Tariffs threat shakes US market, Deepseek keeps AI bull run in Hong Kong and China markets

Austin Or, CFA

Highlights

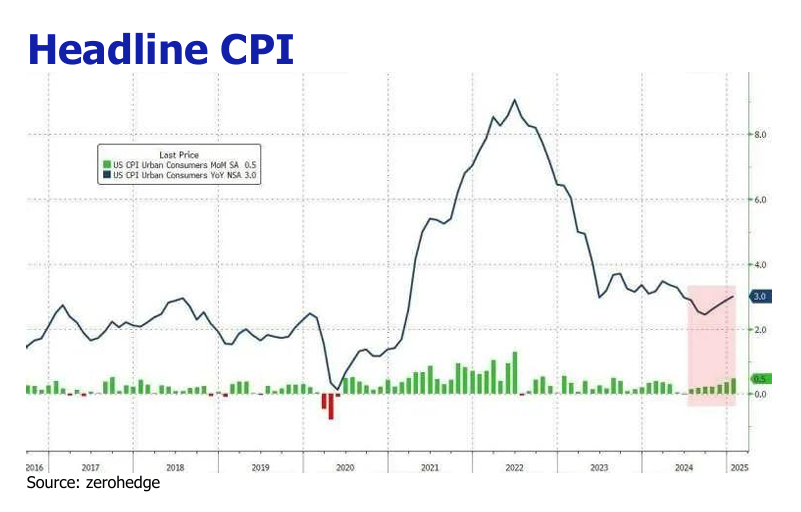

![]() Thelast mile of inflation stayed murky with hotter-than-expected print of 3%YoY and 0.5%MoM.

Thelast mile of inflation stayed murky with hotter-than-expected print of 3%YoY and 0.5%MoM.

![]() Persistent yet smaller January NFP add, sound wage growth and lower unemployment rate render strength to the labor market.

Persistent yet smaller January NFP add, sound wage growth and lower unemployment rate render strength to the labor market.

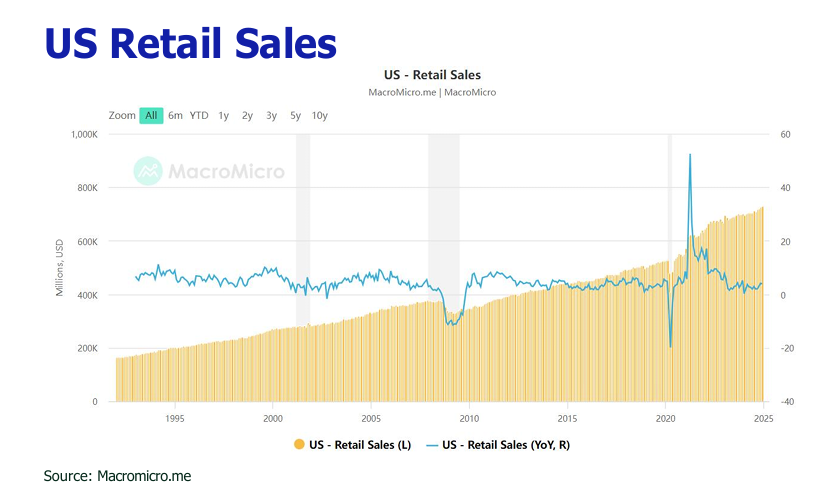

![]() Retail sales tanked 0.9%MoM due to adverse weather and wildfires.

Retail sales tanked 0.9%MoM due to adverse weather and wildfires.

![]() The US Service PMI contracted, driven by federal spending cuts and tariff concerns, signaling potential headwinds for the economy.

The US Service PMI contracted, driven by federal spending cuts and tariff concerns, signaling potential headwinds for the economy.

![]() New tariffs on China, Canada and Mexico and expanding tariffs to wider scope and nations are poised to fuel inflation in the months ahead.

New tariffs on China, Canada and Mexico and expanding tariffs to wider scope and nations are poised to fuel inflation in the months ahead.

![]() Inlight of the higher inflation threat posed by tariff, the Fed will likely postpone the rate cut to the second half per the market view.

Inlight of the higher inflation threat posed by tariff, the Fed will likely postpone the rate cut to the second half per the market view.

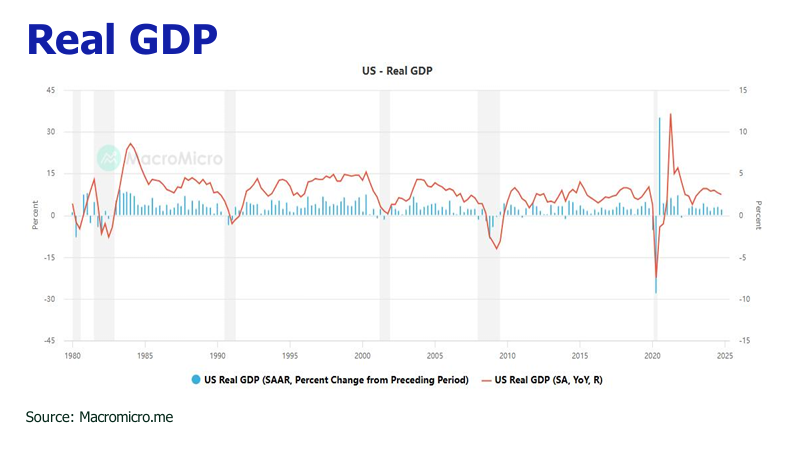

![]() Trump’s persistent pressure for lower rates, emerging cracks in the service sector, potential slowdown of retail sales and the U.S. GDP growth precipitated by tariff, as well as the likley rally of unemployment rate due to government job cuts by DOGE could entail an earlier rate cut.

Trump’s persistent pressure for lower rates, emerging cracks in the service sector, potential slowdown of retail sales and the U.S. GDP growth precipitated by tariff, as well as the likley rally of unemployment rate due to government job cuts by DOGE could entail an earlier rate cut.

