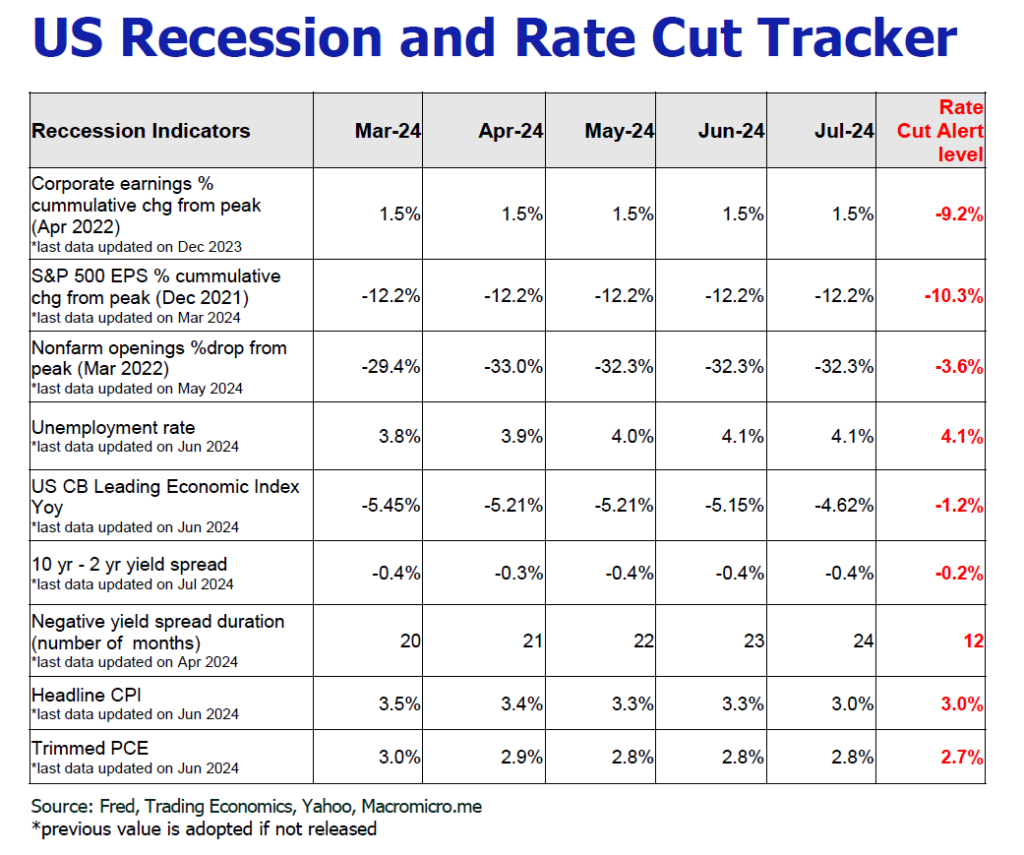

Encouraging inflation cooling and spiking unemployment keeps rate cut odd alive

Austin Or, CFA

Highlights

tracjectory boost by BTC spot ETF.

Sahm’s Rule.

reelected as the President.

HK$86 billion-HK$119 billion.

