Fed scales back rate cut in 2024 to one time only on sturdy labor market and economy

Austin Or, CFA

Highlights

🔵 May NFP notched 272k growth but may be inflated by the number of new enterprises assumption.

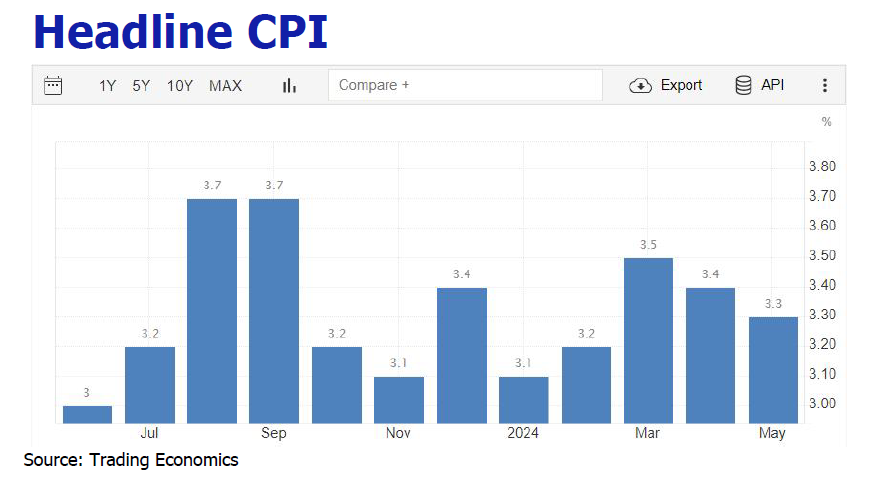

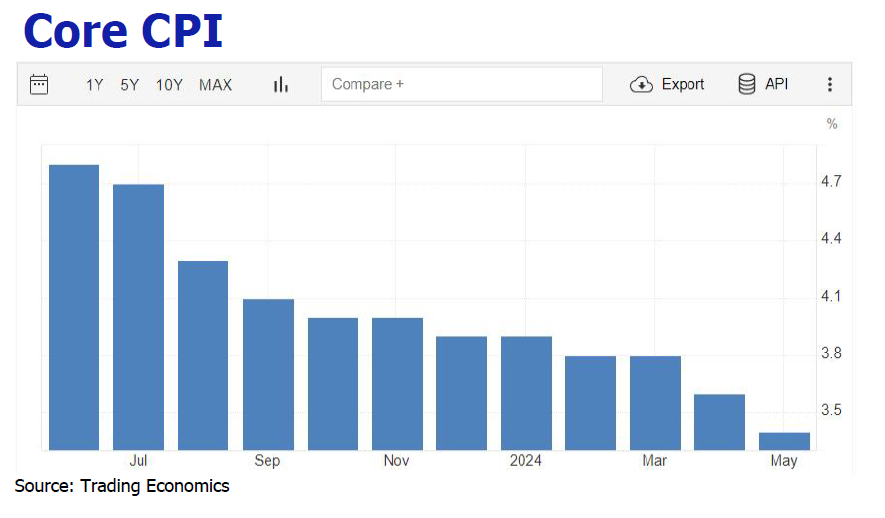

🔵May CPI and core CPI slowed to 0.01%MoM and 0.16%MoM, supporting rate cut bet in September.