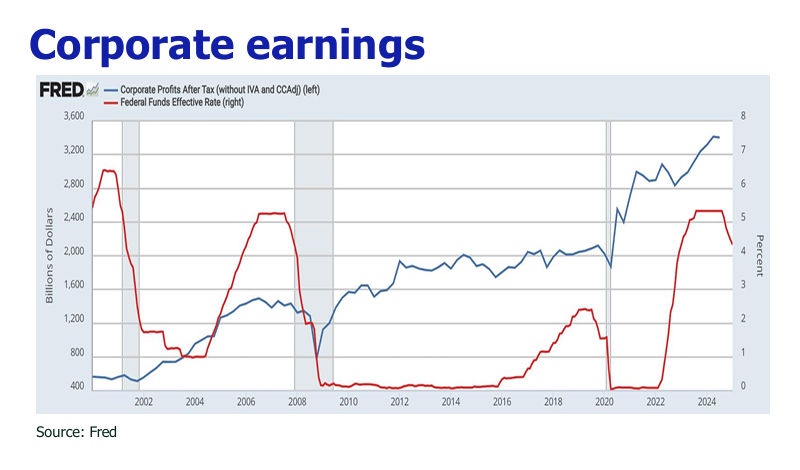

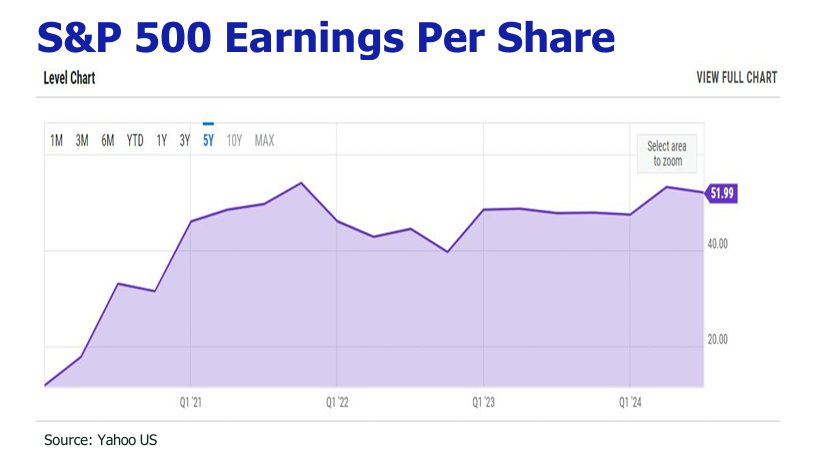

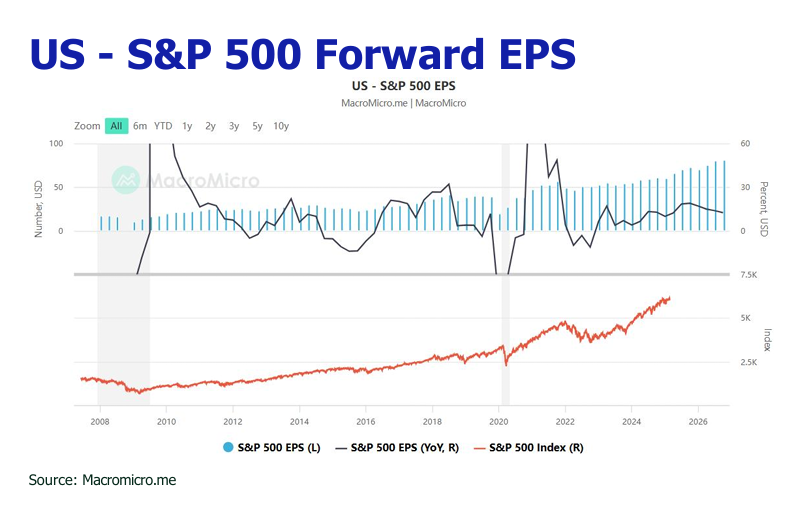

![]() We uphold our 2025 S&P 500 target at 6,600, in view of in the potential consumption stimulus and corporate earnings boost from promised tax reductions by Trump and ongoing rate cuts by Fed.

We uphold our 2025 S&P 500 target at 6,600, in view of in the potential consumption stimulus and corporate earnings boost from promised tax reductions by Trump and ongoing rate cuts by Fed.

![]() China’s sweeping AI advancements are anticipated to attract significant global capital inflows, igniting a bull run with further upside projections of 16% to 19%, according to Goldman Sachs.

China’s sweeping AI advancements are anticipated to attract significant global capital inflows, igniting a bull run with further upside projections of 16% to 19%, according to Goldman Sachs.

![]() In February, the Hong Kong Hang Seng Index (HSI) surged 14% to around 23,000, accompanied by increased daily trading volumes of HKD 300 billion to 400 billion in the latter half of the month.

In February, the Hong Kong Hang Seng Index (HSI) surged 14% to around 23,000, accompanied by increased daily trading volumes of HKD 300 billion to 400 billion in the latter half of the month.

![]() We foresee an additional 8% to 10% upside to HSI, fueled by new stimulus measures from the NPC and CPPCC in March, alongside asset reallocations by global investors capitalizing on the China re-rating sparked by AI eruption.

We foresee an additional 8% to 10% upside to HSI, fueled by new stimulus measures from the NPC and CPPCC in March, alongside asset reallocations by global investors capitalizing on the China re-rating sparked by AI eruption.

