Whopping nonfarm payroll spike to decelerate rate cut pace

Austin Or, CFA

Highlights

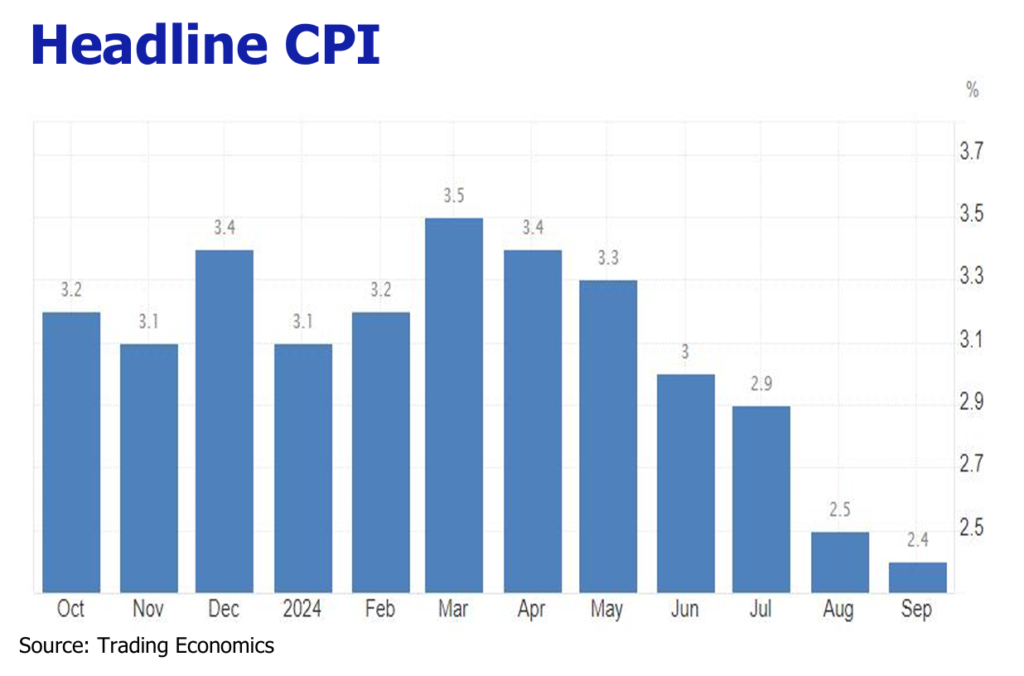

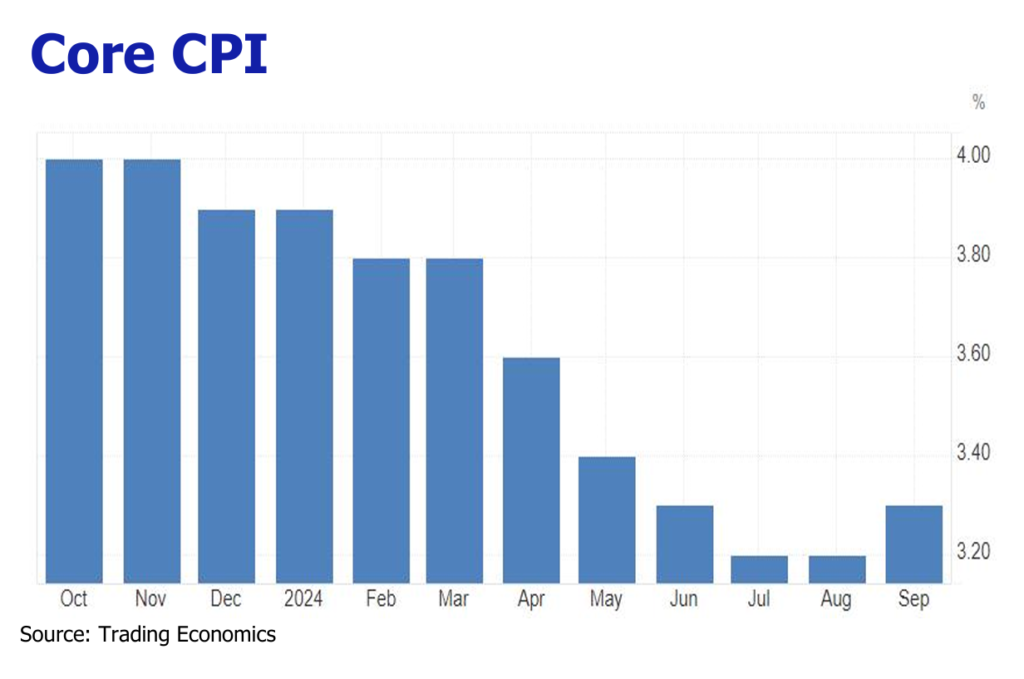

![]() US inflation softened to 2.4%YoY with loosening energy and housing pressure amid small goods uptick.

US inflation softened to 2.4%YoY with loosening energy and housing pressure amid small goods uptick.

![]() Ultra high September NFP and lighter unemployment rate were due to the sharp seasonaly growth of government hires while the private sector openings were imploding.

Ultra high September NFP and lighter unemployment rate were due to the sharp seasonaly growth of government hires while the private sector openings were imploding.