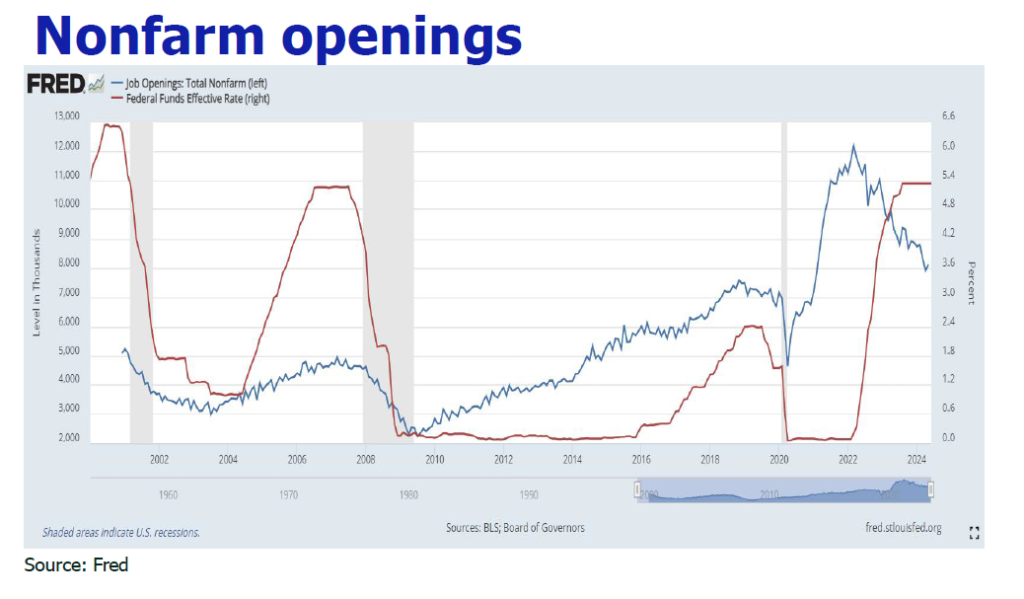

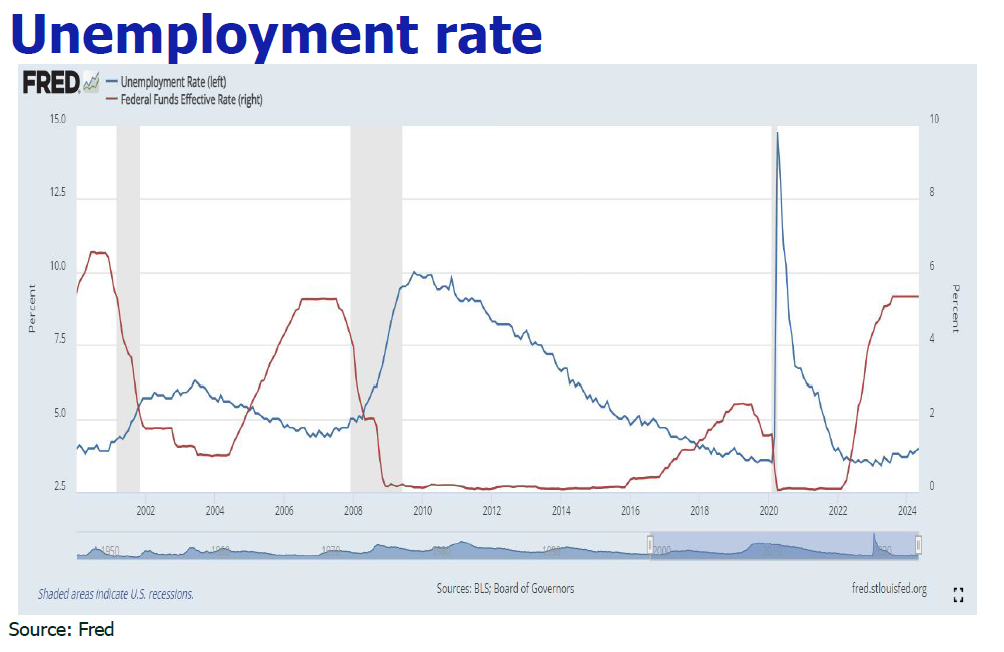

Softer NFP and wage growth, unemployment rate edged up to 4.1%

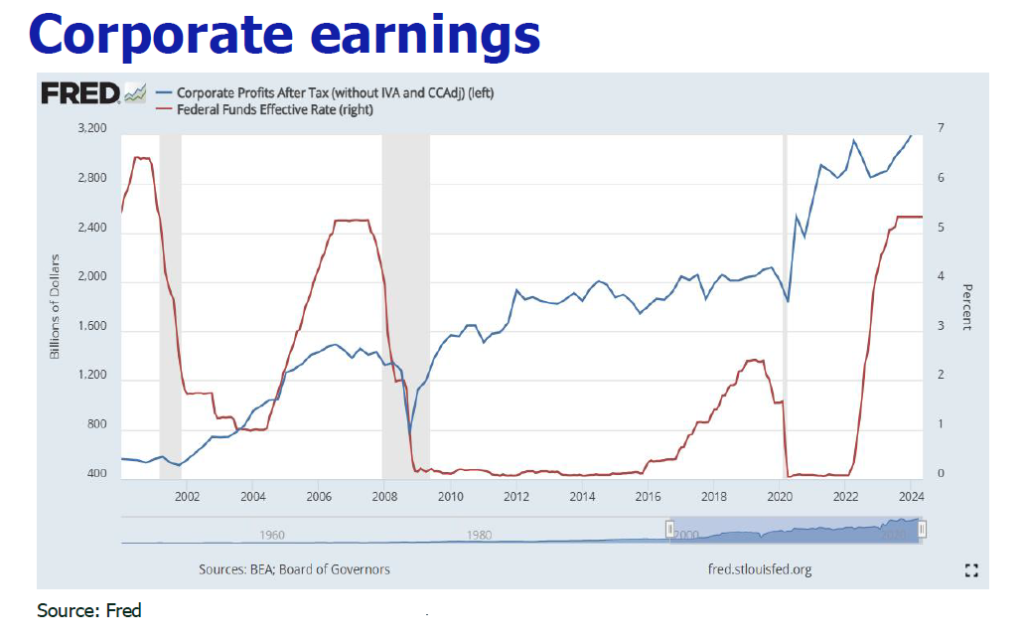

NFP in June logged 206,000 gain, beating the expected 180,000, but fell sharply from the previous value of 272,000. Previous reported May and April NFPs were exorbitant as the figures were overstated by a total of 111,000. May NFP was revised down 272,000 to 218,000, and April from 165,000 to 108,000. The perceived robustness of the labor market is essentially twisted by the part-time and government hire. The labor force increased by 50,000 in June to 28.1 million, against 28000 loss of the number of full-time workers. Since June 2023, the U.S. has added 1.8 million part time jobs, while 1.6 million full-time jobs were lost. Private sector added 136,000 jobs in June, well below the expected 160,000, while government sector remained a buttressing force by raising hire from 25000 in May to 70000 in June. Meanwhile, average hourly earnings were up 0.3% MoM and 3.9% YoY in June, the slowest pace since 2021. The overall unemployment rate ticked up to 4.1% in June, its highest level since 2020 and has increased in each of the last three months. The number of unemployed people rose to 6.8 million in June from 6 million 12 months ago, underscoring the subsiding trend of US labor market.

