Era of Globalization Officially Over

-HowTrump Tariffs will affect the Global Economy

Austin Or, CFA

Executive summary

Global trade has historically contributed to low inflation by creating deflationary supply chains. However, Trump tariffs is set to raise goods costs, trigger retaliatory tariffs, strengthen the USD, and increase wage inflation, leading to overall higher inflation. High US federal deficits could raise Treasury yields, pressuring asset prices, particularly stocks and bonds, while commodities and cryptocurrency will become the sweet pots.

Highlights

![]() Global trade is a crucial factor in low inflation as supply chains became a global deflationary force.

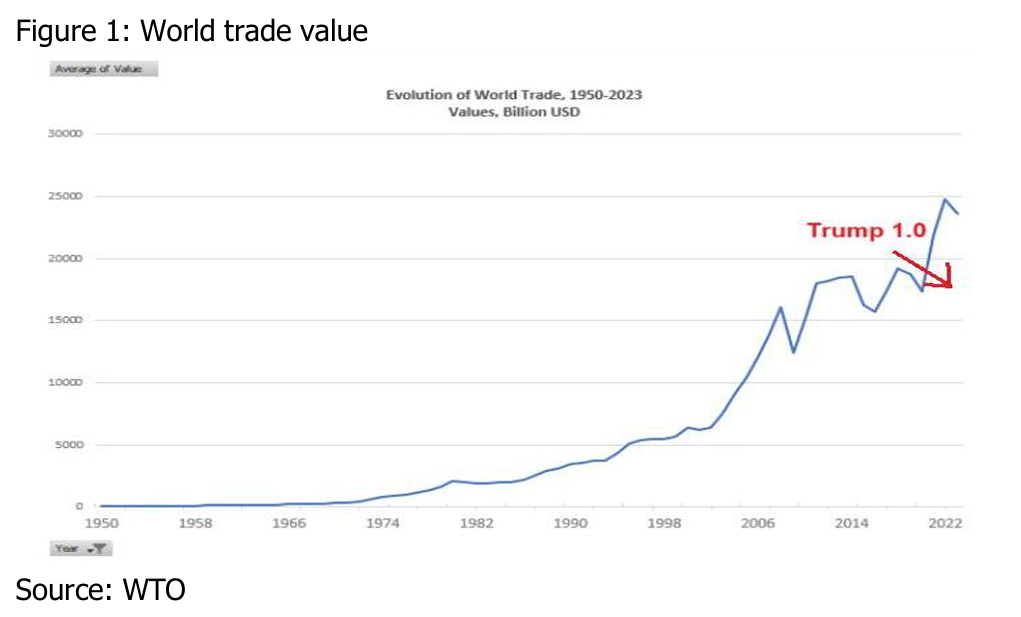

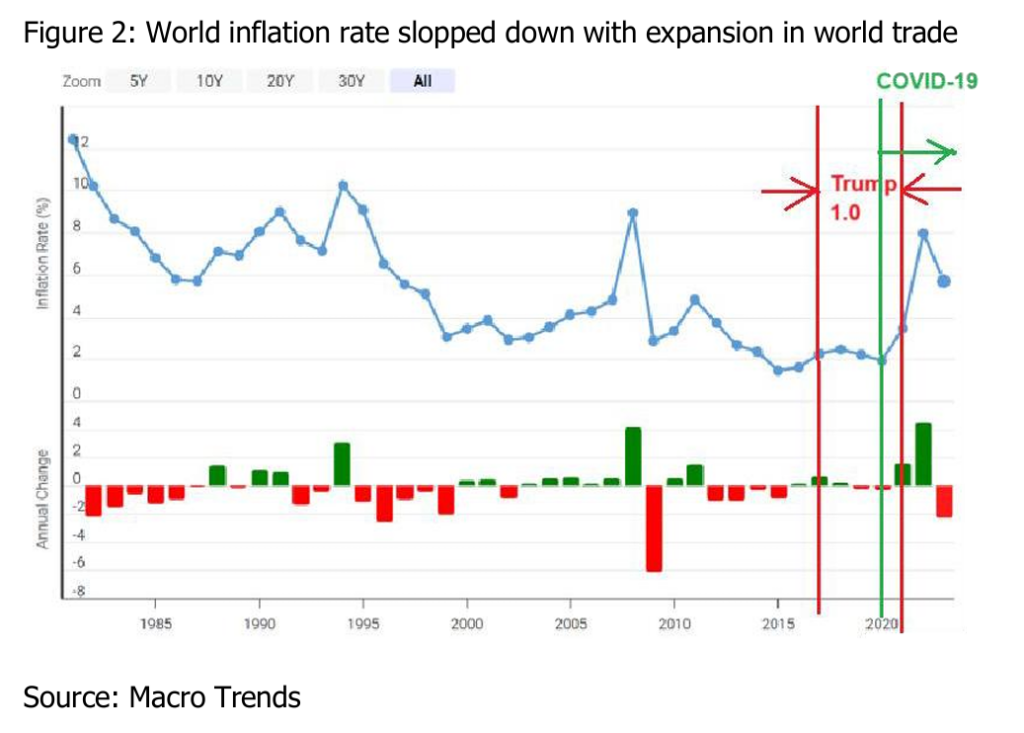

Global trade is a crucial factor in low inflation as supply chains became a global deflationary force.