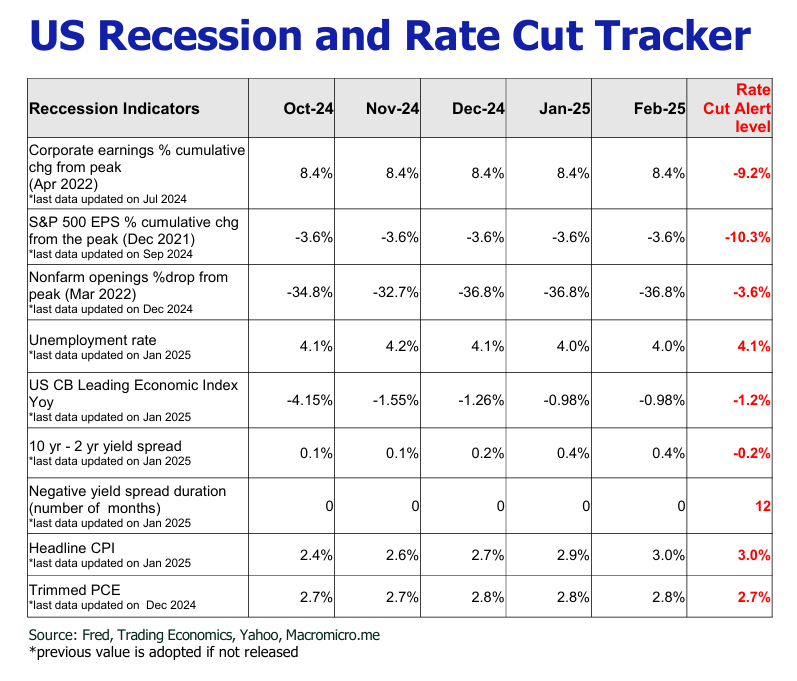

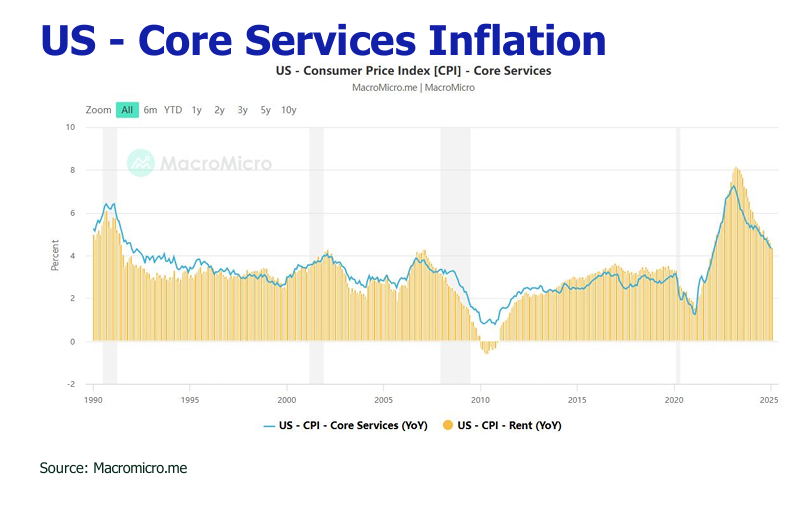

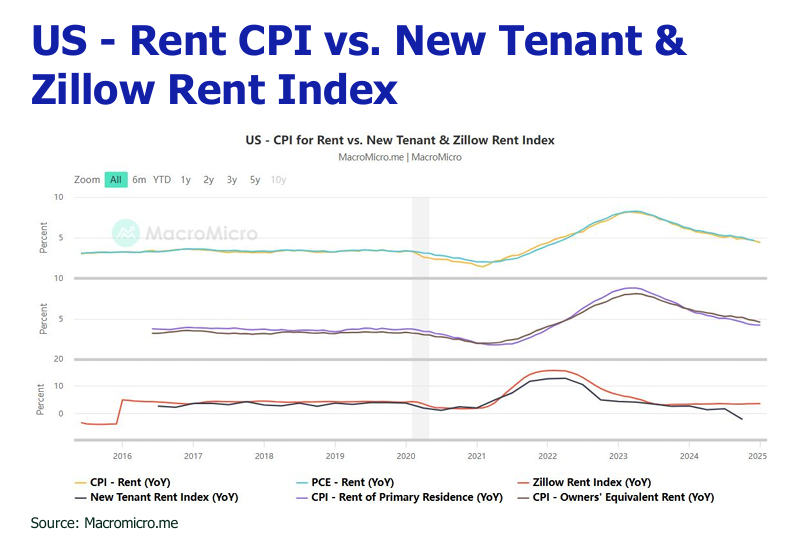

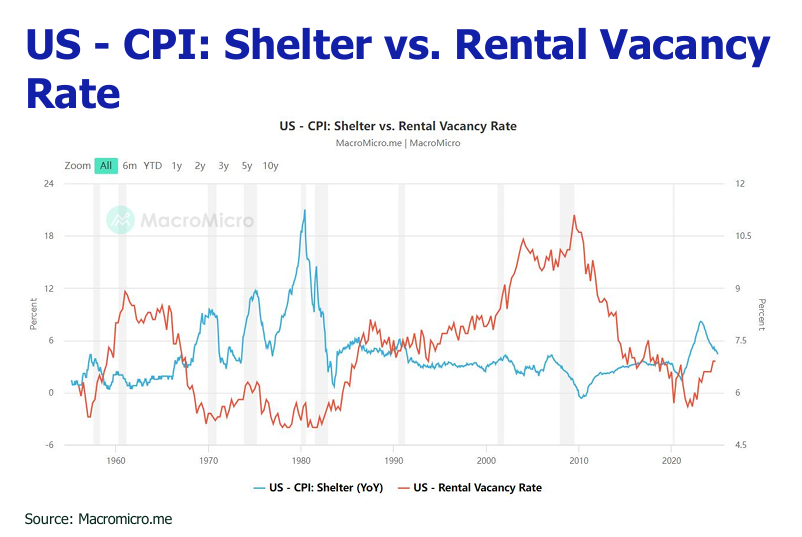

Inflationary edged up amid rising food, energy, and shelter costs

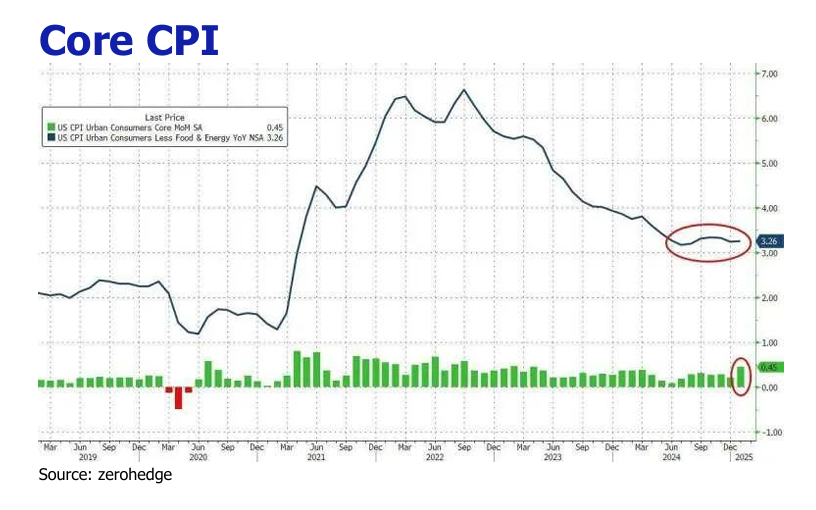

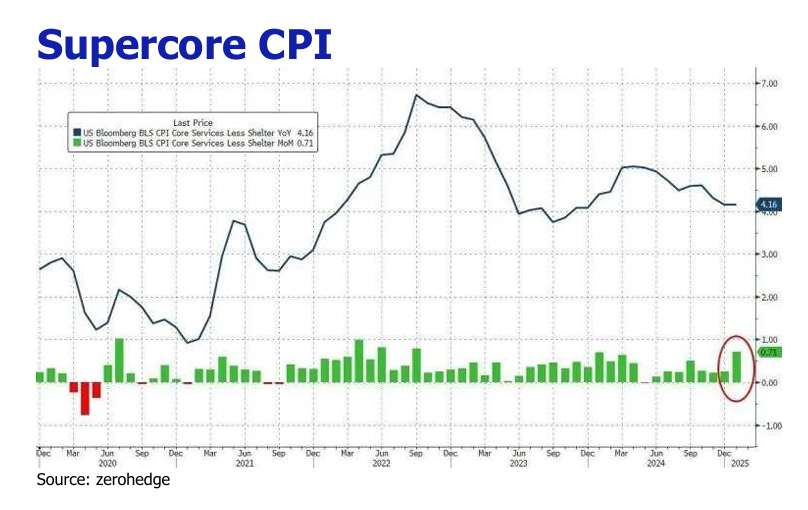

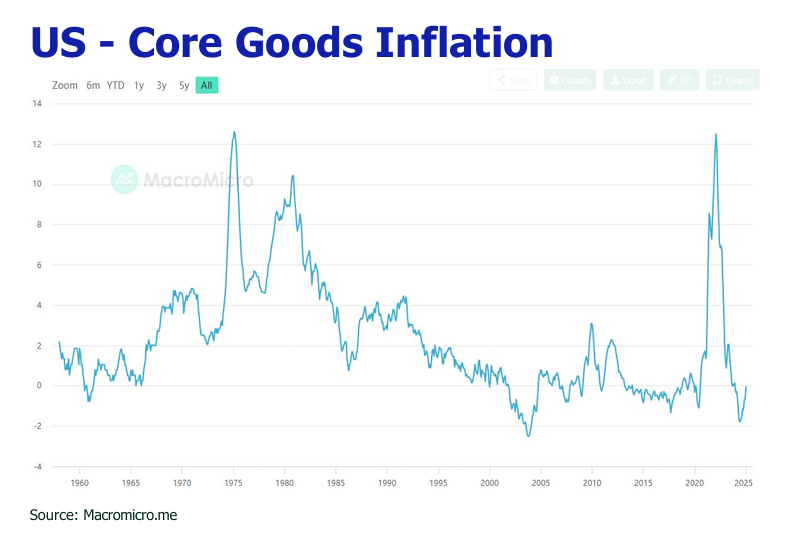

The January inflation data in the United States racked the nerve of the market as to a potential reacceleration of inflationary trends. The headline Consumer Price Index (CPI) edged up to 3% YoY and 0.5%MoM increase (December: 2.9% YoY and 0.4% MoM), while the core CPI, which excludes volatile food and energy components, rose to 3.3% YoY and 0.4% MoM (up from December’s 3.2% YoY and 0.3% MoM). Food prices experienced a 0.4% uptick, driven by a sharp 15.2% surge in egg prices, a consequence of ongoing disruptions caused by avian influenza outbreaks. Energy costs climbed 1.1%, fueled by a 1.8% rise in gasoline prices. Shelter expenses, a persistent driver of core inflation, increased by 0.4% for the month, as elevated mortgage rates continue to divert more Americans toward the rental market, exacerbating housing demand pressures. Supercore CPI which excludes shelter cost on top of core CPI stalled at 4.2% YoY but rose to 0.7% MoM (December: 4.2% YoY and 0.3% MoM).