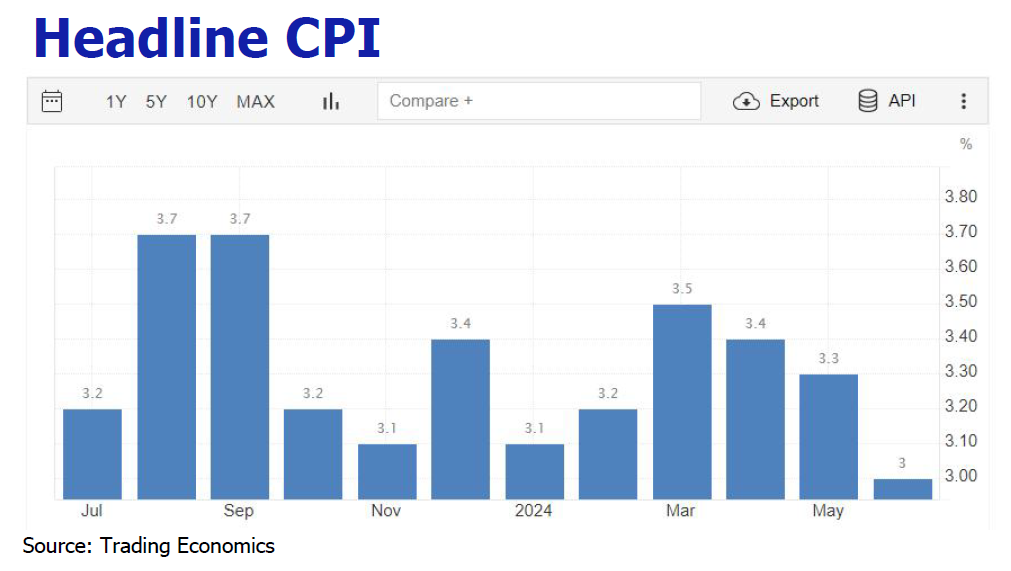

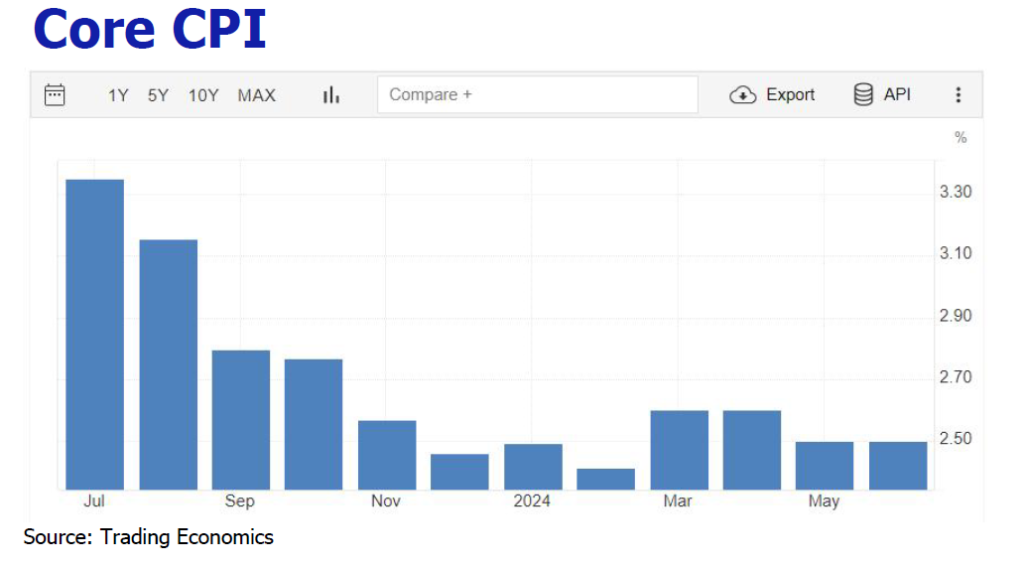

Inflation is simmering down, the first MoM decline in four years

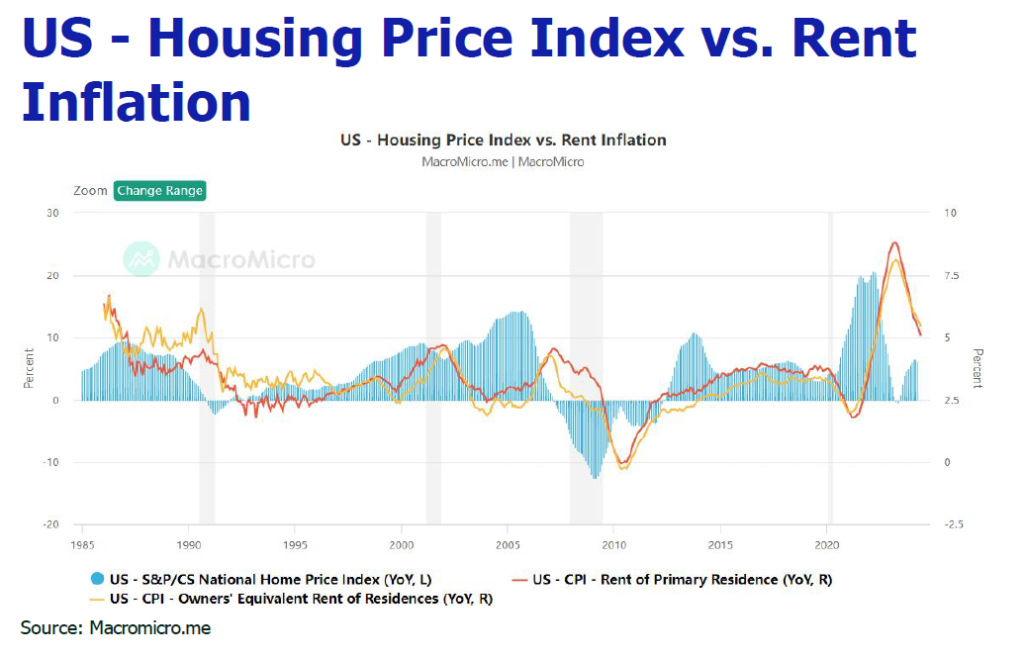

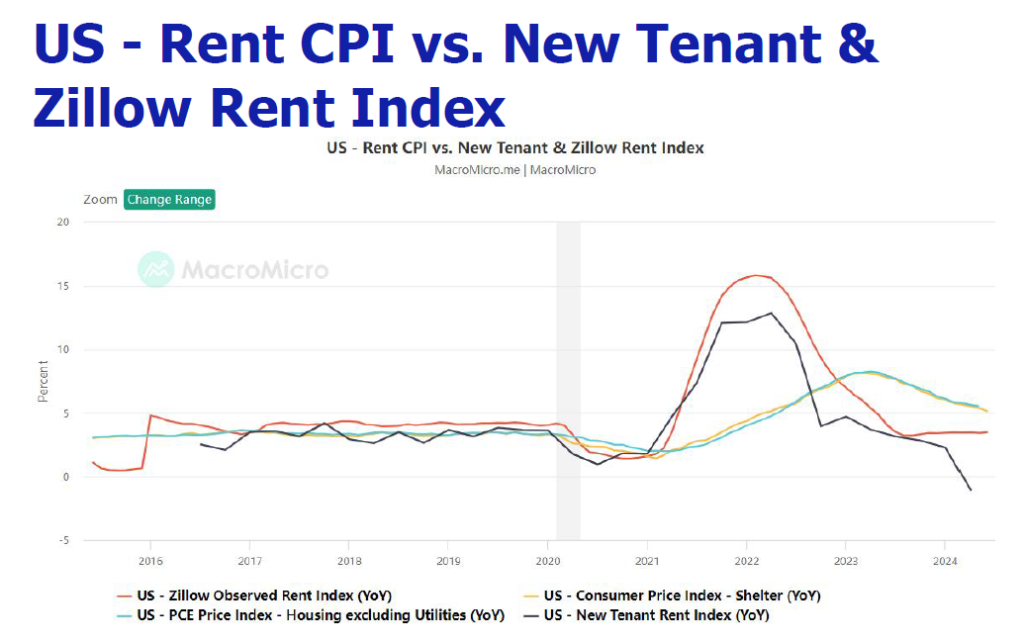

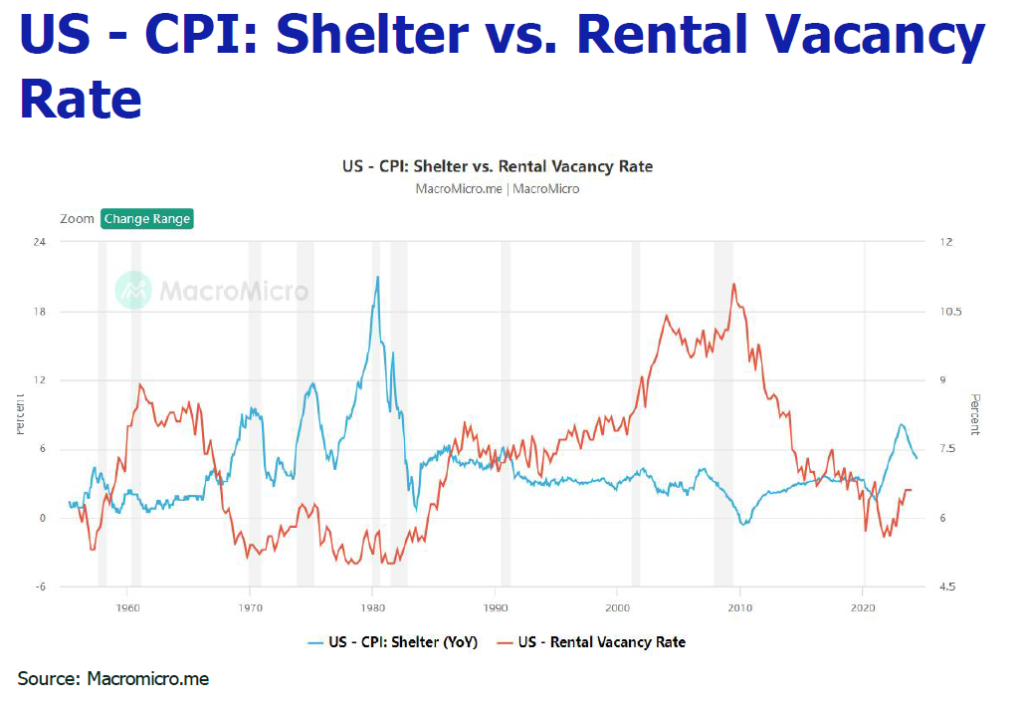

The U.S. CPI rose 3% YoY in June, slowing from 3.3% in May, a fell of 0.1% MoM; the core CPI in June rose 3.3% YoY, dipping from 3.4% in May, and softened to 0.1% MoM against 0.2% MoM in May. The supercore inflation (core services CPI ex. sheler) rose slightly by 0.1% MoM, and the YoY gain fell back to below 5.0%. The slowing in consumer prices was driven by a sharp decline in gas prices and easing shelter price pressures. Gasoline prices fell 3.8% MoM in June, following a 3.6% decline in May. Shelter prices increased by a softer 0.2% MoM rise in June than the 0.4% rise in May; and logged a softer 5.16% YoY growth vs 5.41% YoY in May. Rental inflation showed a long-awaited moderation to 0.3% MoM and 5.07% YoY.