![]() Trump tariffs will likely trigger: a. Higher goods cost b. Similar tariffs by other countries c. stronger usd and currency depreciation of other countries d. spike in wage inflation in US, feeding through to higher inflationary pressure.

Trump tariffs will likely trigger: a. Higher goods cost b. Similar tariffs by other countries c. stronger usd and currency depreciation of other countries d. spike in wage inflation in US, feeding through to higher inflationary pressure.

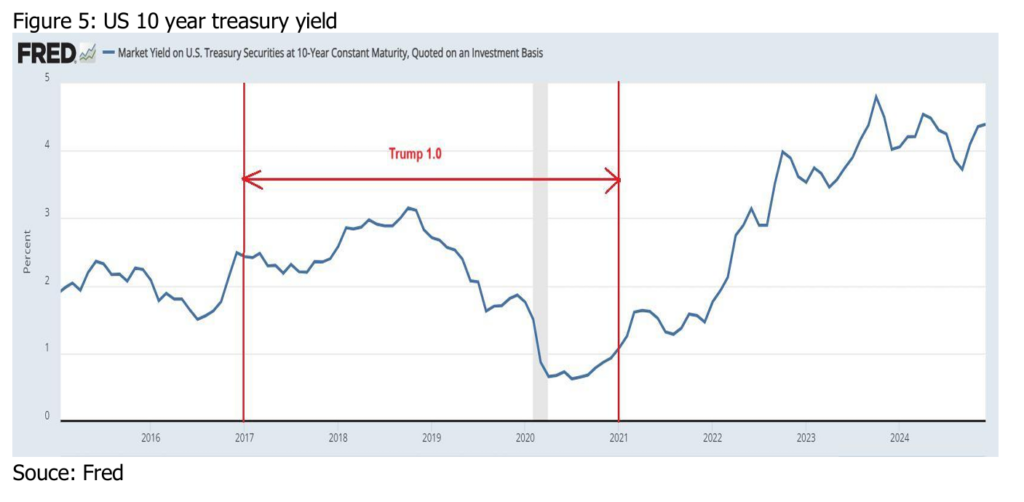

![]() Withhigher federal deficits in US, treasury yields is expected to spike.

Withhigher federal deficits in US, treasury yields is expected to spike.

![]() Outlook of asset prices: a. decrease in bond prices b. stock prices face pressure c. short term appreciation of Crypto assets but strong headwinds in 2nd half of 2025 d. increase in commodity prices, especially agriculture.

Outlook of asset prices: a. decrease in bond prices b. stock prices face pressure c. short term appreciation of Crypto assets but strong headwinds in 2nd half of 2025 d. increase in commodity prices, especially agriculture.

![]() Recommend purchase of producers of commodities, companies that are able to pass off inflationary pressures to end customers, silver and other precious metals (potentially excluding gold).

Recommend purchase of producers of commodities, companies that are able to pass off inflationary pressures to end customers, silver and other precious metals (potentially excluding gold).

Global trade as a global deflationary force

Global trade plays a pivotal role in shaping inflation dynamics, predominantly through exerting deflationary forces on price levels. On one hand, global supply chains amplify operational efficiency by enabling the specialization of labor and resources across different geographic domains. This specialization cultivates economies of scale, trims production costs, and amplifies productivity. Consequently, goods can be manufactured with heightened efficiency and at reduced costs, thereby exerting downward pressure on prices. On the other hand, global trade provides avenues for companies to delegate manufacturing and services to nations with lower production costs. This strategic maneuver, can pare down labor expenditures and production outlays. Consequently, enterprises can offer products and services at more competitive price points, mitigating inflationary pressures.