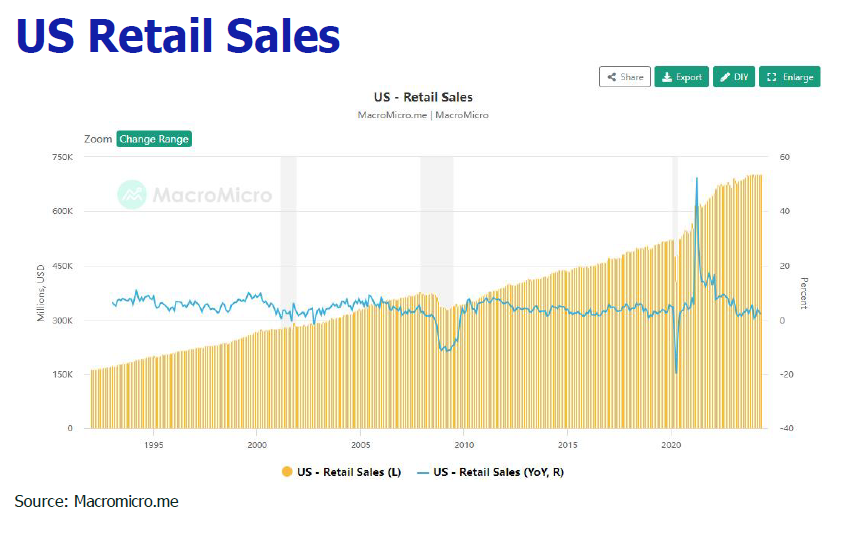

🔵Slidding housing starts (-5.5%Mom), sluggish retail sales (+0.1% MoM), increased bankruptcy (+88% YTD) and higher unemployment (4%) are the red flags to US economy.

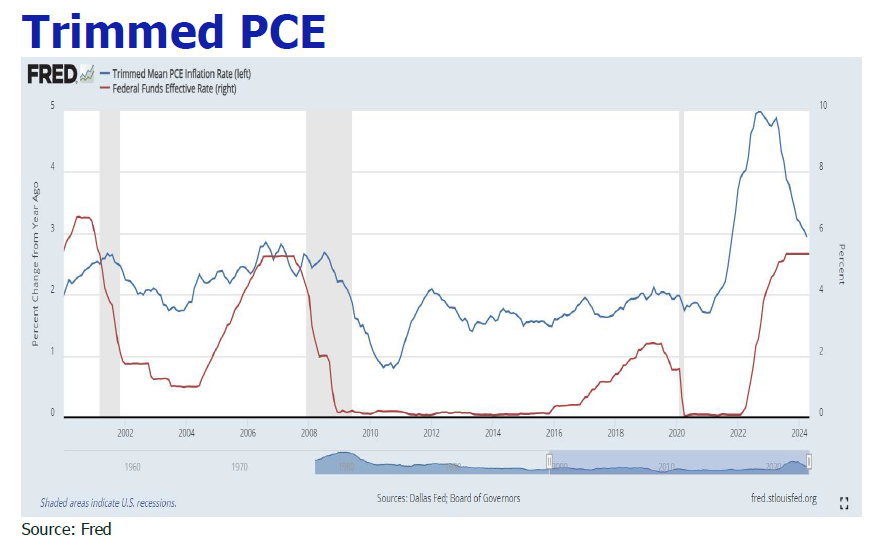

🔵Fed anticipates one time rate cut this year, conditional on more persistent inflation cooling prints.

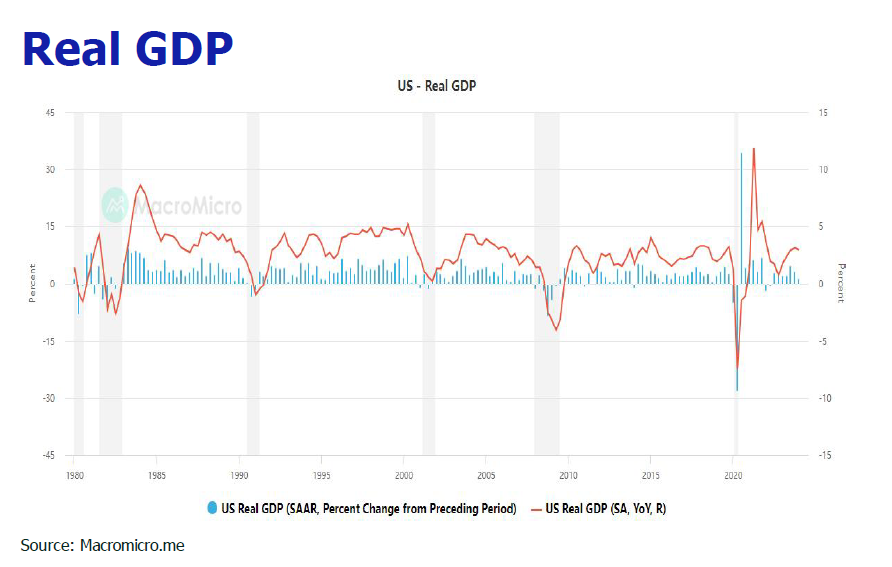

🔵US economy likely to achieve 2.1%/2.0% GDP growth in 2024/2025.