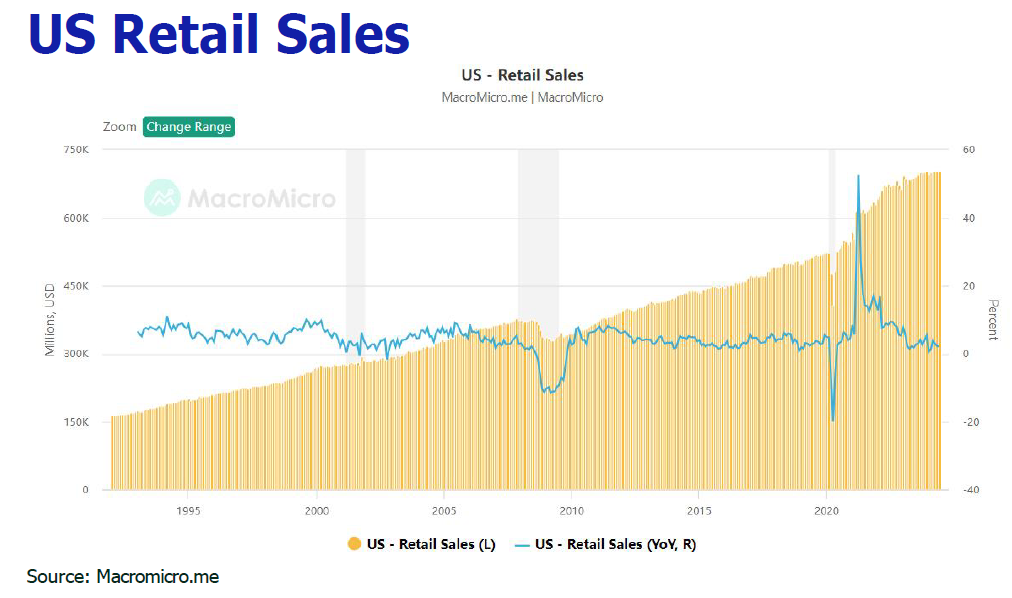

Retail sales growth stayed steadfast

Retail sales increased 2.3% YoY in June, defying Wall Street’s prediction of a 0.3% decline amid virutal exhaustion of excess savings and signs of slowing in the US economy. The conflicting reality is ascribed to credit spending of low- and moderate-income group and the stalwart spending of high income group.

Prediction

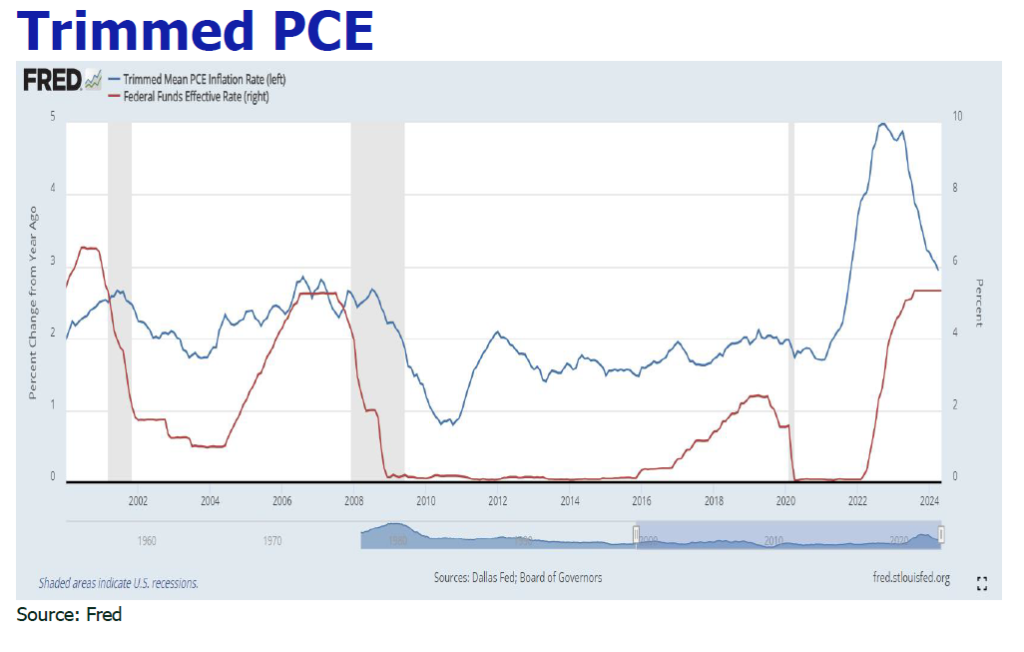

1. Disinflation continuity gains more assurance.

As wage growth is slowing as the labor market eases, and absolute unemployment number and unemployment rate spike, the cooling progression of inflation is likely to sustain, with a new push by the oil price drop outlook in Q4, led by 2.2mbpd output increase by OPEC starting in October.