Trump tariffs to jack up inflation

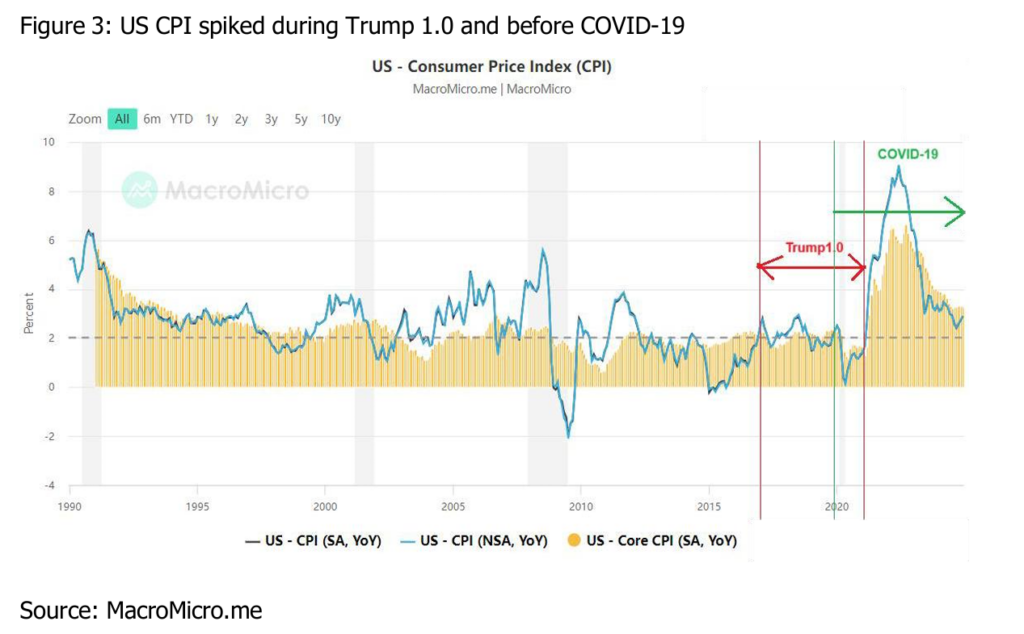

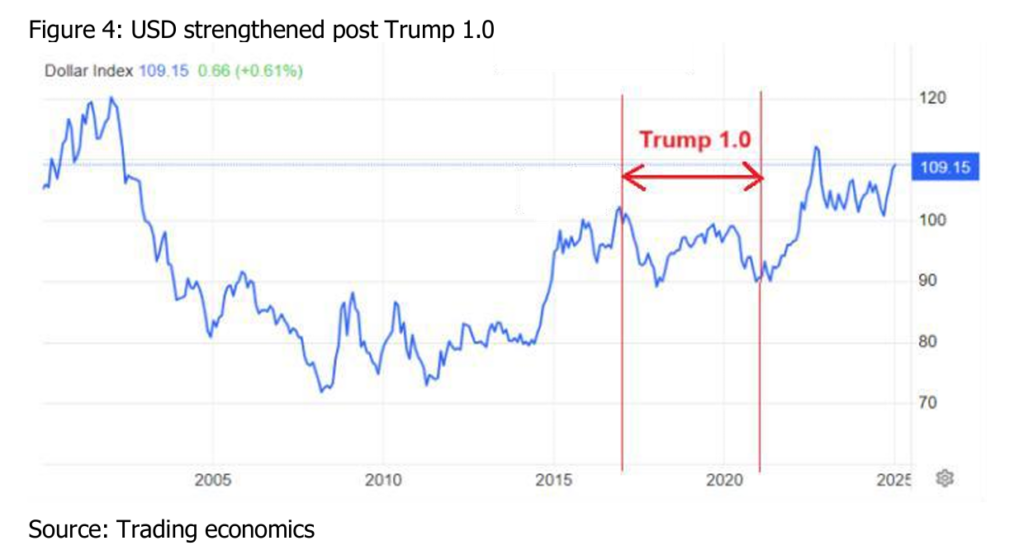

Trump’s propositions to slap tariffs ranging from 10-20% on imports from all nations except China, alongside a maximum of 60% tariff specifically targeting China, are poised to escalate inflation through various channels:

Higher Goods Cost: Tariffs amplify the expenses associated with imported goods, thereby increasing production costs for enterprises reliant on such imports. Faced with heightened expenditures, businesses may transfer these costs to consumers through elevated prices.

Similar Tariffs by Other Nations: When one country imposes tariffs, it can lead to retaliatory measures by other countries in the form of similar tariffs on goods.This tit-for-tat escalation of trade barriers can create a trade war scenario, further increasing costs for businesses and consumers across borders.

Stronger USD and Currency Depreciation of Other Countries: Tariffs can lead to a stronger US dollar as foreign investors seek safer assets in response to trade tensions. On the other hand, the currencies of countries targeted by US tariffs may depreciate due to reduced demand for their exports, impacting their purchasing power and potentially leading to currency depreciation and import inflation.