🔵We contend that at most 25bp or no rate cuts at all in 2024, due to possible further deterioration of unemployment and struggled cooling of inflation.

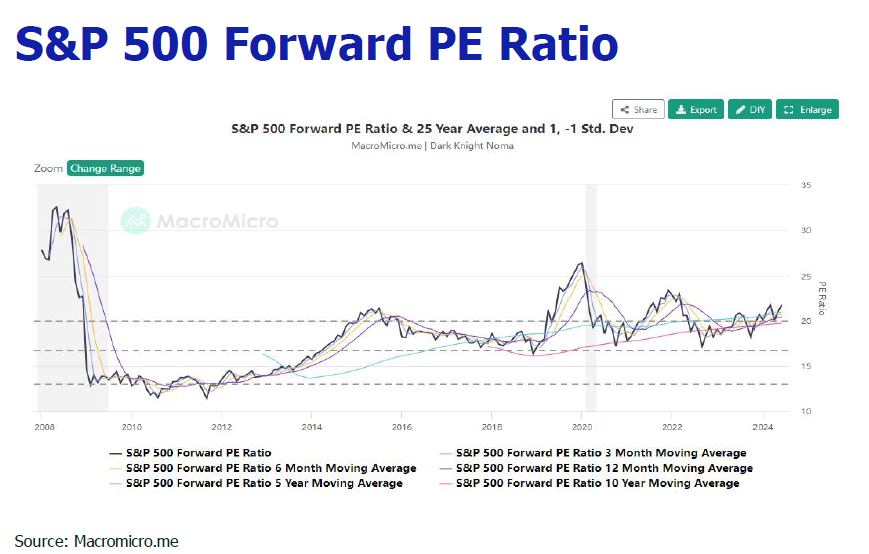

🔵We maintain our S&P 500 forecast at 5200-5800 at year end due to the strong consensus EPS earnings growth of 11.0% and the AI hype that will move S&P500 forward PE to higher reading.

🔵In June, Hong Kong Hang Seng Index (HSI) whipsawed between 18000 and 19000, with trading volume ticking down to HK$94 billion-HK$132 billion.

