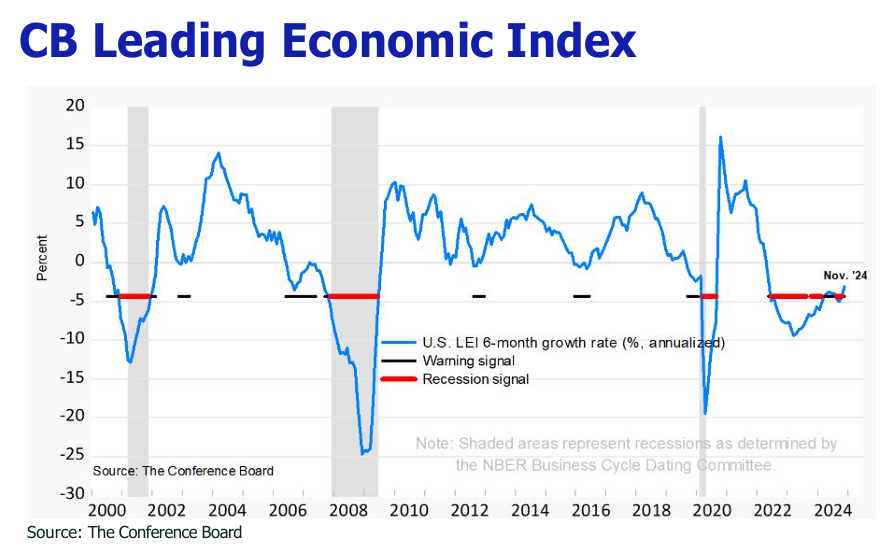

2. Rate cuts in 2025 maycome shallower than expected.

Fed signaled a hawkish speech of tailing off rate cut to two times or fewer in 2025 for dodging the withdrawal of the restrictive policy too fast. As Trump will take office on Jan 20 next year, we believe that the Fed will sit on the fence to evaluate the impact of Trump’s policy on US inflation and the economy across the board. Thus, we expect the Fed to hold back rate cut in January FOMC next year. Though the inflation is expected to spike, the deviation of the current rate from the Fed’s neutral rate estimate of 2.375% – 4%, the possible deterioration of the labor market suggested by the constant downward revision of NFP, the flimsy manufacturing sector, together with the significant increase in treasury financing pressure will compel Fed to track the rate cut path, as long as the rally of inflation is not excessive per our take.

Disclaimer

All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however we do not guarantee the accuracy or completeness of this report and have not sought for this information to be independently verified. Forward-looking information or statements in this report contain information that is based on assumptions, forecasts of future results, estimates of amounts not yet determinable, and therefore involve known and unknown risks, uncertainties and other factors which may cause the actual results to be materially different from current expectations.

We shall not be liable for any direct, indirect or consequential losses, loss of profits, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note.