Spike in Wage Inflation in the US: In a scenario where tariffs augment the expenses of imported goods, domestic production may emerge as a more competitive option compared to imports. The upsurge in demand for domestic goods and services can stimulate heightened production levels, potentially resulting in labor scarcities and intensified competition for skilled labor. Faced with a constrained labor market due to elevated demand, businesses may escalate wages to allure and retain skilled professionals, thereby contributing to wage inflation. Employees may also engage in wage negotiations to counterbalance the effects of inflation on their purchasing power, particularly if they perceive that their employers are benefiting from tariff-induced price escalations.

Higher Federal deficit and treasury yields to come around

While tariffs can initially generate revenue, their broader economic repercussions, such as reduced domestic consumption, impeded global trade and higher production cost, can ultimately result in larger fiscal deficits.

Tariffs escalate the expenses of imported goods, triggering heightened prices for consumers. Consequently, this can curtail consumer spending, negatively impacting economic expansion and overall tax income. Companies reliant on imported materials may face increased production costs, leading to diminished profits and reduced tax contributions. Moreover, the imposition of tariffs may incite retaliatory actions from trading partners, potentially decreasing exports. This scenario can harm domestic industries reliant on foreign markets, further depleting government tax revenues.

The tariffs levied by the United States against China have prompted an export prohibition on rare earth metals by China—a critical component in numerous advanced products, including electronics and electric vehicles. This prohibition could impede the manufacturing of such products in the United States, consequently diminishing global market sales.

Although tariffs offer immediate government revenue, this influx may not suffice to offset the adverse economic consequences and the decline in tax revenues. As time progresses, if economic growth significantly decelerates, the initial tariff revenue may diminish.

When the government operates with a larger deficit, it must procure more funds to sustain its operations and bridge the revenue-expenditure gap. A heightened deficit raises apprehensions regarding the government’s capacity to fulfill its forthcoming debt obligations, prompting investors to demand higher yields on government debt.

Furthermore, an enlarged deficit signifies a heightened supply of government bonds in the market. If the demand for these bonds does not rise proportionally, the government may need to offer higher yields to attract investors. Additionally, if the government resorts to printing more money to fund its deficit, concerns may arise about inflation eroding the actual value of bond returns. To counterbalance this anticipated inflation, investors may insist on higher yields on Treasury securities.

Outlook of asset prices

Decrease in Bond Prices: An ongoing downward trend in bond values is foreseen, primarily attributed to mounting inflationary forces and the formidable federal deficit challenge.

Stock Prices Under Pressure: The stock market is poised to encounter downward pressure as uncertainties in the economy and diminished prospects of interest rate cuts may weigh on investor confidence. Market instability is expected to endure as scrutiny intensifies on corporate earnings.

Short-Term Appreciation of Crypto Assets: In the near term, we may see a brief appreciation in cryptocurrency prices, fanned by heightened market enthusiasm mirrored by continuous inflows of capital into ETFs and institutional acquisitions, along with Trump’s commitment to establishing a national reserve for bitcoin and other pro-crypto policies. Nevertheless, we anticipate significant obstacles in the latter part of 2025, spurred by risk-averse behavior towards volatile assets amidst a surge in inflation and heightened bond yields.

Increase in Commodity Prices: A surge in commodity prices is envisioned, particularly in agricultural products. Tariffs are set to disrupt global supply chains by elevating the costs of procuring various essential materials such as steel, aluminum, oil, consumer goods, and industrial products from international sources. Trump’s pledge for reshoring of supply chains and potential new Chinese stimulus response to tariffs would be positive catalysts for the mining sector. Given that agricultural exports contribute 21% to the revenue of the US agricultural sector, the imposition of tariffs on US agricultural exports is expected to trigger a more pronounced upsurge in agricultural prices compared to other commodities.

Winners of Trump’s tariff plan

In the context of Trump’s tariff plan, it is advisable to consider investing in producers of commodities as they may benefit from increased demand and potentially higher prices resulting from tariffs on imports. Companies that have the ability to pass on inflationary pressures to end customers could also be good investment options, as they can maintain their profit margins despite rising costs.

Additionally, silver and other precious metals, excluding gold, may be attractive investment choices. Silver, for instance, is often sought after as a safe haven asset during times of economic uncertainty and can serve as a hedge against inflation. Other precious metals like copper, platinum and palladium could also be considered due to their industrial applications and potential price appreciation in the face of tariffs and inflationary pressures. However, gold may have a limited benefit from inflation due to likely asset reallocation from gold to cryptocurrency.

Disclaimer

All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however we do not guarantee the accuracy or completeness of this report and have not sought for this information to be independently verified. Forward-looking information or statements in this report contain information that is based on assumptions, forecasts of future results, estimates of amounts not yet determinable, and therefore involve known and unknown risks, uncertainties and other factors which may cause the actual results to be materially different from current expectations.

We shall not be liable for any direct, indirect or consequential losses, loss of profits, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note.