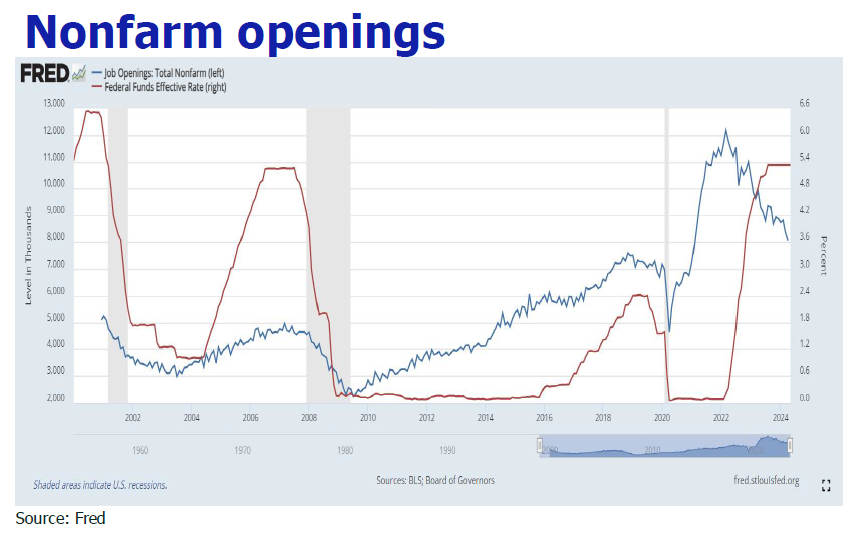

Hotter-than-expected May NFP but devil is in the details

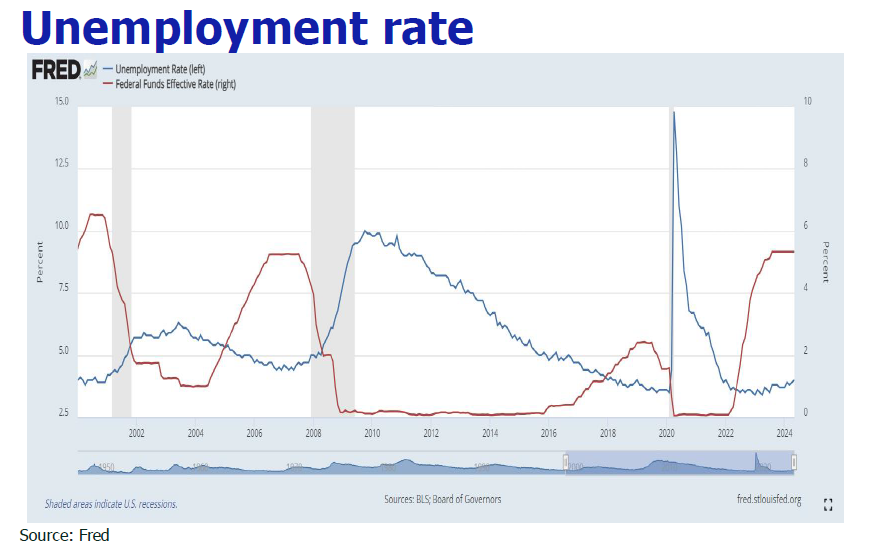

The U.S. non-farm payrolls report showed that both employment and wage growth notched stronger than expected gain in May. 272,000 new U.S. non-farm jobs were added in May, coming in 92,000 higher-than-expected, and average hourly wages increased by 4.1% YoY, exceeding the expectation by 0.4%. However, 231,000 of the reported NFP number are due to new employments created by an estimated number of new enterprises derived from the “birth/death adjustment” model, rather than true corporate survey data. In stark contrast to the corporate survey-based NFP, the Household Survey report unveiled that the number of U.S. labor force sagged by 408,000 in May.