2. Consumer spending risks graudal slowdown on exhausation of credit-back consumption.

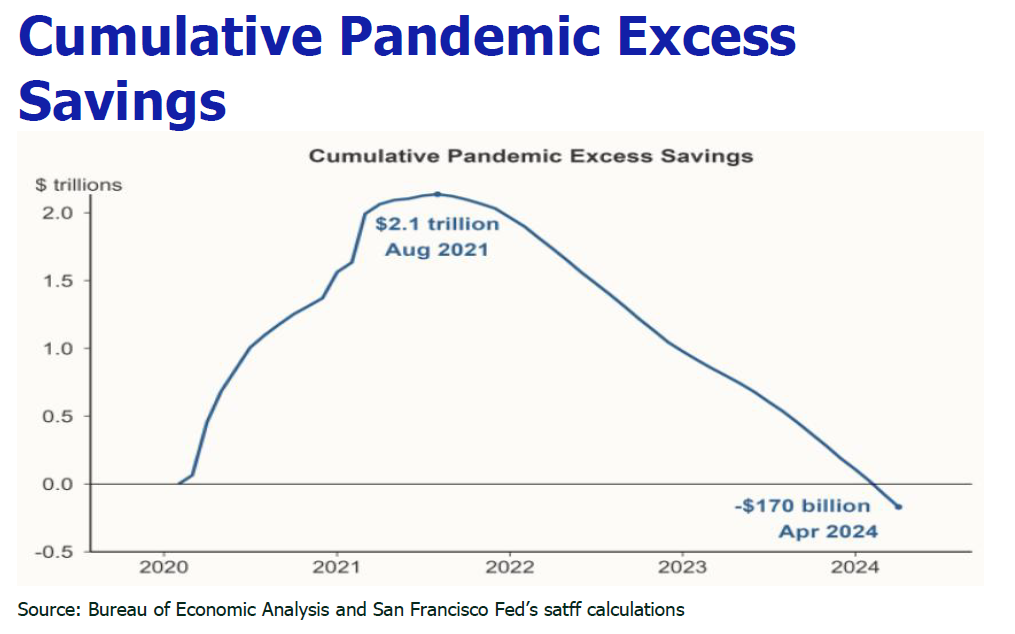

Although openhanded spending by affluent consumers is keeping the economy as a whole moving forward, there are signs of softness around the edges where low- and moderate-income consumers which are are reaching their max and most at risk for a cutback in hiring. Most households have run down the excess savings accumulated during the COVID-19 pandemic and are carrying a lot of credit card debt, which is becoming more expensive because of higher borrowing costs. Data from the New York Federal Reserve shows that U.S. credit card balances have increased one-third to $1.1 trillion in 1Q2024 from 2022. According to data from the Federal Reserve, the average annual interest rate on credit card repayments has increased by about 22% this year, up from 15% two years ago, which has led to higher loans repayment delinquency. Federal Reserve data shows the delinquency rate on credit card accounts exceeded 3% in 1Q2024, the highest level since 2011. Gradual exhausation of credit limit of grassroot consumers will rein in spending considerably down the road.

3.Stand pat on interest rate in July and pull the trigger in September or November.