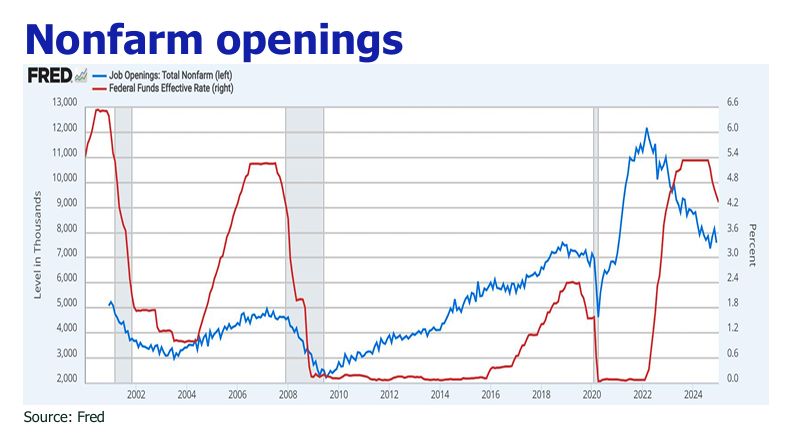

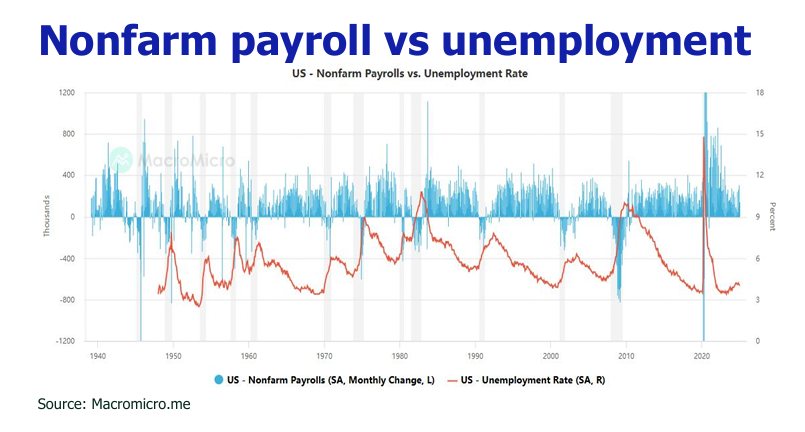

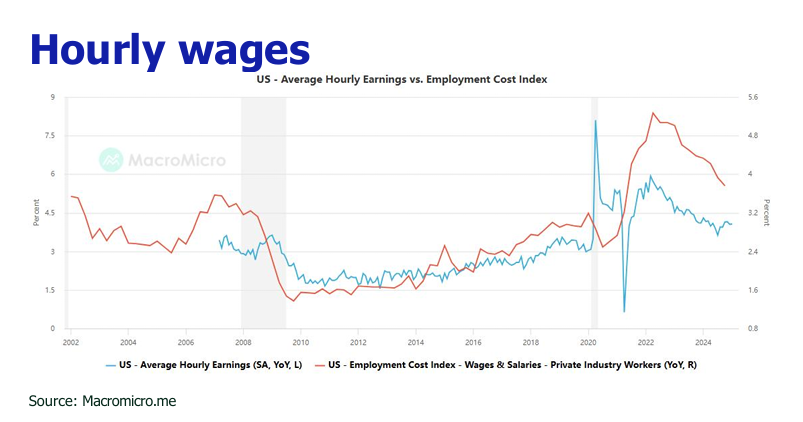

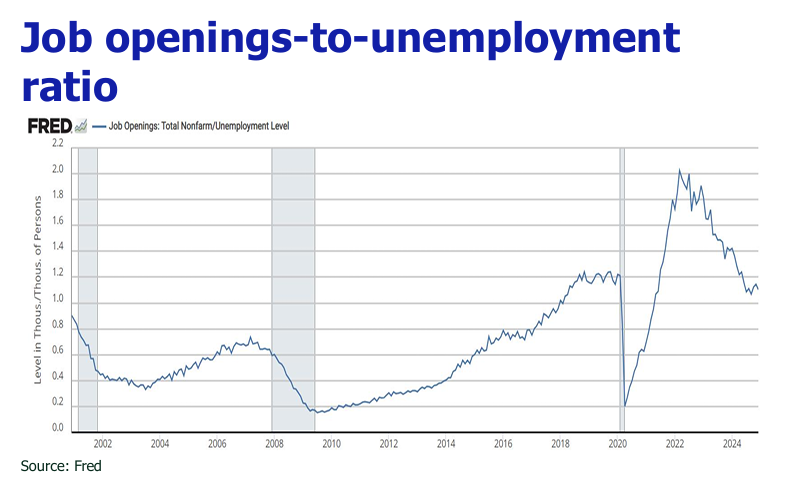

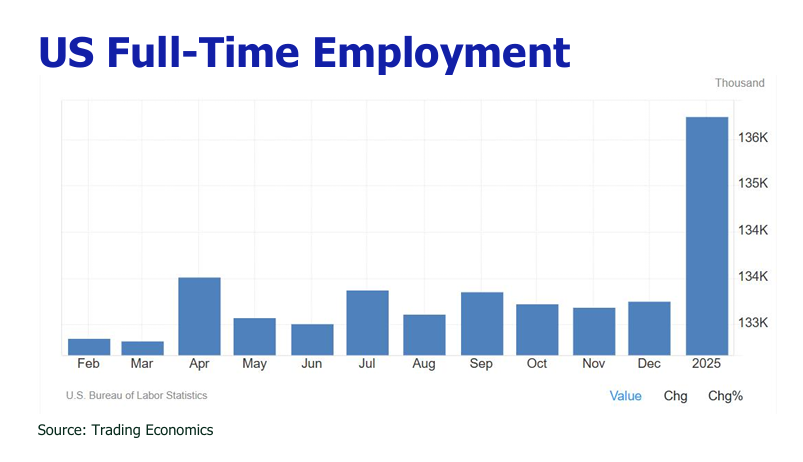

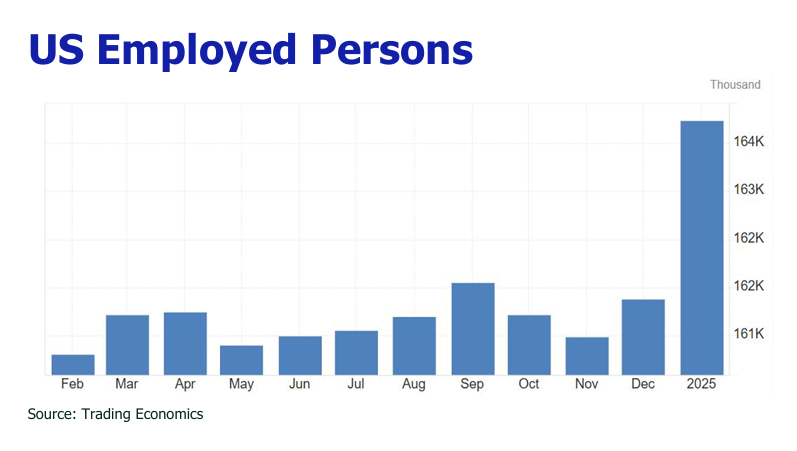

NFP slided with declining unemployment rate and pleasant wage growth

January’s nonfarm payrolls expanded by a seasonally adjusted 143,000, a notable deceleration from December’s robust gain of 307,000. Employment growth was predominantly concentrated in healthcare (+44,000), retail (+34,000), and government sectors (+32,000). Despite the subdued headline figure, the sharp combined upward revision of 1000,000 to November and December datapoints, and the decline of unemployment rate to 4% took some of the sting from the report. Although job gains were subdued, wage growth exceeded expectations, with average hourly earnings rising by 0.5% MoM and 4.1% YoY.

Trump imposed tariffs on China, Canada and Mexico

The U.S. administration unveiled a series of aggressive trade measures, including an immediate 10% tariff on all Chinese imports starting in February, followed by an additional 10% increase in March. A phased 25% tariff will be applied to goods from Canada and Mexico, with a specific 10% tariff targeting Canadian energy exports, also effective from March. Furthermore, a 25% tariff on steel and aluminum imports has been reinstated, and reciprocal tariffs will be imposed on countries that levy duties on U.S. exports. In response, China has countered with a 15% border tax on U.S. coal and liquefied natural gas, alongside a 10% tariff on crude oil, agricultural machinery, and large-displacement vehicles. Canada is preparing to retaliate with a 25% tariff on U.S. goods worth 155 billion Canadian dollars, while Mexico plans to impose its own tariffs on U.S. exports, escalating tensions in the global trade landscape.