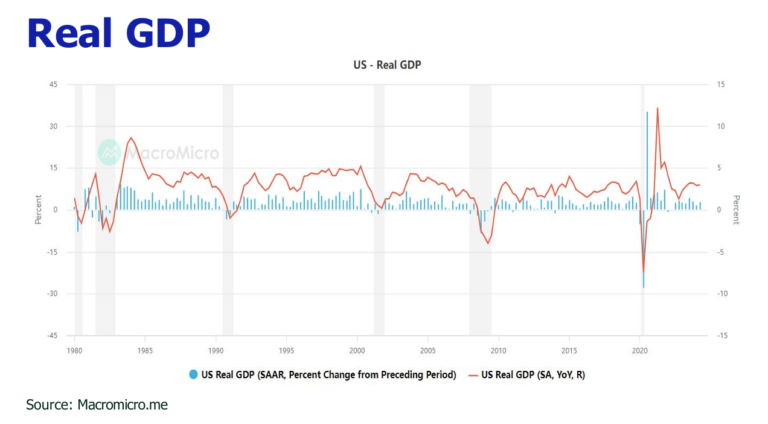

![]() Sustained strong wage growth shouldered retail sales and was auspicious for US Q3 GDP growth.

Sustained strong wage growth shouldered retail sales and was auspicious for US Q3 GDP growth.

![]() Services PMI expanded for 22 consecutive months while manufacturing PMI dived to the lowest level since June 2023.

Services PMI expanded for 22 consecutive months while manufacturing PMI dived to the lowest level since June 2023.

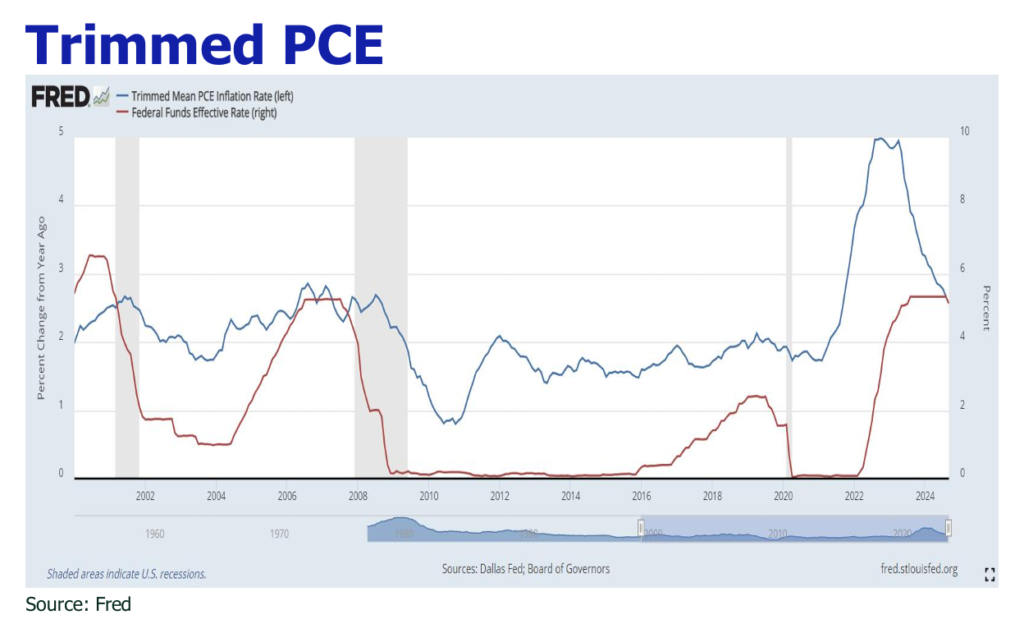

![]() Inflation should stay in the downtrack under weaker oil price prospect and unwinding of shelter components, depsite possible rally in October.

Inflation should stay in the downtrack under weaker oil price prospect and unwinding of shelter components, depsite possible rally in October.

![]() Notwithstanding the exceptional spike in September NFP, the labor market is still pinched by the grim manufacturing and private sectors, the disinflation trend remains sound and ECB will exert greater rate cut pressure, driving Fed to trim the rate cut to 25 bp in Nov FOMC.

Notwithstanding the exceptional spike in September NFP, the labor market is still pinched by the grim manufacturing and private sectors, the disinflation trend remains sound and ECB will exert greater rate cut pressure, driving Fed to trim the rate cut to 25 bp in Nov FOMC.