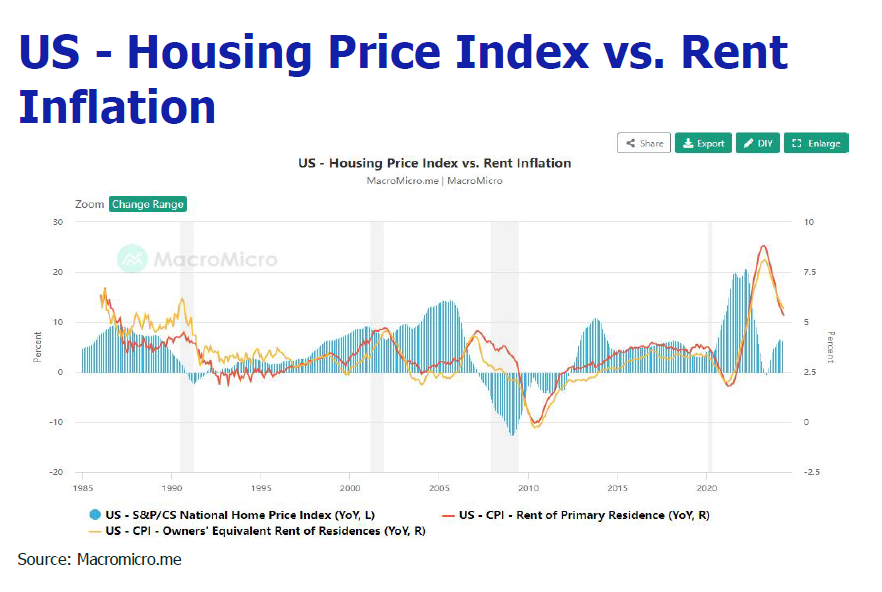

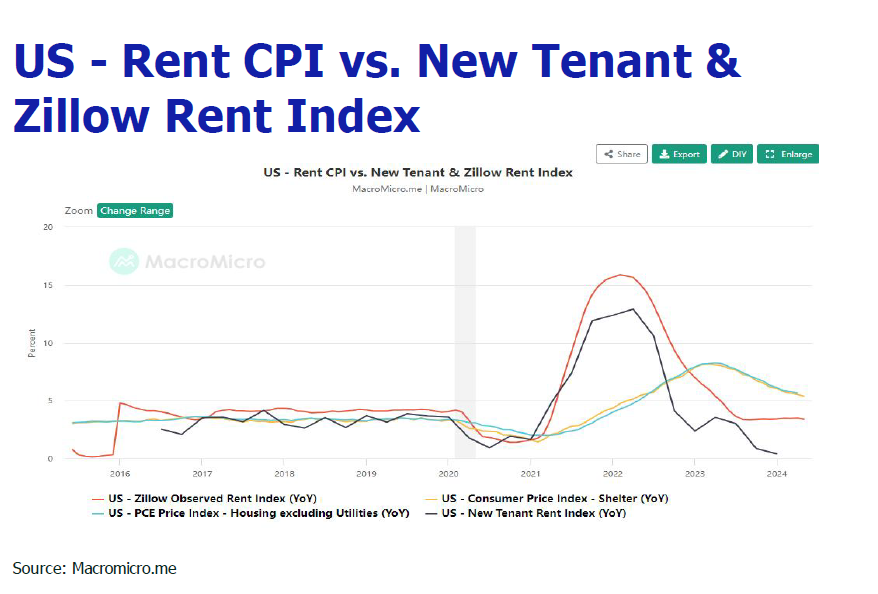

US inflation pressure kept wilting

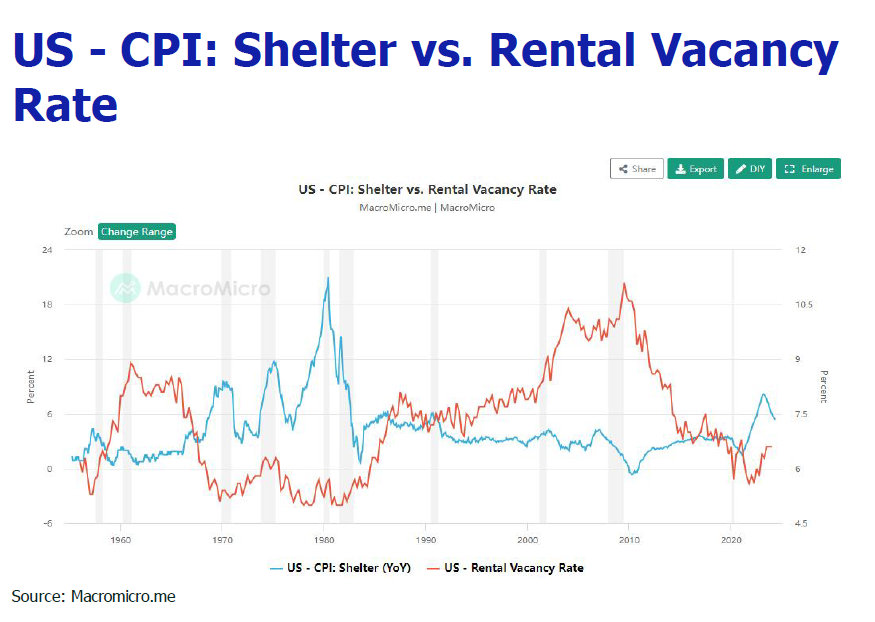

US inflation showed continued relief at muitiple fronts. CPI print in May was 3.27% YoY (3.4% expected) and 0.01% MoM (0.1% expected); core CPI print was 3.42% YoY (3.5% expected) and 0.16% MoM (0.3% expected). While the stubborn shelter prices posted 0.4% MoM surge precipitating fourth month streak of increase, energy prices dipped 2% in May and services prices rose a very subdued 0.2% MoM–the weakest monthly gain since December 2021, heightening investors’ confidence that inflation is steering towards the slow lane and rate cut is upcoming in September.