Retail sales plummeted on adverse weather and wildfires

U.S. retail sales contracted by 0.9% MoM, with core sales plummeting 0.8%MoM, chalking up to harsh winter conditions and California wildfires dampening consumer activity. The automotive sector led the decline, with receipts at auto dealerships falling 2.8%, reflecting a post-holiday slowdown in vehicle purchases. The wildfires in Los Angeles, combined with severe winter storms across other regions, significantly curtailed in-person shopping.

Contraction of US Service PMI casts a pall over US economy outlook

Suprising the market to the downside, the US Services PMI Business Activity Index unexpectedly contracted, registering a 25-month low of 49.7 in February, down from 52.9 in January. This downturn, which caught markets off guard, was accompanied by a pronounced deceleration in new order growth and a significant deterioration in business confidence for the year ahead, driven by mounting jitters surrounding federal spending cuts and escalating trade tariffs. Service sector employers reported a reversal in hiring trends, with job losses resuming after two consecutive months of net employment gains. In contrast, the US Manufacturing PMI edged higher to 51.6, marking an eight-month peak and up from 51.2 in January. However, this modest uptick in manufacturing output was partially attributed to anticipatory stockpiling ahead of impending tariffs, suggesting that the boost may be transient rather than indicative of sustained growth. The decline in services activity, which more than offset the marginal acceleration in manufacturing, precipitated a drop in the US PMI Composite Output Index to 50.4, its lowest level in 17 months, down from 52.7 in January.

Prediction

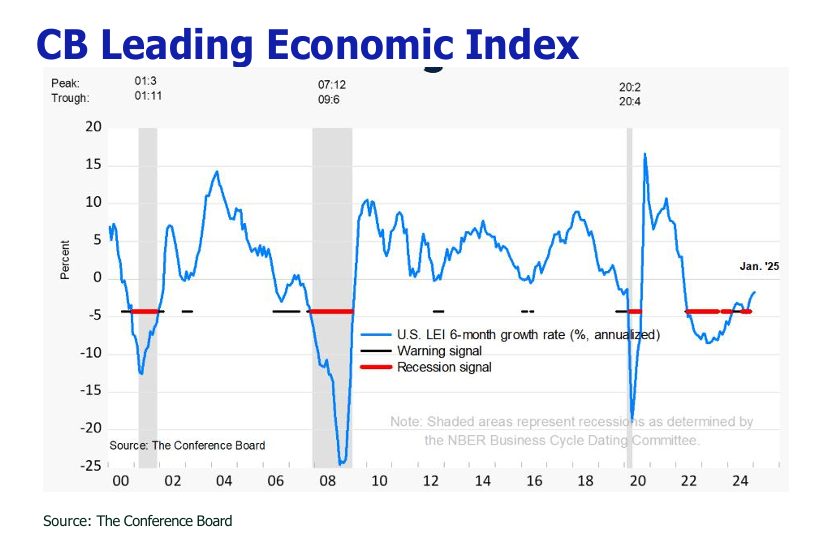

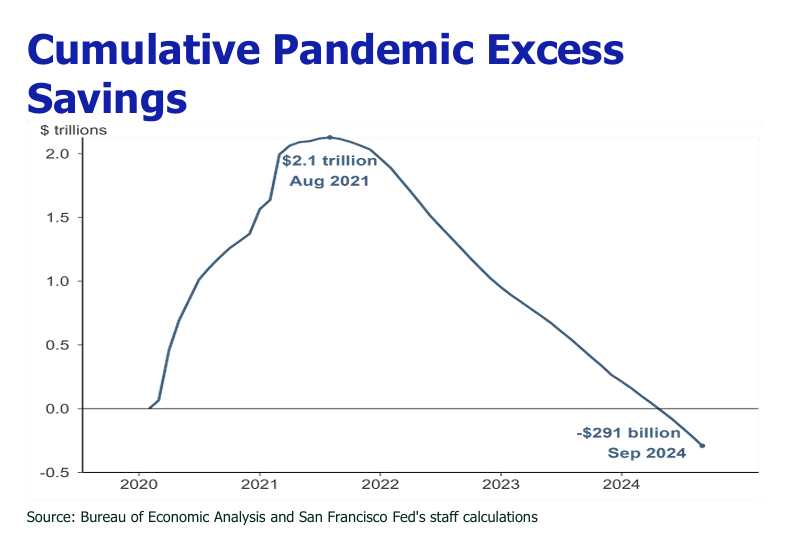

1.Built-up of greater inflationary pressure following from the imposition of tariff.