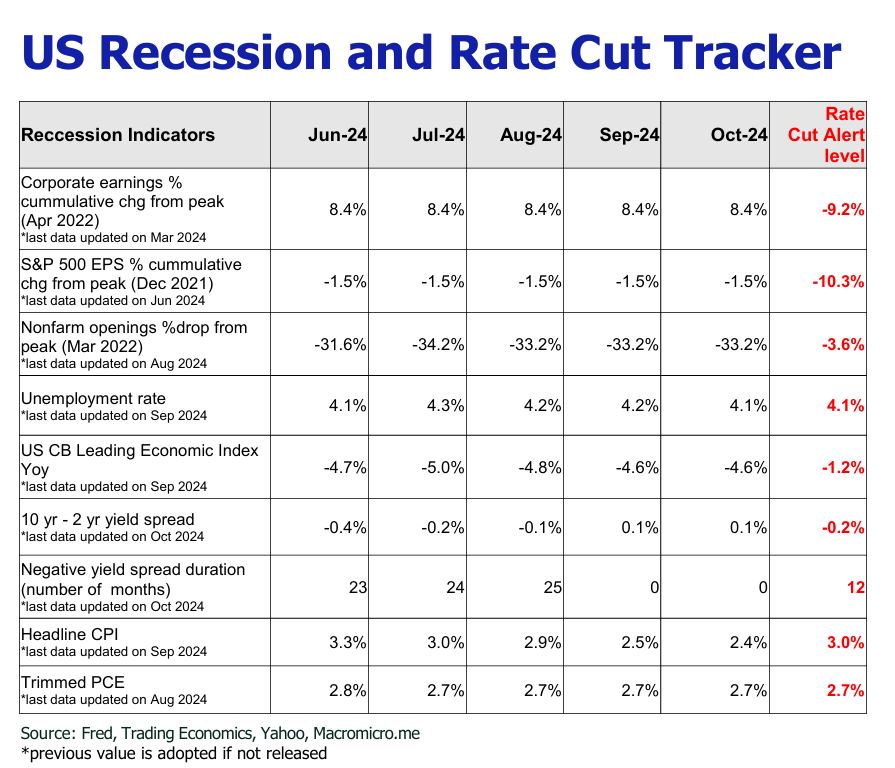

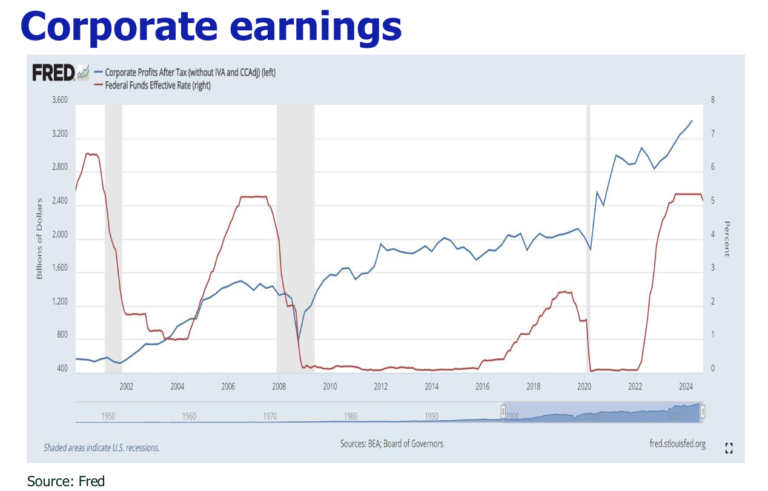

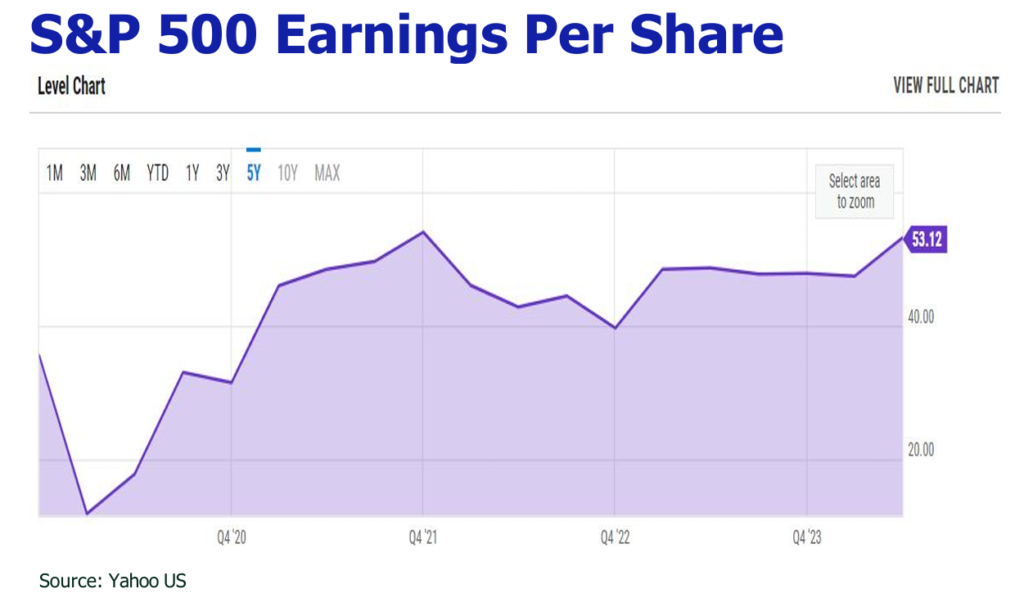

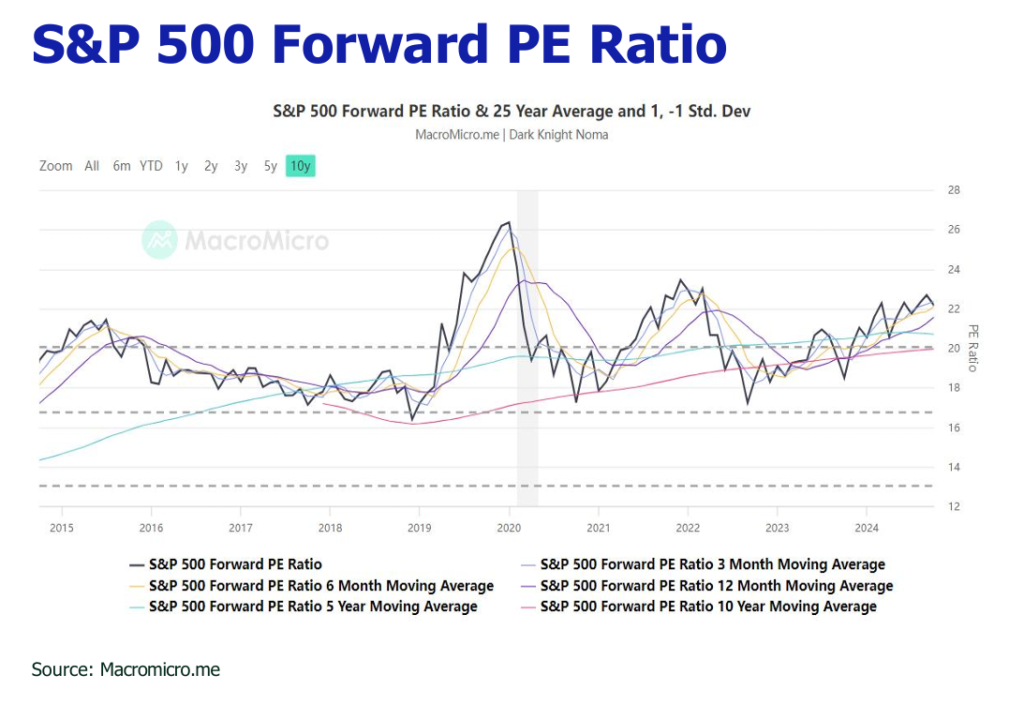

![]() We unalter our S&P 500 forecast to 5800-6000 ending 2024 on the strong US economy standing, benign corporate earnings growth and rate cut incentivisation.