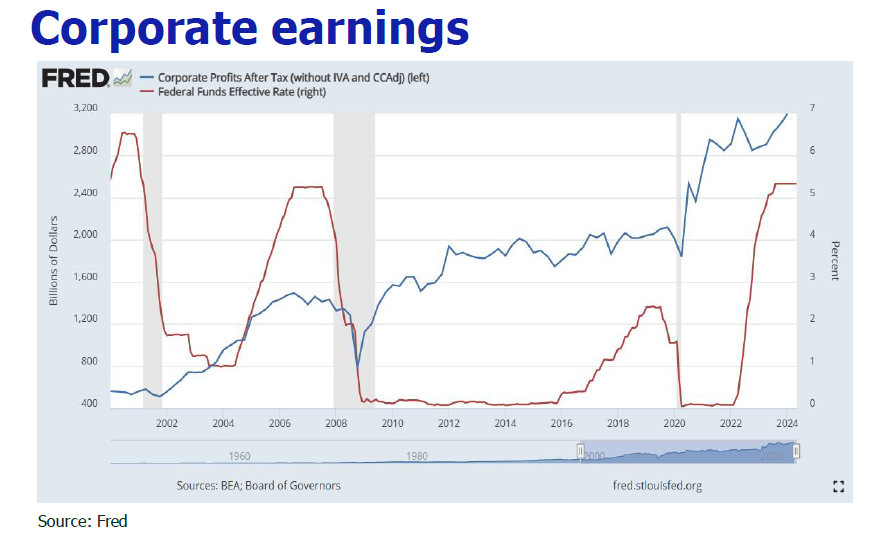

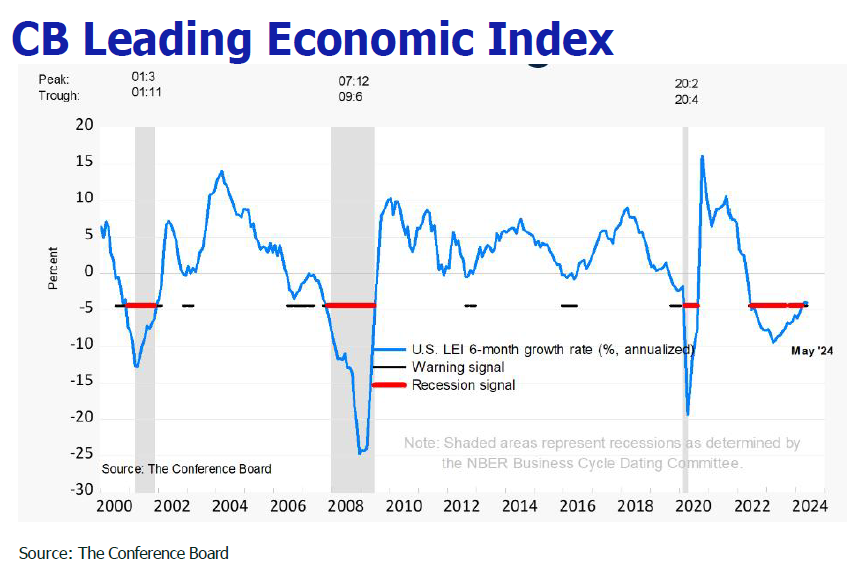

Cracks appearing in housing, consumer and labor markets

The housing market was beleaguered by high interest rates. Housing starts for privately-owned units fell 5.5% from April to a seasonally adjusted annual rate of 1.28 million units in May. Residential building permits fell 3.8% MoM and 9.5% YoY in May to an annualized rate of 1.39 million units. US economy strength also got whacked with denting retail sales and escalating corporate bankruptcy. Retail sales grew by only 0.1% in May, falling short of economists’ expectations of 0.3%, while the number of corporate bankruptcies in the US increased by 88% in April compared with the beginning of the year, with the unemployment rate surpassing 4% the first time in the recent two years.

Fed reduced leeway for rate cut to one time only in 2024

While May’s CPI and unemployment rate shore up the view that inflation has become in check and will trend lower in this year, May’s hotter-than-expected labor data stoked Fed’s worry that it is not out of the woods yet. Fed spooked the market by scaling back rate cut expectation to one time only this year, reiterating that persistent cooling trend to track the 2% inflation goal are required before rate cut.