While we reckon that January CPI spike is more a seasonal swing than a structural shift, the U.S. inflation is expected to grind higher after the imposition of tariff commencing in February. Compounding the issue, the Trump administration is considering imposing tariffs exceeding 25% on automobiles, semiconductors, and pharmaceuticals, 10% tariff on all import goods to the U.S., while also expanding the scope of these tariffs to encompass the EU, Japan, and South Korea. These additional measures will inadvertently exacerbate inflationary pressures in the months ahead.

According to Goldman Sacchs estimate, the tariff will jack up the inflation rate of the U.S. by 0.3ppt to 1.6ppt.

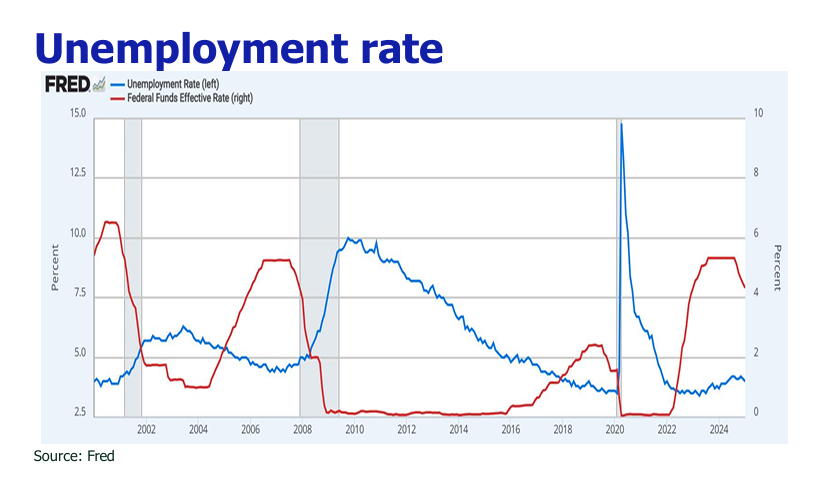

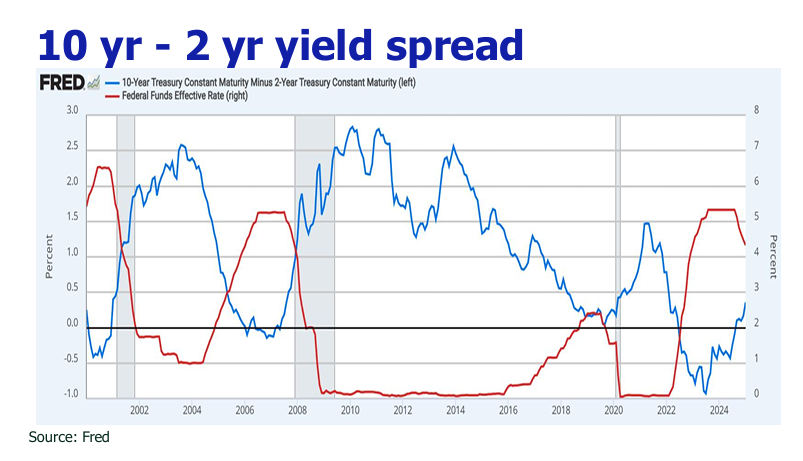

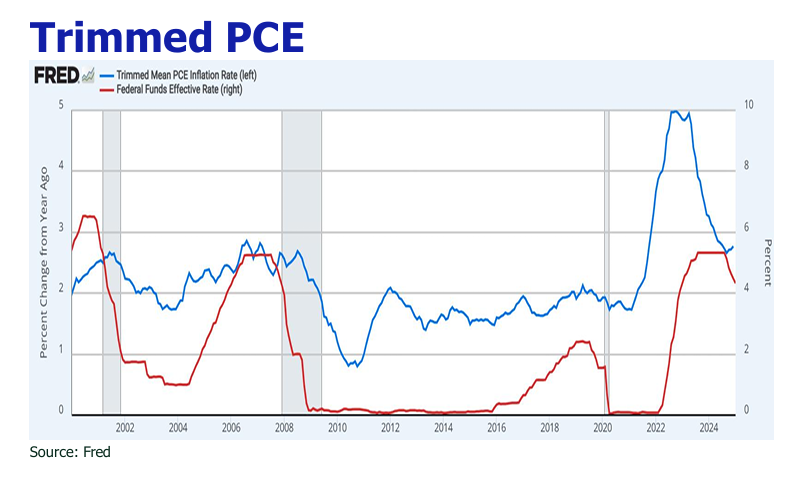

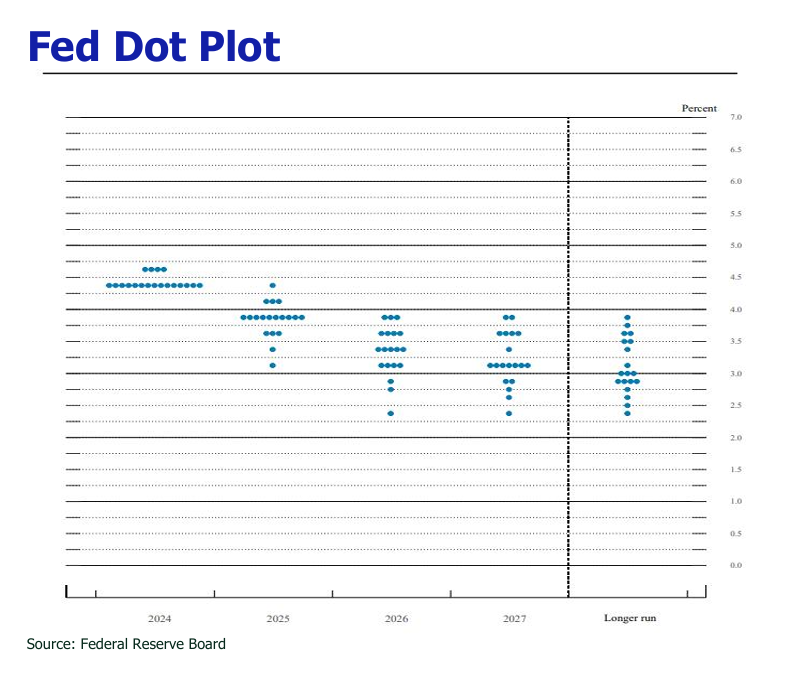

2.Rate cut to remain on hold for longer but a batch of factors are the wild cards.

In the context of consistent hiring and wage growth, coupled with escalating inflationary pressures arising from tariffs, the market anticipates that the Federal Reserve will refrain from resuming interest rate cuts until the latter half of the year. We believe the Fed is likely to resort to trimming or halting Quantitative Tightening (QT) as a strategic alternative to rate cuts, aiming to soften the impact of prolonged restrictive monetary policy. However, Trump’s persistent pressure for lower rates, coupled with emerging cracks in the service sector, potential slowdown of retail sales and the U.S. GDP growth precipitated by tariff, as well as the likley rally of unemployment rate due to government job cuts by DOGE, could potentially reshape the Fed’s path in one way or the other.

3. The AI eruption ignites China’s bull run.

As China continues flexing its AI muscles in LLM, robotics, smartphone, autonomous vehicles, cloud computing, healthcare and beyond, international capital is flocking into China equities market. According to the latest forecast of the World Economic Forum, China’s AI economy will currently grow from US$70 billion to US$140 billion by 2030, triggering re-rating of the China equities by the global capital market. According to the latest report on global capital flows from the Institute of International Finance (IIF), January saw foreign investors actively positioning themselves in Chinese assets, with net inflows into Chinese stocks and bonds surpassing US$10 billion. This marks the first time since August of last year that foreign capital has simultaneously increased its stakes in both Chinese equities and debt. In the past month, DeepSeek has catalyzed a remarkable surge in the Hang Seng Index and MSCI China, driving gains of 19% in both.