We unalter our S&P 500 forecast to 5800-6000 ending 2024 on the strong US economy standing, benign corporate earnings growth and rate cut incentivisation.

![]() In October, Hong Kong Hang Seng Index (HSI) receded slightly to 21000 after soaring to around 23100, with trading volume pulling back from over HK$ 400 billion to around HK$ 190 billion.

In October, Hong Kong Hang Seng Index (HSI) receded slightly to 21000 after soaring to around 23100, with trading volume pulling back from over HK$ 400 billion to around HK$ 190 billion.

![]() A share and HK stock market bull run are expected to switch to a slower and bumpy pace due to the market’s growing prudence towards the effectiveness of China stimulus policy to boost the economy and the stock market, the possible tax hindrance by US to local funds for investing in China and the rumored 20% tax on overseas asset transactions of wealthy individuals by China.

A share and HK stock market bull run are expected to switch to a slower and bumpy pace due to the market’s growing prudence towards the effectiveness of China stimulus policy to boost the economy and the stock market, the possible tax hindrance by US to local funds for investing in China and the rumored 20% tax on overseas asset transactions of wealthy individuals by China.

![]() The latest proposal of forming the stablization fund with intended size of RMB 2 trillion will help even China A share volatility and improve public investment sentiment.

The latest proposal of forming the stablization fund with intended size of RMB 2 trillion will help even China A share volatility and improve public investment sentiment.

Inflation reprieved with energy and housing but got disturbed by rally of consumables