Prediction

1. US economy stays in the course of soft GDP growth.

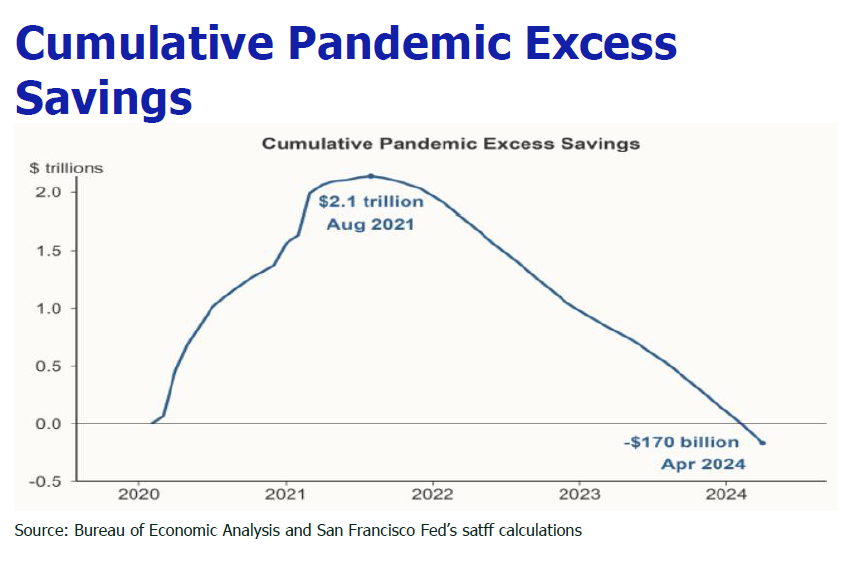

In June FOMC, the Fed projected GDP growths of 2.1% in 2024 and 2.0% in 2025. Despite the elevated rate hampers interate-sensitive industry and household excess savings have been exhausted, we share Fed’s view that US economy will continue to hum along this year owing to several reasons. Firstly, instead of shedding headcounts remarkably, many US corporates turn to hire new immigrants and part-time workers to reduce labor expense, thereby propping up domestic consumption. Secondly, US households and corporates have locked in low mortgage and loan interest rate before the rate hikes, and the higher saving rates support wage increase and generate more disposable income for consumption. Moreover, the trade war initiated against China has attracted return of manufacturing companies and crippled competitions from China’s enterprises. Furthermore, the AI mania has drawn massive investment from worldwide, creating new job openings, pushing up US stock market and US people’s wealth. Additionaly, U.S. government has increased spending on infrastructure, computer chips and battery factories to boost the economy. Last but not least, beginning in June, the cap on redemptions of U.S. Treasury bonds has been lowered from $60 billion to $25 billion each month, providing new liquidity to help stay US economy afloat, with possible further liquidity pumped by the recent rate cuts of Canada and ECB.