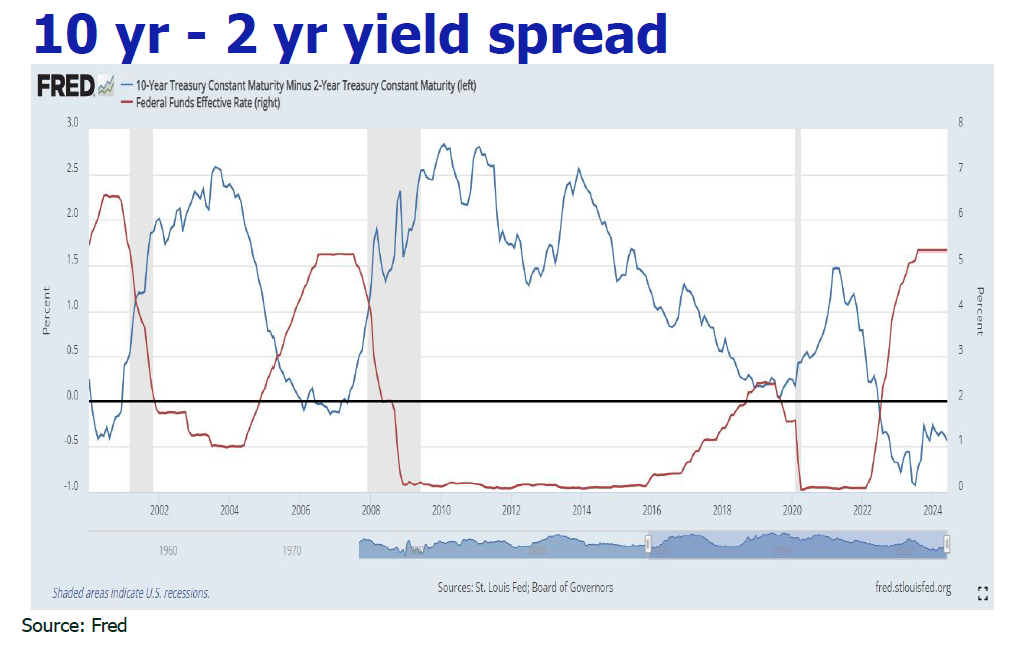

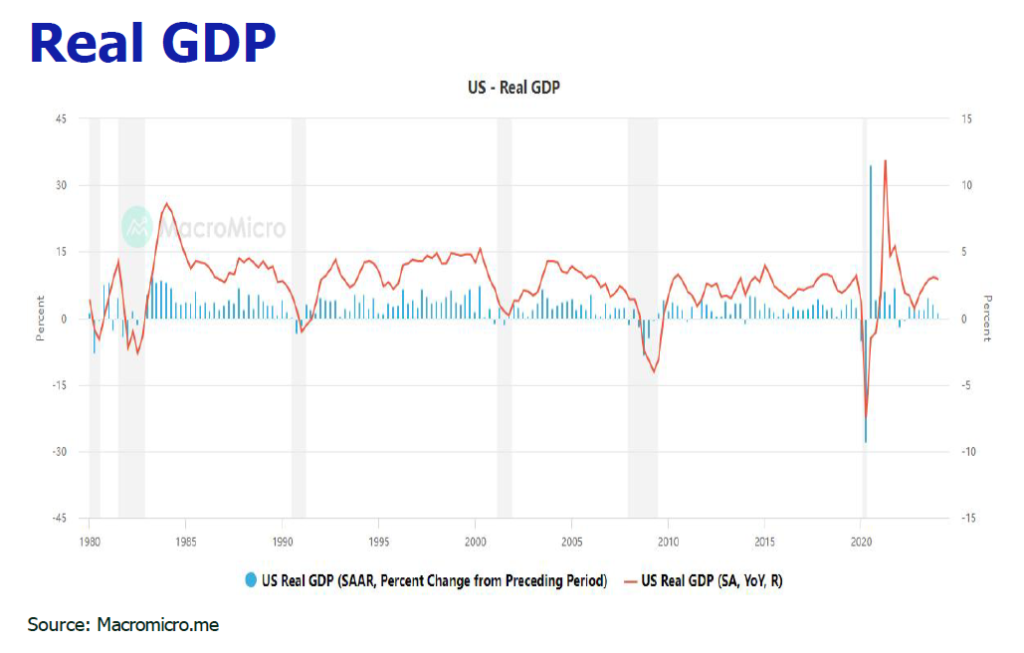

A rise in the unemployment rate to 4.1% in June and the encouraging signs of continued cooling of inflation are paving the way for Fed’s rate cut. From the standpoint of Sahm’s Rule, the latest 3-month average unemployment rate has increased 0.42% from the 12 month-low, not far away from the 0.5% threshold of recession trigger. Besides, the widely-followed Taylor Rule would suggest the current rate should already be roughly 4%, more than a point lower than it is now. To avoid stagflation and recession risks, Fed is expected to implement preventive rate cuts as in the case of 1989-1992, 1995-1996 and 2019 before the economy really crashed. Currently, more than half of the institutions expect the first interest rate cut to occur in September, and the derivative markets priced in 80% rate cut likelihood in September as well. November cut is not ruled out by the market lest inflation will rally before the President election.

4.Biden’s dropout substantially decreases the chance of Trump’s victory of Presidency.

After Kamala Harris’s substitution for Biden, she had gained substantial increase in crowd support revealed by the laterst poll of Wallstreet Journal, greatly raising her chance for competing the Presidency againist Trump to 50:50. According to the Washington Post, she had successfully raised US 200 million for President election fund, heightening her wining chance to slighly over 50, in our view.

Disclaimer

All information used in the publication of this newsletter has been compiled from publicly available sources that are believed to be reliable, however we do not guarantee the accuracy or completeness of this report and have not sought for this information to be independently verified. Forward-looking information or statements in this report contain information that is based on assumptions, forecasts of future results, estimates of amountsnot yet determinable,

and therefore involve known and unknown risks, uncertainties and other factors which may cause the actual results to be materially different from current expectations.

We shall not be liable for any direct, indirect or consequential losses, loss of profits, damages, costs or expenses incurred or suffered by you arising out or in connection with theaccess to, use of or reliance on any information contained on this note.