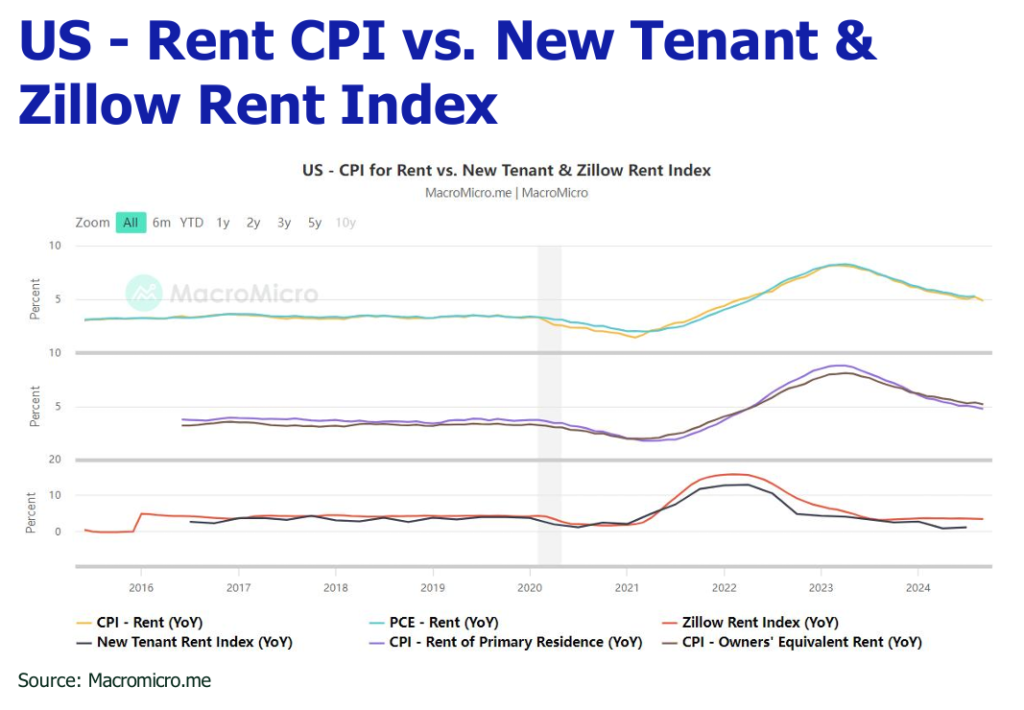

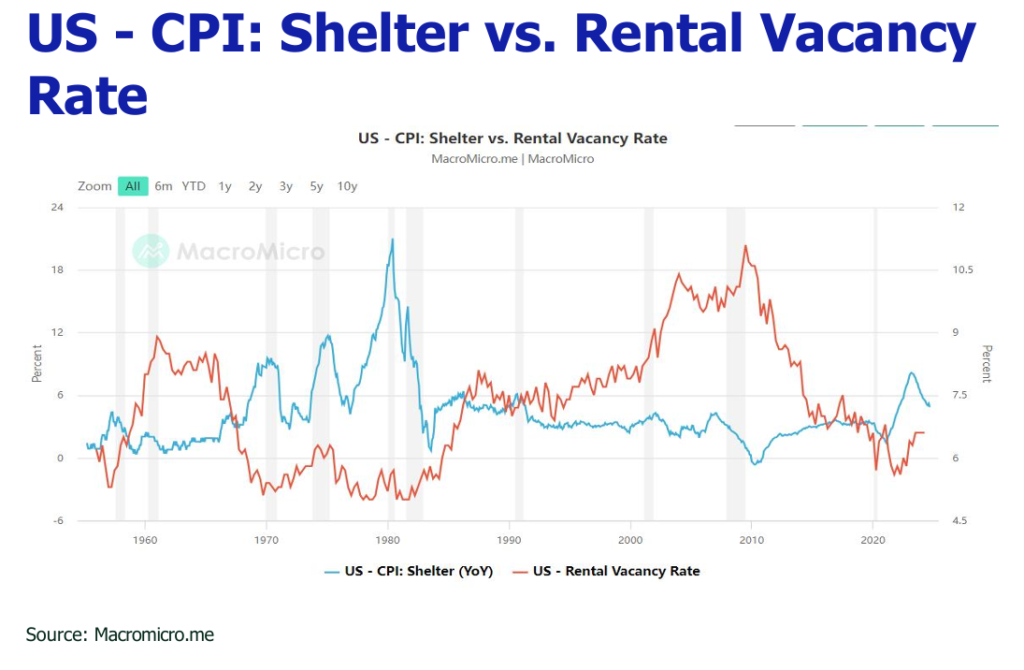

The U.S. CPI rose 2.4% YoY in September, dipped from 2.5% in August down to waning gasoline prices and moderation in housing inflation; it rose 0.2% MoM, at par with the previous value. Energy prices fell about 4% MoM and about 15% YoY. Energy prices declined 4% MoM and 15%YoY as oil prices hit a nearly three-year low in September amid weak demand in China and concerns of oil supply outstripping demand. Shelter cost surged by 0.2% MoM, a sharp fall from the 0.5% print in August; and the annual pace slowed from 5.2% in August to 4.9%. The U.S. core CPI in September rose 3.3% YoY, slightly exceeding the previous value of 3.2%; it rose 0.3% MoM, unchanged from the previous value. Super core CPI also ticked up, with a 4.6% YoY increase and a 0.4% MoM. The confounding rebound in core and super core readings against the softening of headline CPI was resulted by gains in categories such as apparel, auto insurance and groceries, most appear to be one-off increases.