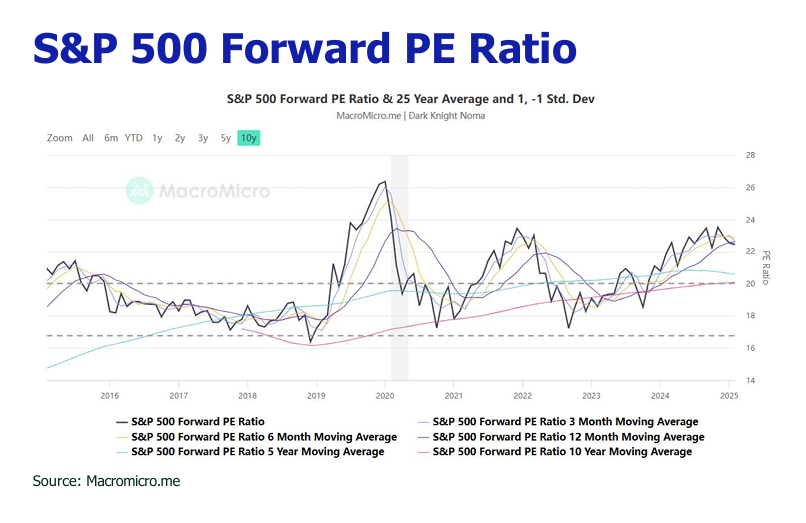

Amid the AI mania, American and international investors have net purchased approximately US$660 billion in U.S. stocks over the past year, propelling the S&P 500 and NASDAQ indices to rise by 20% and 24%, respectively, adding over US$10 trillion in market value. Drawing parallels with the U.S. experience, Goldman Sachs forecasts that the allure of the Chinese AI narrative could attract as much as $200 billion in net inflows (including an estimated $104 billion from southbound capital), translating to an increment of total market capitalization of the China market by US$3 trillion within the next 12 months. In light of these developments, Goldman Sachs has raised its target points for the MSCI China and CSI 300 indices to 85 and 4,700, respectively, indicating potential upside of 16% and 19% for these indices over the next year.

Morgan Stanley and CICC have both turned bullish on China’s equity markets, citing the country’s advancements in AI, attractive valuations, and the potential for a shift in foreign institutional asset allocation. MSCI China is currently trading at a forward P/E of 10.6, representing a 53% discount to the S&P 500 and a 14% discount to the MSCI Emerging Markets index. Morgan Stanley contends that China’s breakthroughs in AI, coupled with a more prudent U.S. approach to tariffs, will help reverse the outflow of active foreign funds. According to CICC, China’s current asset allocation weight is at a historical low of 6%, significantly below the peak of 14.6% seen in 2021 and 1.1 percentage points below the baseline. A re-rating of Chinese assets could prompt a shift from underweight to equal-weight or even overweight positions, potentially driving inflows of US$6.3 billion to US$41.9 billion.

Disclaimer

All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however we do not guarantee the accuracy or completeness of this report and have not sought for this information to be independently verified. Forward-looking information or statements in this report contain information that is based on assumptions, forecasts of future results, estimates of amounts not yet determinable, and therefore involve known and unknown risks, uncertainties and other factors which may cause the actual results to be materially different from current expectations.

We shall not be liable for any direct, indirect or consequential losses, loss of profits, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note.