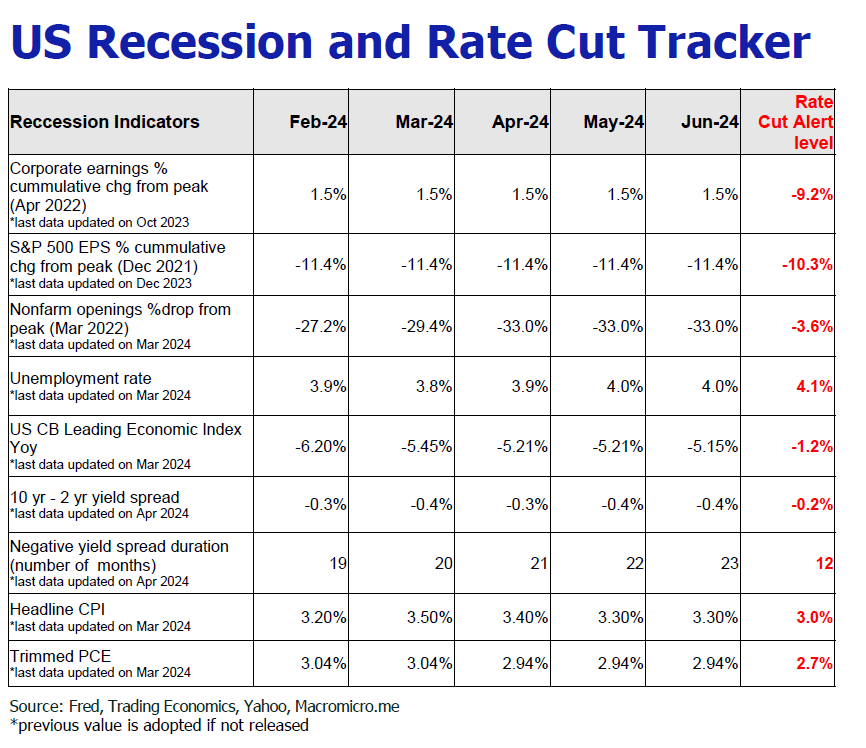

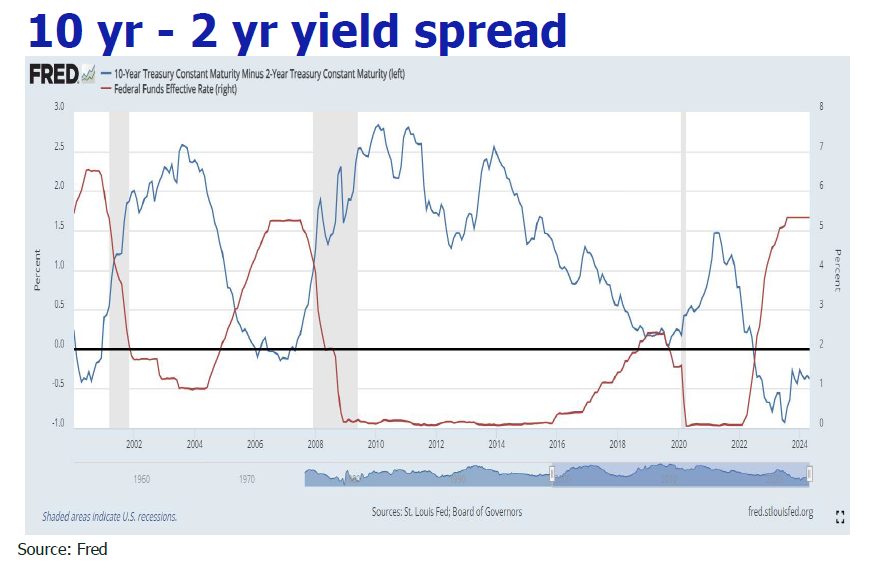

2. Struggling inflation and spiking unemployment rate create exit conundrum of the restrictive policy.

In the latest Fed’s forecast, PCE is expected to be 2.6% in 2024 and 2.3% in 2025, whereas core PCE is expected to be 2.8% in 2024 and 2.3% in 2025; unemployment will remain at the current 4% level till the end of 2024, rising to 4.2% in 2025. From Fed’s speech conveyed to the market, the tipping point of rate cut is either continued cooling of inflation (2% inflation needs not be met in 2024) or a spike of unemployment rate to over 4%. Judgin from the movement of inflation components and the status quo of US economy, we contend that at most 25bp or no rate cuts at all in 2024 are up in the air at the moment. On one hand, as the stubborn shelter cost and volatile energy prices make inflation choppy, the first criteria may not be met easily. On the other hand, the aforementioned cracks in housing, consumer and labor markets would falter the US economy, leading to higher unemployment and prompting rate cuts by the Fed, according to the second criteria.

Disclaimer

All information used in the publication of this newsletter has been compiled from publicly available sources that are believed to be reliable, however we do not guarantee the accuracy or completeness of this report and have not sought for this information to be independently verified. Forward-looking information or statements in this report contain information that is based on assumptions, forecasts of future results, estimates of amountsnot yet determinable,

and therefore involve known and unknown risks, uncertainties and other factors which may cause the actual results to be materially different from current expectations.

We shall not be liable for any direct, indirect or consequential losses, loss of profits, damages, costs or expenses incurred or suffered by you arising out or in connection with theaccess to, use of or reliance on any information contained on this note.