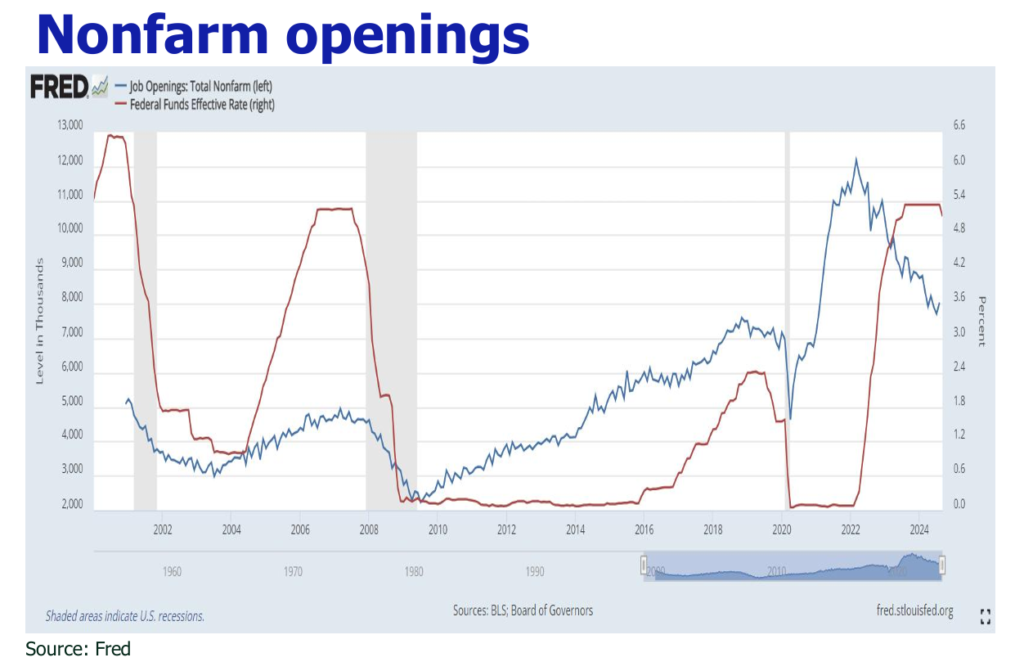

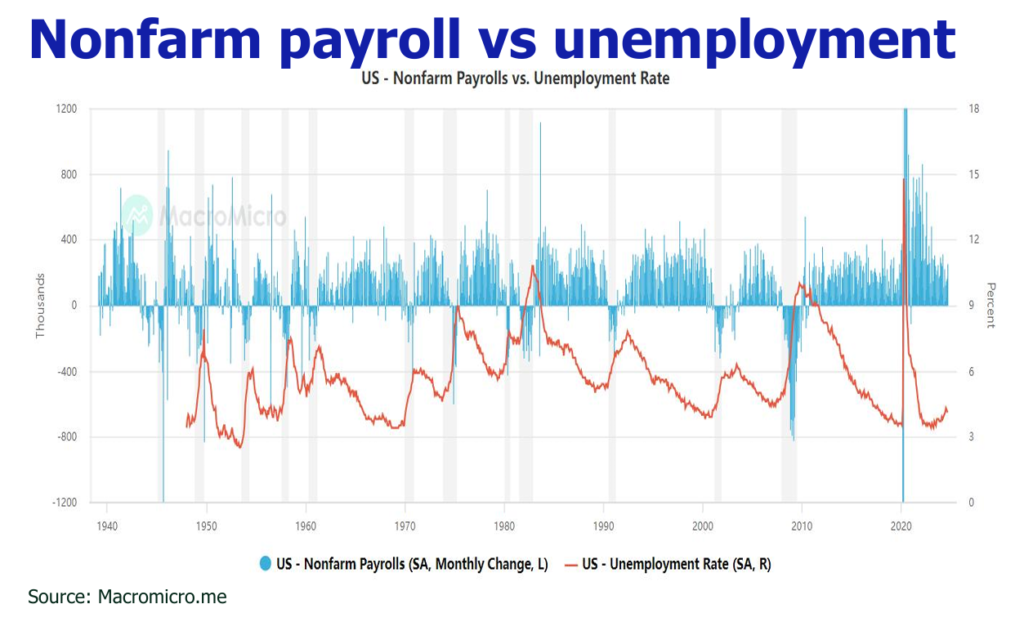

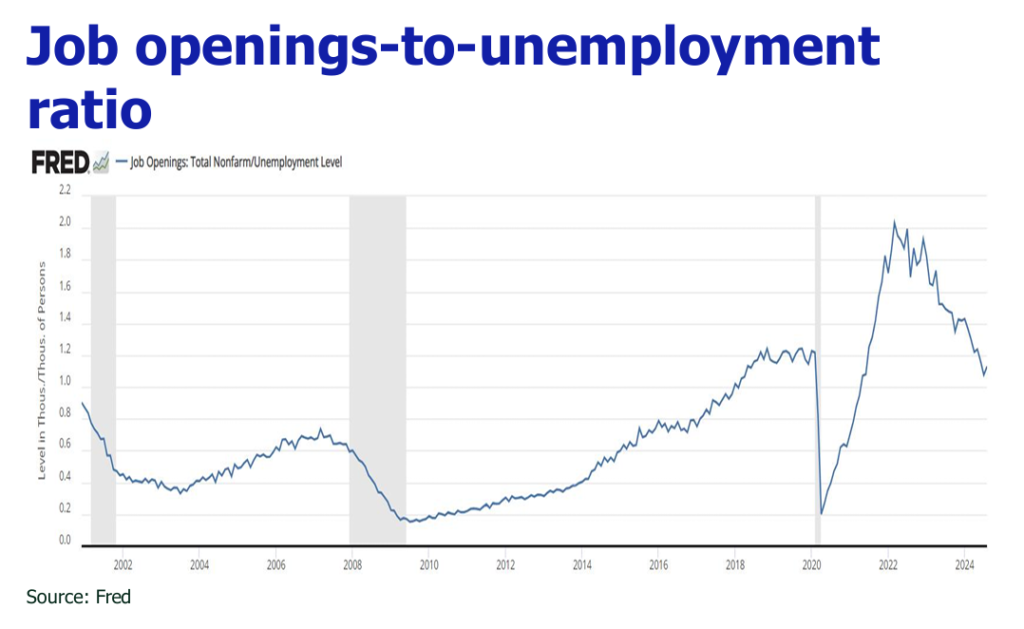

Startling increase of nonfarm payroll carried doubt of sustainability

The U.S. Bureau of Labor Statistics released an egregious 254,000 newly filled nonfarm openings in September, far exceeding the expeted number of 140,000. Concurrently, it revised up the NFP in July from 89,000 to 144,000 and the NFP in August from 142,000 to 159,000. After the revision, the number of new jobs in July and August was 72,000 higher than before the revision. Additionally, the unemployment rate was reported to fall to 4.1% from 4.2% in August, alllaying the recession concern. However, the sharp spike in September nonfarm payroll was due to drastic increase of 0.785 miillion in the seasonally adjusted government hires contributed by return of school teachers when the new school year started in September. And, the private sector hire was found to increase only by 133,000 people by the household survery and sag by more than 400,000 people by the establishment survey.

US eocnomy is still in a good shape underpinned by radiant retail sales

US retail sales in September increased by 0.4% MoM (Aug: 0.1% MoM) and 1.7% YoY, continuing pleasant growth from August (0.1% MoM and 2.1%YoY). The core retail sales (excluding automobiles, gasoline, building materials and food service expenditures) also shined with 0.4% MoM growth after 0.1% MoM in August. The ironclad wage growth have provided the strong foothold for the retail sales growth and supported the US economy strength in Q3. In September, wage posted 4%YoY growth vs 3.9%YoY in August and maintained 0.4%MoM growth as August.

Chasm between manufacturing PMI and service PMI widened

The preliminary value of the Markit manufacturing PMI fell from 47.9 in August to 47.3 in September, the lowest level since June 2023. The initial value of the new orders sub-index posted a three month falling streak to 42.7, a new low since December 2022. Firms also reduced employment for the second consecutive month in September. The fall in staffing levels was the steepest since January 2010 if the initial pandemic period in 2020 is excluded. The initial value of the services PMI in September was 55.4, a slight rebound from the previous value of 55.7 in August, and it has expanded for 22 consecutive months, underscoring that U.S. economic growth is completely dependent on the service industry.

Prediction

1. Inflation may hit a bump in October but the downtrend should not be derailed.

The cooling of inflation would be interrupted in October by the uptick of energy and merchant goods prices. Due to heightened geopolitical risk in the Middle East and Hurricane Milton, energy prices have jumped in October. Besides, the three-day port strike is expected to feed through to supply chains of some consumer goods and supplies. That said, we submit that rally of inflation due to the coalescence of the above factors should be a blip. The grueling oil prices outlook and the denting rental inflation would help sustain the disinflation progress. Accounting for the slowdown of China demand and the mounting number of EV, OPEC revised down the 2024 and 2025 global oil demand to 1.93 mbpd and 1.64 mbpd, down from 2.03 mbpd and 1.74 mbpd respectively. The resumption and increase of oil output by Libyia and US will risk pushing OPEC to join the fray and help pummel energy inflation. The unwinding of rental and OER remains in the run to coincide with the lower Zillow rent index, and the pace may be quickened by the possible housing supply increase following from the US rate cut.

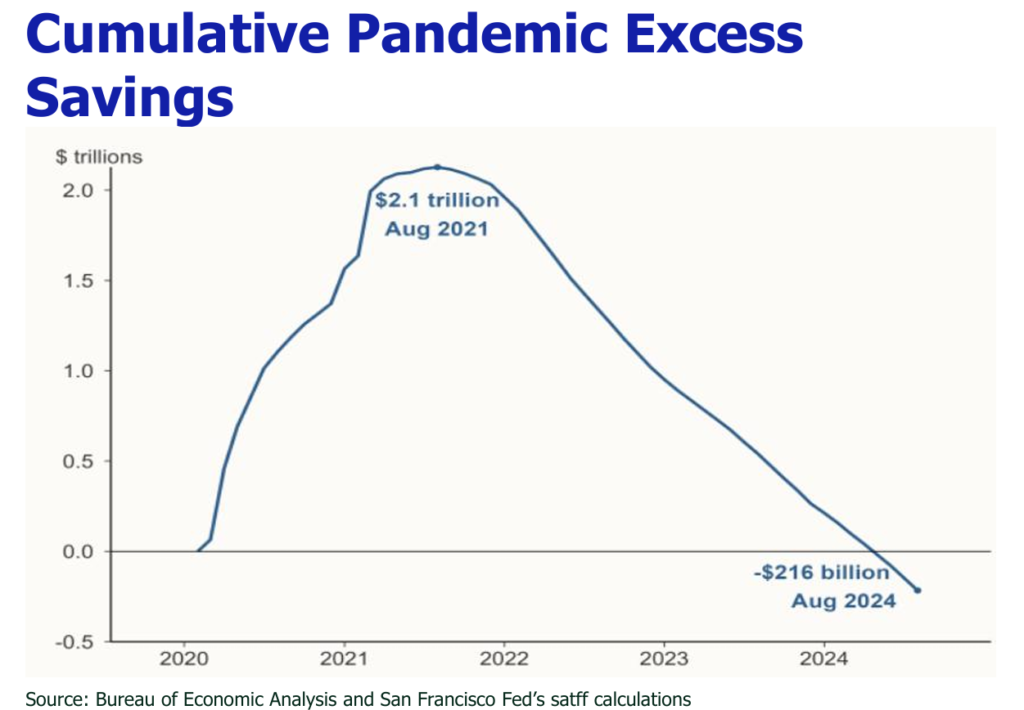

2. Labor market is not out of the woods yet.

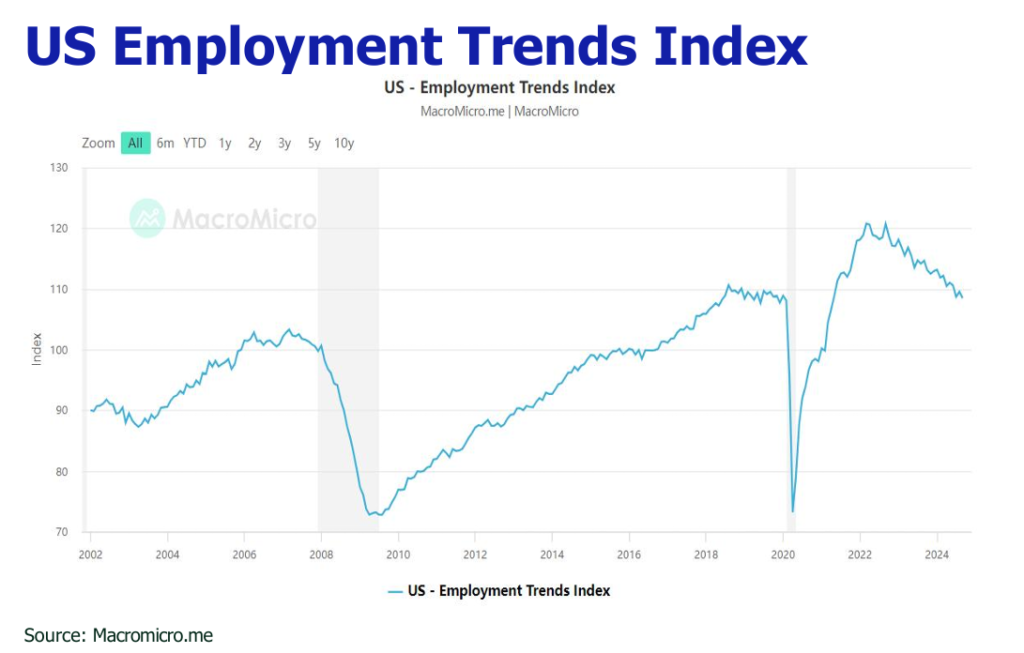

The whopping increase in the September payroll is largely the result of the one-off seasaonal add of the government workers mentioned above. The headwind in the labor market is still flaunted by the sagging private hire. The ISM employment index dipped from 50.2 in August to 48.1 in September, signaling shrinking employment incentives of companies. Besides, the Employment Trends Index issued by the Conference Board also fell from 109.54 to 108.48, futher corroborating that the the labor market is still in the troubled water.

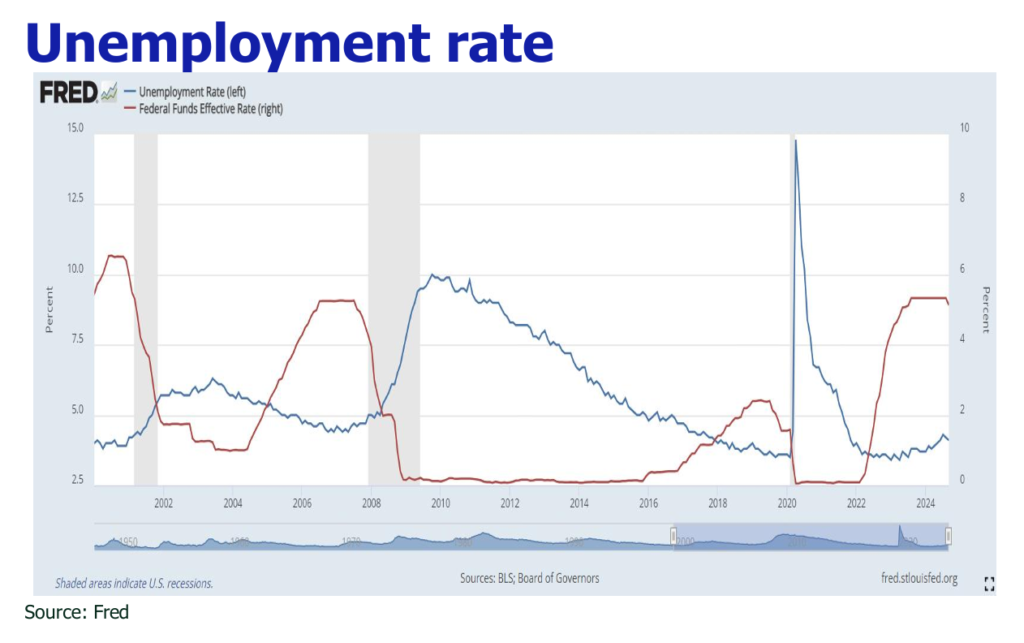

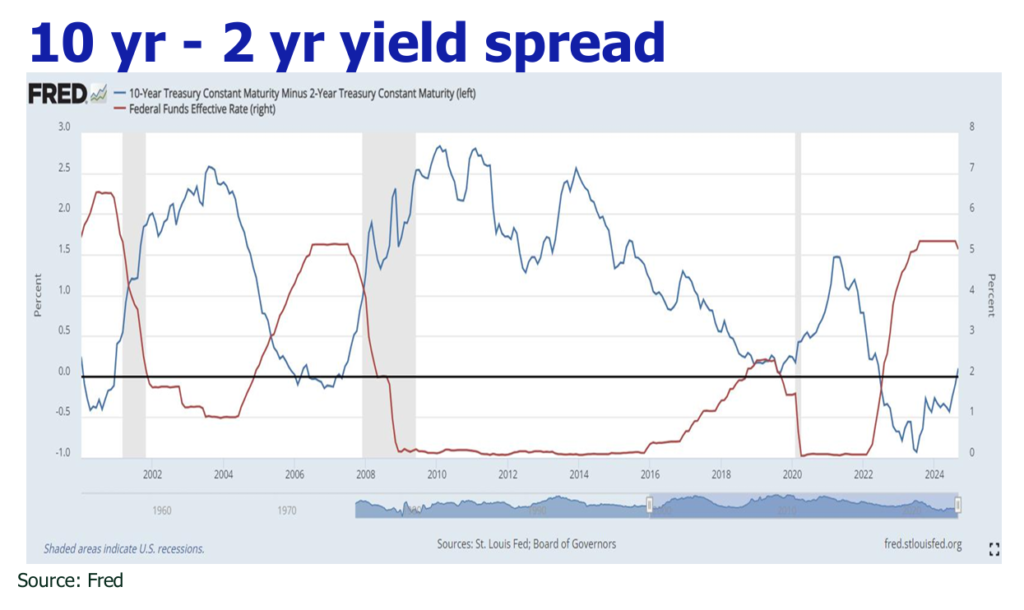

3. Rate cut in November will be slowed but not doushed.

As inflation contiunes to cool, retail spend stays comforting and labor market hardship is allayed, we opt for a smaller but sustained rate cut of 25 bp in Nov FOMC, irrespective of the emerging voice of rate cut suspension prompted by the hotter-than-expected nonfarm payroll in September. Despite the jaw-dropping NFP, several Fed officials reiterated the necessity of further rate cut mulling the headwind to the labor market and the dented inflation.The latest quarter-point cut by the ECB on Oct 18 and the three further reductions in speculation through next March will likely keep Fed rate cut on agenda to safeguard the domestic manufactuing sector.

4. A share and HK stock market bull run to turn potholed.

In October, China rolled out a new basket of policies to galvanize the economy, the stock market and the property market, including rendering RMB 300 billion financing for listco to repurchase share, lowering loan prime rate by 25 bp to spur corporate investment and civilian consumption, issuing RMB 2.3 trillion national treasuries to resolve the financial straits of local government and property developers, and launching 1 million city village and old housing refurbishment plan and upsizing white-label property development loan facillity to RMB 4 trillion. However, the zing in the bull run of China and Hong Kong stock markets in late September and early October greatly effaced as the market’s askance about the effectiveness of the new policies to stimulate property purchase and personal consumption loomed given the elevated housing inventory and unemployment rates, and was disappointed in the lack of measures to promote employment. Making things worse, the steep pullbacks of China and Hong Kong stock markets after the National Day Holiday, and the rumor that China will impose a 20% tax on overseas asset transactions of wealthy individuals notably buffeted public confidence. The hope of flocking of overseas fund was also stung by the proposed act of US Republicans to impose the highest capital gain tax on investment in China. As China government signals strong determination to boost the eocnomy and the captial market, we reckon that more measures will be announced gradually after successive US rate cuts, and thus China and Hong Kong stock markets should enter into a slow bull run mode unless China lowers saving rates and injects much stronger liquidity. The latest proposal of forming the stablization fund with intended size of RMB 2 trillion will help even China A share volatility and improve public investment sentiment.

Disclaimer

All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however we do not guarantee the accuracy or completeness of this report and have not sought for this information to be independently verified. Forward-looking information or statements in this report contain information that is based on assumptions, forecasts of future results, estimates of amounts not yet determinable, and therefore involve known and unknown risks, uncertainties and other factors which may cause the actual results to be materially different from current expectations.

We shall not be liable for any direct, indirect or consequential losses, loss of profits, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note.